We learned that one of New York’s famous hedge fund managers has lost 18% this year. He describes himself as a “value” investor. I don’t see how losing 18% in this market is of any value to his investors, says Mike Turner, who’s presenting at The MoneyShow San Francisco and Dallas.

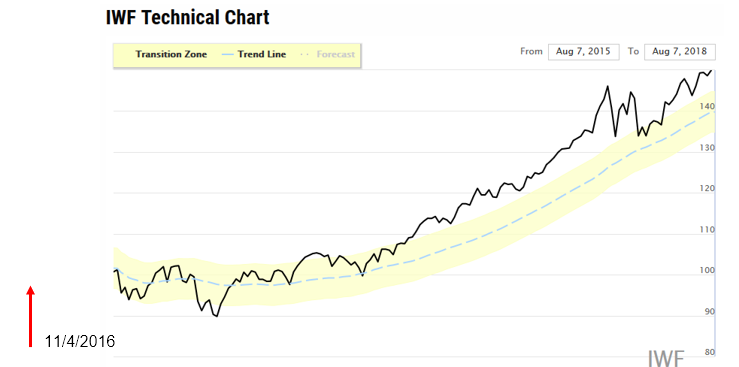

This famous investor bemoaned the fact that for the past few years, the Russell 1000 Growth stocks have outperformed the Russell 1000 Value stocks. I looked at ETFs for both of these. Here’s the Market-Directional Chart for the iShares Russell 1000 Growth Index ETF (IWF).

This is a great chart. Since early November 2016, IWF has been bullish and has climbed almost 50%. But these are the growth stocks. Let’s look at the value stocks. They must have been really beaten up for the famous investor to lose 18%.

Here’s the Market-Directional chart for the iShares Russell 1000 Value ETF (IWD). It’s definitely underperforming the Growth index but has still made money in the past 3 years.

Since that same November 2016 date, IWD has moved up by about 20%. I don’t see any drop of 18% during 2018 in these value stocks. In his letter to the investors in his hedge fund, he expressed confidence going forward that his value stocks would begin to outperform the market. Sometimes, “confidence” is just another way of saying “I hope it goes back up.”

Hope is a lousy investment strategy. We’ve all had trades that didn’t work out. That’s why you need to have an exit strategy in place before you enter a trade. Don’t let small losses become big losses.

The market continues to climb walls of worry. Trade wars, interest rates, government oversight…. none of these have mattered as the S&P 500 (SPX) continues tmove higher. Here’s the Market-Directional chart for the SPDR S&P 500 ETF (SPY).

The weekly Expected Move (EM) is $6.77 which puts my stop price at $277.13. So far, it’s been a great summer.

Last week, I showed you how well the Market-Directional approach would have worked during one of the most volatile periods of time in the stock market – Black Monday in October 1987. If you missed it or want to read it again, you can click here.

By the way, the MoneyShow San Francisco is coming up in just a couple of weeks and the MoneyShow Dallas just a little more than a month after that. I’d like to meet you and talk investment strategies with you. Here’s more information about these important events.

- The MoneyShow San Francisco – August 23-25.

- The MoneyShow Dallas – October 3-5.

Stop guessing and start measuring,

If you’re interested in learning more about how I manage money using the Market-Directional Investing methodology, you can read more here.