Markets got their comeuppance yesterday, with the S&P 500 suffering its first drop of more than 1% in 47 trading sessions. Volatility finally awoke from its recent slumber, too, with the VIX hitting its highest level in two months.

Stocks are trading a bit lower this morning as well along with gold and silver, while crude oil is higher. The dollar is flat. Long-term Treasury bonds are falling in price again, sending yields higher.

On the news front...

Treasury bonds were initially subdued in the wake of the Fitch Ratings downgrade to the US “AAA” sovereign debt rating. But then the US Treasury announced it would have to sell more debt than expected ($103 billion) to fund the government this quarter.

ADP’s employment data also topped estimates by a wide margin. That raised expectations the “official” Labor Department numbers out tomorrow will be strong enough to put more Federal Reserve rate hikes on the table. Bonds got blown out of the water as a result.

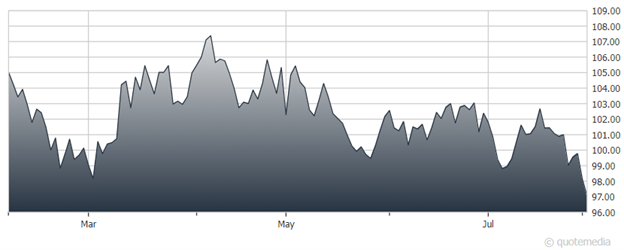

That fits with what I outlined in this YouTube “Short” video recorded for you yesterday morning. Ratings DO NOT matter that much. Economic and borrowing news DOES. The iShares 20+ Year Treasury Bond ETF (TLT), which tracks long-term bond prices, was hanging in there earlier this year. But recent losses have pushed it into the red YTD now.

iShares 20+ Year Treasury Bond ETF (TLT)

Elsewhere on the interest rate front, the Bank of England hiked its benchmark rate another quarter-point to 5.25% today. That was the 14th straight hike, and the BOE said it would hike even more if inflation didn’t cool down.

Meanwhile, if you need help covering higher interest costs thanks to rising rates, you can always buy a Mega Millions ticket. The jackpot for tomorrow night’s drawing is up to an estimated $1.25 billion! That’s the fourth-largest in the history of the lottery game.