Amazon (AMZN) bought online pharmacy PillPack Inc. for $1 billion in cash.

This deal should worry the likes of CVS (CVS) and Walgreens (WBA), as Amazon continues to create the one-stop buy everything you need conglomerate.

Seems a bit antitrust like, but we know that will never happen, even if Trump does talk a tough game.

**

**

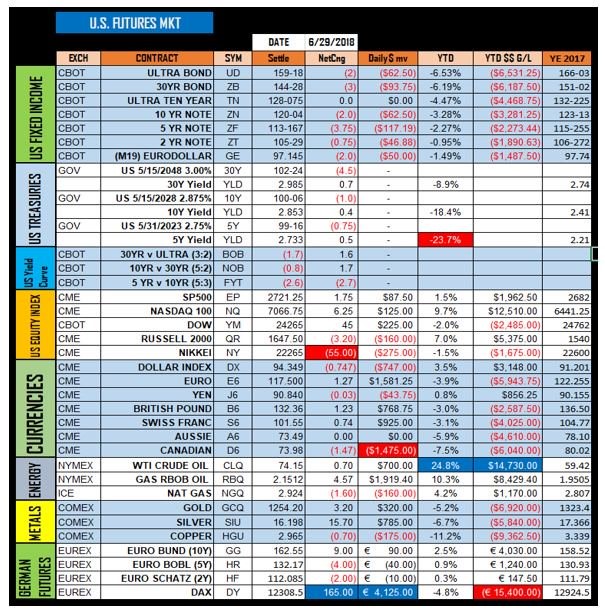

Let’s take a look at the futures settles for Friday, June 29.

Crude Oil has been the standout, up some 25% on the year and up 17% last quarter alone!

Natural Gas was up 7% last quarter as well, the Russell 2000 (RUT) was the best equity performer edging out the Nasdaq, up 10% and 8.7% respectively for Q2. We don’t follow OJ but it was a standout for Q2 up 20%.

**

We would like to highlight the S&P 500 (SPX) weekly chart of raw data and a simple 7-period moving average this weekly close should see follow through this week if we can’t trade above the 2750 area.

**

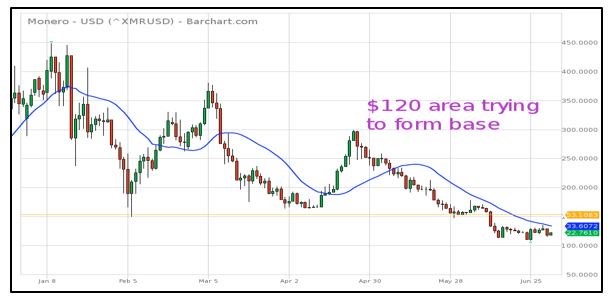

The cryptocurrencies were once again bottom fishing.

It seems as if the momentum has slowed and that a bounce was in order. This did occur over the weekend but here are the closes for Friday June 29.

We highlighted a chart on Friday of monero as we saw a nice bounce on Friday and they were actually up 8% last week:

As far as our CryptoCorner Index boring to lower is how we can explain it, although with the weakened momentum we may be gearing up for a nice summer bounce.

As many know the ecosystem continues to grow and we are more than bullish.

**

**

Just to reinforce our two-tiered economy once again, what has become the obvious theme of who truly benefits from QE, we have these headlines, first up, H&M, whose tag line is “fashion and quality at the best price.”

Well we suppose you can keep dropping prices, because if there isn’t discretionary spending at the lowest levels, then demand sinks, inventory’s rise and as for profit:

**

As far as the luxury brands, well considering the disparity in income, this shouldn’t come as too much of a surprise.

Moët Hennessy Louis Vuitton SE (LVMH) or what it is commonly referred to solely as Louis Vuitton posted record 2017 revenue, so too did Kering Group (KER) better known as Gucci and YSL:

Cheers!

Nell

Subscribe to Nell Sloane's free Unique Insights and Crypto Corner newsletters here