Market bubbles normally drag on longer and go higher than most traders anticipate. Yes, there was a shorting opportunity a couple of weeks ago. Yet, it’s important for a trader not to get complacent, says Jeff Greenblatt, editor of The Fibonacci Forecaster on Tuesday.

We’ve made to Thanksgiving with two themes for this year. The market gave traders a big rally and it’s still delivering. Congress promised tax reform and they are still lagging. We’ve been tracking the progress all year. First, we were promised something would get done by Labor Day and since that didn’t happen, Thanksgiving for sure!

Why is this important? There is a famous book called Extraordinary Popular Delusions and the Madness of Crowds. The market somehow survived two months of some of the biggest time cycle windows I’ve ever seen.

It’s not that they don’t work. The possibility exists these cycles inverted, thus creating the mother of all stock market bubbles. Not only that, if we don’t get the correction in the September/October season, odds increase something will happen before Thanksgiving.

Get Trading Insights, MoneyShow’s free trading newsletter »

Why? There is always going to be a Santa rally and they don’t go straight up. Markets started correcting in early November but selling dried up prematurely.

Part of the reason is the delusion. How many times did the market accelerate over the past two months because some politician or cabinet member told us taxes would get done? Last week the mood was as sour as I can remember. You’ve read about the Roy Moore scandal. Since I wasn’t in the room I offer no opinions. But here’s the problem: there is a special election coming up in about three weeks and now the possibility exists the Democrat could win a seat controlled by the GOP for a long time. Markets digested that dilemma as they dropped.

But by Thursday morning, the House passed their version of taxes and once again, markets were higher! The problem is the Senate where they can only lose two votes and right now I count at least three and possibly four sitting on the fence. The margin of error is razor thin. Even Trump admits Flake is a likely no vote. Early last week I heard some GOP official say they needed to get it done by Thanksgiving or at least before the Alabama vote. Then Mnuchin came out and said a bill would be on the president’s desk by Christmas!

You know why we are talking about this. This is a rally that has been fed by the hope a new administration would create meaningful tax reform to create better GDP. Right now, a year into it, all we have is hope. Many are starting to get the impression that’s all we’ll get. Is the crowd really deluding themselves?

Since it’s Thanksgiving, here is some stuffing to go with the main course.

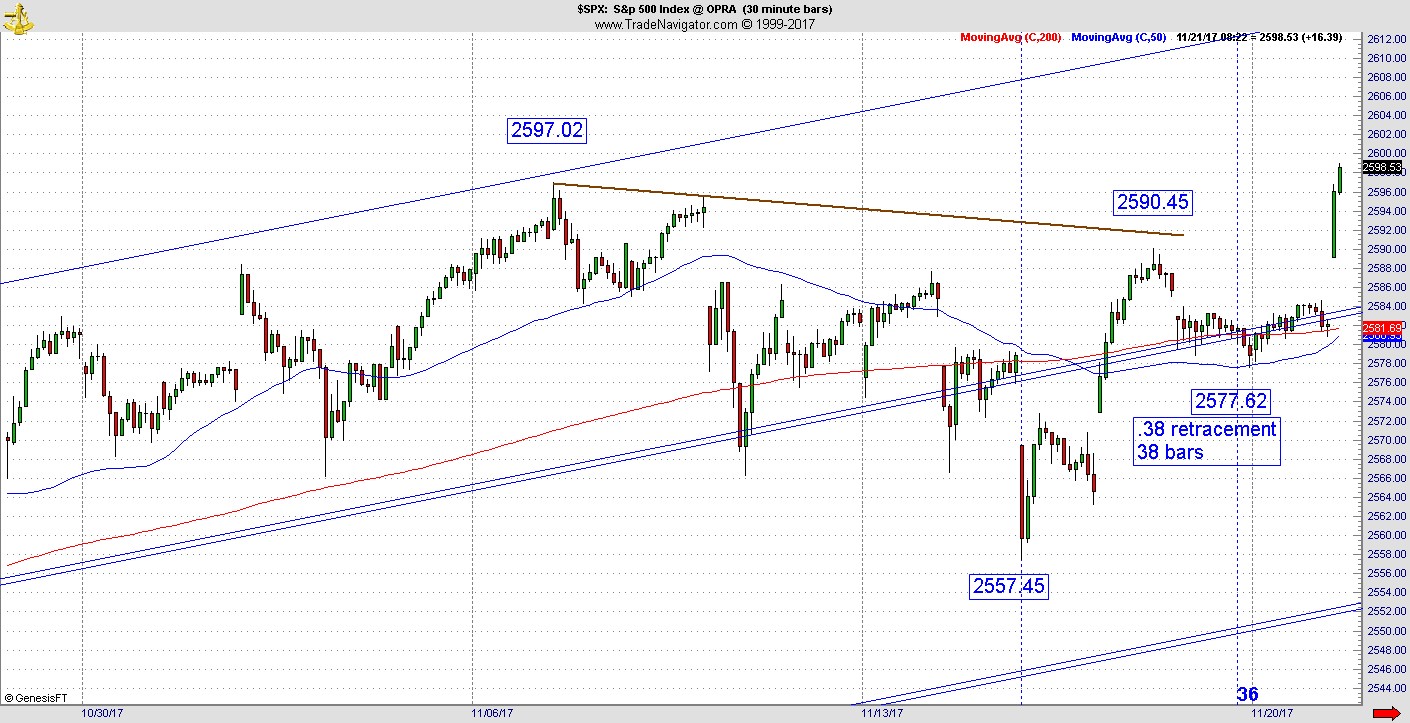

In recent posts, I’ve shared the Gann version of retracements squaring out to create very interesting turns and opportunities in the market. Markets were up very nicely on Tuesday. Here’s the technical reason for it. Last Thursday’s low did have enough calculations to stop the downtrend.

But here’s one that plays exactly into what I’ve been showing you recently. By Friday, the S&P 500 Index (SPX) gave us a 38% retracement given the move up of 32.64 and push back of 12.47 for a .382 retracement. On a 30-min chart, it’s 38 bars. Normally the 38% retracement is common. In this case, the retracement ratio lines up with time. When the retracement ratio lines up with time, it’s enough to give a trader sufficient conviction to believe it has a good chance of working.

It reduces unexplained variation. Unexplained variation is a statistical term but in our case, think of it as what you don’t know can and will hurt you. It creates the Kairos moment which is the most opportune time because Gann did tell us 100 years ago when price and time square out, the pattern changes direction.

Finally, market bubbles normally drag on longer and go higher than most people anticipate. Yes, there was a little shorting opportunity a couple of weeks ago.

However, it’s important for a trader not to get complacent because, in a market like this, one must be ready for a square out setting up to go the other way. For instance, after Brexit it looked like markets were ready for a big drop, the Dow Jones Industrials (DJI) had already dropped roughly one thousand points but it was only a couple of days.

Yet there it was: the SPX bottomed that Monday evening at 1991 in 91 hours.

Most people missed that. Here is another little SPX example yet most people don’t know what to look for.