“Fear Trades” were back in full swing yesterday, with gold and crude oil prices surging and stocks tumbling. Those trades are back again today, though with less “oomph” behind them. Treasuries and the dollar are flat.

On the news front...

Investors scrambled out of risk assets and into gold as a safe haven play and crude oil as a “supply fears” trade. Israel is evacuating a town of 22,000 people near the border with Lebanon amid increased skirmishes with Hezbollah militants there. A US warship in the Red Sea also shot down several drones and missiles reportedly headed toward Israel from Yemen.

Both developments increase the risk of a wider conflict in the Middle East, which could lead to all kinds of market impacts. I just spoke with Phil Flynn, Senior Energy Analyst for PRICE Futures Group and Fox Business Network, on potential developments and their influence on crude oil supply and prices for this week’s MoneyShow MoneyMasters Podcast. You can view the segment HERE.

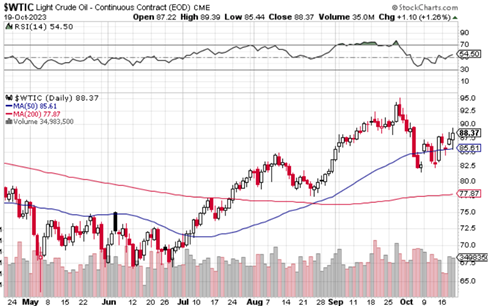

Crude Oil Futures (WTI)

Meanwhile, President Biden gave a primetime Oval Office address last night to build support for a package of up to $100 billion in defense and other spending. Congress would have to approve the administration’s request for $60 billion in funds for Ukraine and US munitions, $14 billion for Israel aid, $14 billion for Mexico-US border spending, and more. That comes as the US budget deficit has roughly doubled to $2 trillion in the current fiscal year...and as interest rates are rising sharply, partly in response.

Finally, Bitcoin is back in the spotlight – topping $30,000 again this morning in anticipation of another court ruling that would increase the likelihood of Bitcoin ETFs gaining approval. A DC court is likely to rule today in favor of Grayscale Investments LLC’s push to convert the Grayscale Bitcoin Trust (GBTC) to a straightforward Exchange Traded Fund.

That would push the industry one step closer to approval of “spot” Bitcoin ETFs, something that would increase money flows into crypto as an asset class. I highly recommend checking out the MoneyShow MoneyMasters Podcast segment I did with Bloomberg Intelligence Senior ETF Analyst Eric Balchunas a month ago. He spoke at length about cryptocurrency ETFs, the probability of approval, and how they could change the investing landscape.