Both stocks and Treasuries are giving up some ground following the three-day weekend. The dollar is higher, gold and silver are mixed, and crude oil is flattish.

It’s a heavy week for corporate earnings, with Goldman Sachs Group (GS) and Morgan Stanley (MS) sharing their latest results this morning. Goldman trounced estimates, reporting a 51% rise in quarterly profit, while Morgan said profit fell due to one-time charges. As the week goes on, we’ll hear from other key names in the financial, real estate, industrial, and materials sectors.

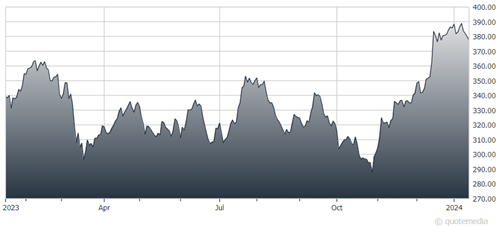

Goldman Sachs Group (GS)

But here’s the “big-picture” thing for investors to keep in mind: The so-called “earnings recession” is over. S&P 500 firms reported a 7.5% year-over-year rise in profits in Q3 2023 and they’re expected to show another increase of around 4.4% when the Q4 2023 season is over. That’s similar to what happened in 1995, when the Federal Reserve finished a series of interest rate hikes, the economy slowed but didn’t shrink, corporate profits kept growing, and the S&P surged 34%. Food for thought.

In the political arena, the Iowa caucus results came in as expected – with former president Donald Trump handily beating his Republican rivals. Ron DeSantis finished in second place, with about 21% of the vote, and Nikki Haley came in third with about 19%. New Hampshire will host its primary vote a week from today.

Finally, the Middle East conflict continues to spread in a couple of ways. Iran launched a missile attack at a base in northern Iraq and at “anti-Iran terror groups” in Syria. The country said it was striking back at those responsible for the recent bombings at a memorial for its former Quds Force commander. Houthi rebels also scored another merchant ship hit in the Red Sea, striking a Greek-owned bulk commodity carrier. They targeted a similar US-owned ship on Monday.