Stocks are trying to tack on some gains in the early going, while Treasuries, gold, and silver are headed the opposite direction. Crude oil is off a bit, while the dollar is up modestly.

On the news front…

We got the latest data on Q1 2023 GDP this morning. Turns out it grew 2%, rather than the previously estimated 1.3%. The price indices in that report eased off just a bit. Initial jobless claims dropped sharply to 239,000 from 265,000. Bonds and gold got throttled on the news because it suggests the Federal Reserve is still very much in play.

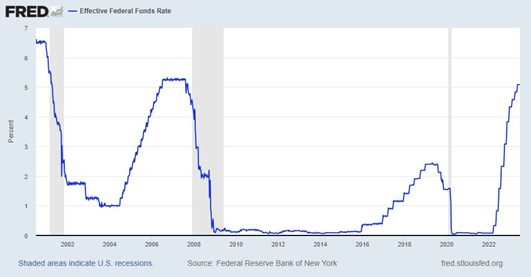

Speaking of which, Chairman Jay Powell poured cold water on the idea that the Fed’s recent meeting “skip” meant the Fed was done with hikes yesterday. At a conference in Madrid, Powell said “A strong majority of committee participants expect that it will be appropriate to raise interest rates two or more times by the end of the year.”

The federal funds rate is currently pegged in a range of 5% to 5.25%. Two more quarter-point hikes at meetings in July, September, November, or December would push it within spitting distance of 6% -- a level we haven’t seen since 2001.

Finally, if you’re looking for a little spice in your life, it’s going to cost you. Huy Fong Foods Inc. is the California company that supplies the ubiquitous Rooster-image bottle of sriracha sauce you frequently see on grocery store shelves and restaurant tables.

But a Mexican drought is killing off pepper crops, driving up the price of a key ingredient. Sellers and resellers are capitalizing by charging an arm and a leg to buy existing bottles on eBay (EBAY) and Amazon (AMZN). No word on if people are switching to Cholula or Frank’s instead!