In this week’s Macro Theme, we discuss “Reflation’s Rollover.” We’ve alluded to this theme, characterized by slowing inflation, several times in the last month, writes Landon Whaley Wednesday. Look for part 2 Friday. He's presenting at MoneyShow Toronto Sept. 15.

This theme flies in the face of the consensus belief that inflation will head higher towards the back half of 2018 and into 2019. We are happy to take the other side of that inflation trade and look for a shorting opportunity in a market that is highly vulnerable to the downside right now.

Fundamental Gravity Says What?

Two chief variables impact the risk and return of asset prices: economic conditions and how central banks respond to those conditions. Together, these variables drive what we call an economy’s Fundamental Gravity.

Our stance that U.S. growth is already slowing and will continue to slow for the remainder of 2018 is well documented. Today, we want to discuss the other primary fundamental catalyst for the risk and return of asset classes: inflation.

We expected U.S. inflation to stay buoyant throughout the remainder of Q3 and begin slowing towards the latter part of the year, but July data is indicating this timeline is speeding up a bit.

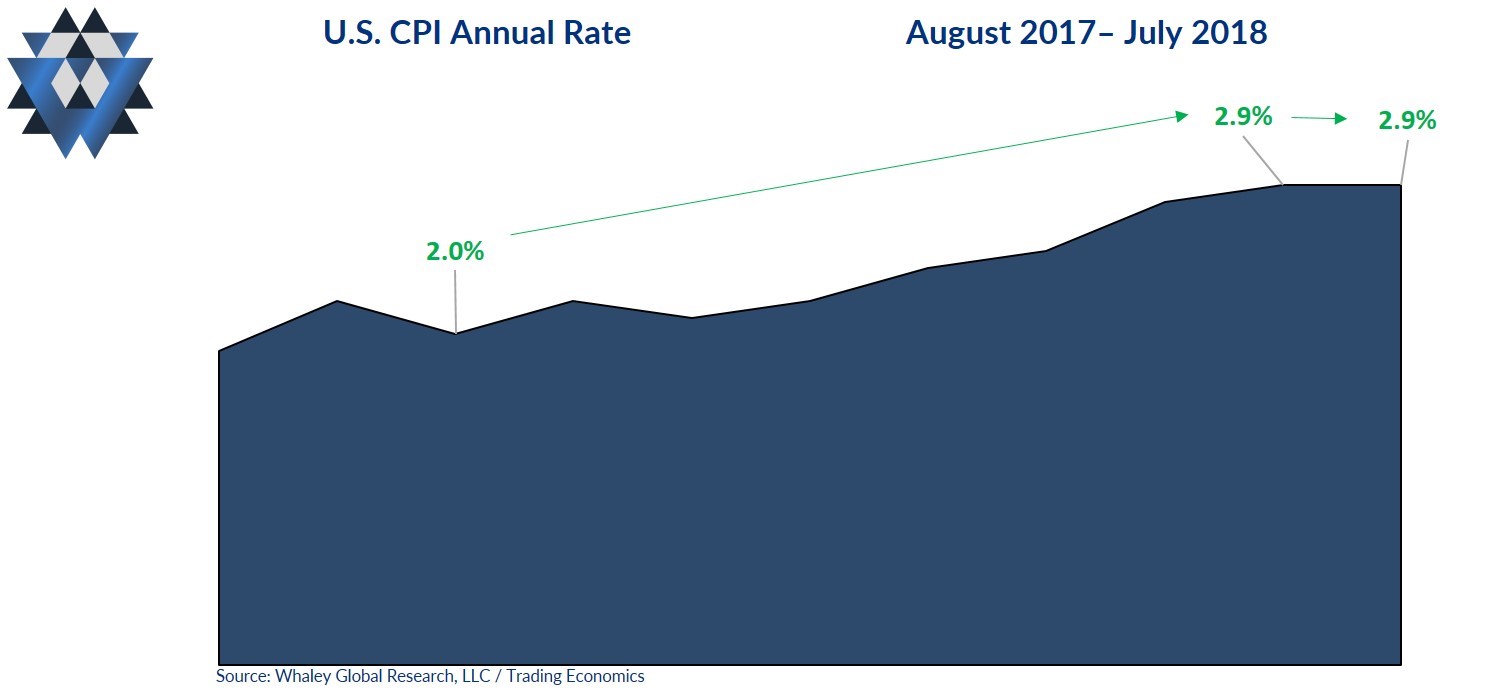

July’s Consumer Price Index (CPI) and core inflation came in as we expected, with CPI flatlining from the prior month (keeping the uptrend intact) and core accelerating for the third consecutive month to the highest level since 2008. However, PPI was a different story.

