“Goldilocks” is driving gold and stocks! Both continue to enjoy rallies here, with the former on the cusp of a breakout to all-time highs. Crude oil and the dollar are trading around the flatline, while Treasuries are modestly higher.

You know what Wall Street loves? News that the economy is growing faster than expected but inflation is slowing more than expected. That’s what today’s revised Q3 data showed. GDP rose 5.2%, the most in almost two years and up from a previous estimate of 4.9%. Meanwhile, the core Personal Consumption Expenditures (PCE) Price Index was revised down to 2.3%.

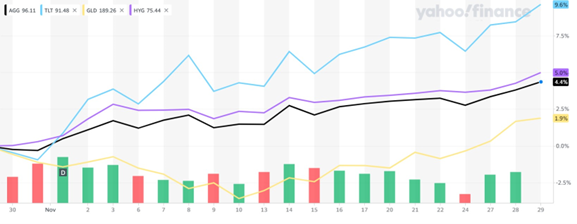

As for the markets, how about ‘dem bonds? Fixed-income markets are having their best month of gains since the 2008 Great Financial Crisis, when growth and credit fears caused investors to dog-pile into sovereign bonds for safety. Slowing inflation is one catalyst. Another? Rising expectations the Federal Reserve won’t just PAUSE its interest rate hiking campaign, it’ll reverse some of it next year.

This chart shows the monthly performance of ETFs that track long-term US Treasuries (TLT), a diversified collection of bonds (AGG), and high-yield debt (HYG). You can see how they have all benefitted from expectations of a looser Fed. So has the SPDR Gold Shares ETF (GLD), because expectations for a looser Fed have put the kibosh on the US dollar.

TLT, AGG, HYG, GLD (1-Mo. % Change)

If you can’t sell enough EVs, you have to find something to do with the money you would’ve invested in designing and building them, right? That’s what General Motors (GM) seems to have decided.

The automaker announced a gigantic $10 billion share repurchase program for 2024, partially funded by money that would have gone toward electric vehicle operations. CEO Mary Barra is dialing back investment as EV sales growth has cooled. She is also trying to boost GM’s slumping stock, which just hit a three-year low.