I’ve been telling you for months there would come a day where the Dow (DJI) would be down 400 on interest rate fears. That day was last Thursday. This is not a case of the clock being right twice a day, writes Jeff Greenblatt Wednesday.

For this condition to finally materialize, the market had to set up properly.

First of all, last Wednesday was the 163rd trading day up from the S&P 500 (SPX) bottom back in February. It was also in the 162nd week off the Dow bottom in 2015. Perhaps the most important condition to develop was the bond market broke long-term support which was the support low in May which set off the bear rally. They woke up to this configuration just as the market got to the other side of the time window.

The market has been down ever since.

But now that they are so consumed by fear of higher rates, the bond market is trying to stage a rally again on a new calculation. That’s how it works with financial markets. Briefly, if the bond market finds a low here it could start a rotation out of stocks due to economic weakness. If the calculation gets taken out it would likely reveal some sort of a debt crisis because a decent reading should spawn a bounce.

Heads I win, tails you lose.

There are many reasons the market is declining. Markets correct excesses in social mood. We can talk about market leaders like Google (GOOG) which has gone parabolic since Vice President Pence urged them to end their development of the Dragonfly app that would compromise the privacy of Chinese citizens. Traders already know all about the Facebook (FB) problems. Just these two companies are 40%of the FAANG leadership group.

We can talk about higher oil prices which finally caused the Dow Transports (DJT) to break down from its support ridge. That’s unfortunate because the oil chart peaked on October 3. But the airlines and delivery names like FedEx (FDX) just couldn’t take it anymore.

How about the political climate? Not enough is said about social mood as the nation has never been more divided, the rhetoric becoming more dangerous with each passing week. This is the kind of thing that happened in 1939 as the Dow peaked for good only two weeks after the start of the invasion of Poland. There might not be a major war brewing today but the market is just as allergic to domestic upset and the uncertainty surrounding the election that is suddenly under a month away.

Imagine what the world would’ve been like in 1939 had there been a 24/7 news cycle. Finally, the bears ended up in the right place at the right time. The time cycles validated in October, a month where anything is possible.

But if a picture tells a thousand words, as luck would have it, we’ve found the perfect warning chart to track this mess.

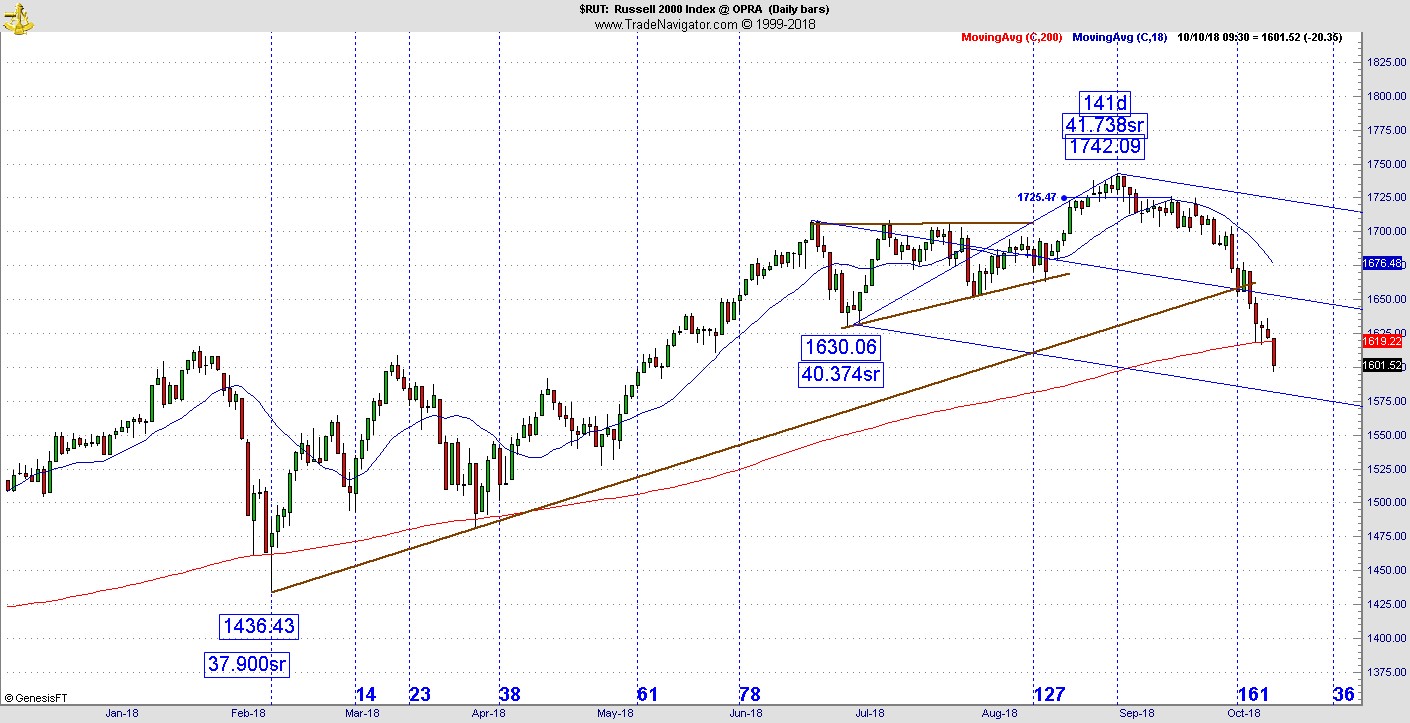

Let’s take another look at the Russell 2000 (RUT). A week ago, it was sitting right on the connect the dots trend line at the same time it was sitting on the Andrews pitchfork midline. Additionally, it was also 161 days from the February low. Since then, it broke down from that trifecta, but there’s more.

On Monday it touched the 200-day moving average and finally on Wednesday it broke through. That’s simply amazing because when an important chart touches the 200 for the first time it usually bounces or wrestles to defend it. This time it sliced right through.

The small caps are an excellent indicator of overall market health and to see the Russell 2000 lead to the downside, it must be a great day to be a bear! More important is the fact the Russell could be an important harbinger of things to come.

By the way, the Transports also broke its 200-day moving average on Wednesday.

The technical damage is real and happening for the first time in a long time. With the CBOE S&P Volatility Index (VIX) only in the 19 handle, the bear has not finished dining as he must be very hungry.

The highest level for the VIX in recent memory was 50 back on February 6. The problem is the fear wasn’t felt across the board. Recall, this was during the first release of the FISA memo documents. The VIX spiked in the overnight action and by the morning came back down to respectable levels. For this correction to end, there likely needs to be an event that washes out a lot of the complacency that has characterized the whole year.