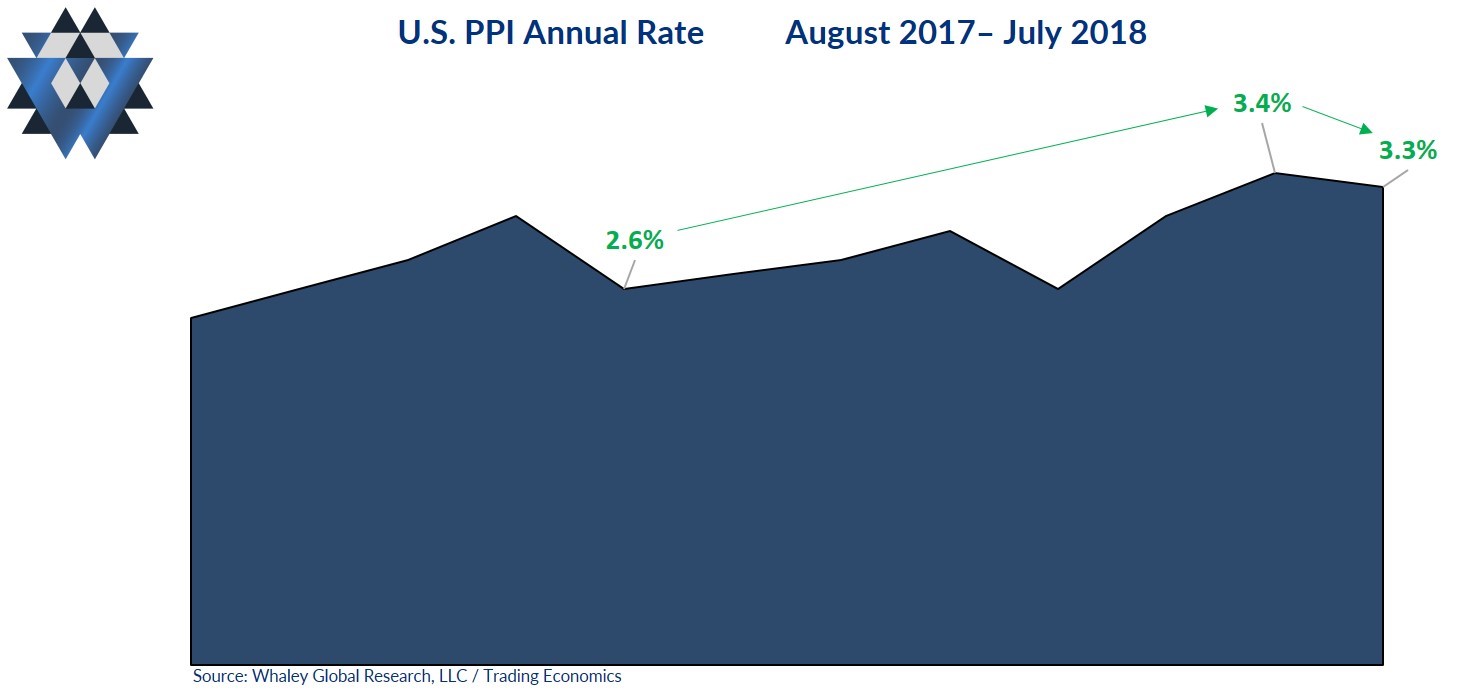

One month after PPI hit the highest rate in seven years, it slowed in July. Now, one data point doesn’t make a trend, but what makes this unexpected slowdown prescient is that the PPI inflation we saw at the tail end of 2017 was the highest in more than four years.

This means it’s going to be very difficult for PPI data in the final five months of 2018 to “comp” against those inflation rates and accelerate. This comp reality is also true for both core and CPI, indicating the most likely direction for all three measures of inflation is lower.

In addition to the inflation data already showing signs of languishing, several inflation-sensitive U.S. asset classes are also starting to confirm slower inflation:

- Metal and Mining stocks peaked on July 24 and are now down -11.2%.

- U.S. Basic Material stocks peaked on June 12 and are now down -3.2%.

- Crude oil peaked on July 3 and is now down -13.3%.

- Grain-related commodities peaked on May 29 and are now down -10.5%.

- Meat-related commodities peaked on July 2 and are now down -13.0%.

We were one of the first firms publicly flagging an approaching rollover in inflation, rather than the consensus expectation that inflation was heading higher from here. In short order, we are getting confirmation of this inflation reality from real time markets as well as lagging inflation data.

From a Fundamental Gravity perspective, it doesn’t get more bearish for energy-related equities (like XOP) than when both U.S. growth and inflation slow together. During this type of FG environment, the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) typically averages a -10.5% quarterly return with an average drawdown of -22.4%. In addition, it posts negative three-month returns 75% of the time.

The Fundamental Gravity bottom line is that there is no more bearish environment for equities related to crude oil than when U.S. growth and inflation are slowing together. We are already seeing ample evidence of this environment across both economic and financial market data.

Reflation’s Rollover and Shorting XOP. Part 2

This Friday, August 31, we will release part 2 of this commentary, which is where we will dig in to the other two critical forces, or gravities, that are currently impacting crude oil-related equities: Quantitative and Behavioral. We will also provide a detailed game plan for trading XOP.

If you can’t wait the 48 hours to get the complete picture for this macro theme and the accompanying trade details, please email us at ClientServices@WhaleyGlobalResearch.comwith the subject line “Reflations Rollover.”

We will provide you with the complete macro theme breakdown as well as offer you the opportunity to participate in an eight-week free trial of our research offering, which consists of three weekly reports: Gravitational Edge, The 358, and The Weekender.