The major averages had their best week in a year, with the S&P 500 rising 5.8% through last Friday. But stocks are subdued in the early going today. Crude oil is up modestly, gold and silver are down a bit with Treasuries, and the dollar is flat.

Israel’s invasion of the Gaza Strip is intensifying, with the military encircling Gaza City and launching a “significant operation” accompanied by a widespread communications blackout. Despite growing protests worldwide over civilian deaths, Israel has so far showed no sign of backing down. US Secretary of State Anthony Blinken has been traveling the Middle East, with stops in Iraq and Turkey, to smooth over disagreements. He has also been warning Iranian-backed proxy forces against attacking US forces in the region.

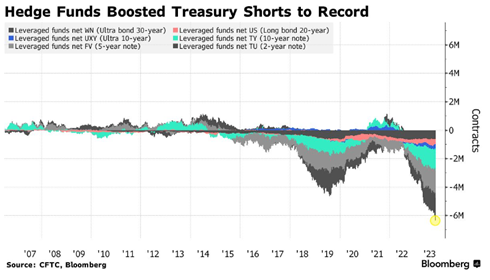

The “higher for longer” interest rate theme reached a fever pitch over the last month, and hedge funds dog-piled into “short” bets on Treasuries. That...didn’t work out so well, as this Bloomberg story notes. After placing the most aggressive bets since 2006 on falling bond prices and rising bond yields, speculators got pummeled when the reverse happened.

That said, the iShares 20+ Year Treasury Bond ETF (TLT) is still down about 9% on the year despite the recent rally. The broader iShares Core US Aggregate Bond ETF (AGG), which owns a much broader range of bonds beyond just government securities, is now roughly flat on the year.

This week will be a quieter one on the economic front, so we will likely see less rate volatility. But Fed Chairman Jay Powell is set to deliver a speech on Wednesday morning. That’ll be his first opportunity to guide market action in the wake of last week’s policy meeting.