Caution has been my watchword throughout most of 2018. Beginning in February/March, I advised investors to dump overhyped, overowned, overloved growth/tech stocks and swap into underhyped, underowned, underloved defensive/utility/consumer staples stocks, writes Mike Larson.

I recommended they raise their cash levels to the highest in years. And I urged them to focus only on the highest-rated stocks with the largest margins of safety.

It may not have made me many friends among the usual risk-loving Wall Street crowd. But the market action since then proves that advice was on point! Consider that in the month leading up to Tuesday (when the market finally managed to put together an oversold bounce):

- The Dow Jones Industrial Average (DJI) plunged roughly 2,500 points from its October 3 high ...

- The Russell 2000 Index (RUT) of smaller capitalization stocks gave back essentially every penny of gains it racked up since September 2017 ...

- And the Nasdaq Composite Index — packed full of overloved, overowned, overhyped technology shares — got crushed. It just suffered its worst monthly decline since the 2008 collapse, with Amazon.com (AMZN, Rated “B-”) losing a whopping $500+ and Netflix (NFLX, Rated “C+”) shedding a third of its value in just a few weeks.

That’s not even the half of it, either. On Monday, October 29 alone, the original four “FANG” stocks (Facebook, AMZN, NFLX, and Google parent Alphabet) lost $200 billion in market capitalization. That’s BILLION with a “B”. In one day. Since July, those same stocks have lost almost THREE TIMES that much -- roughly $570 billion.

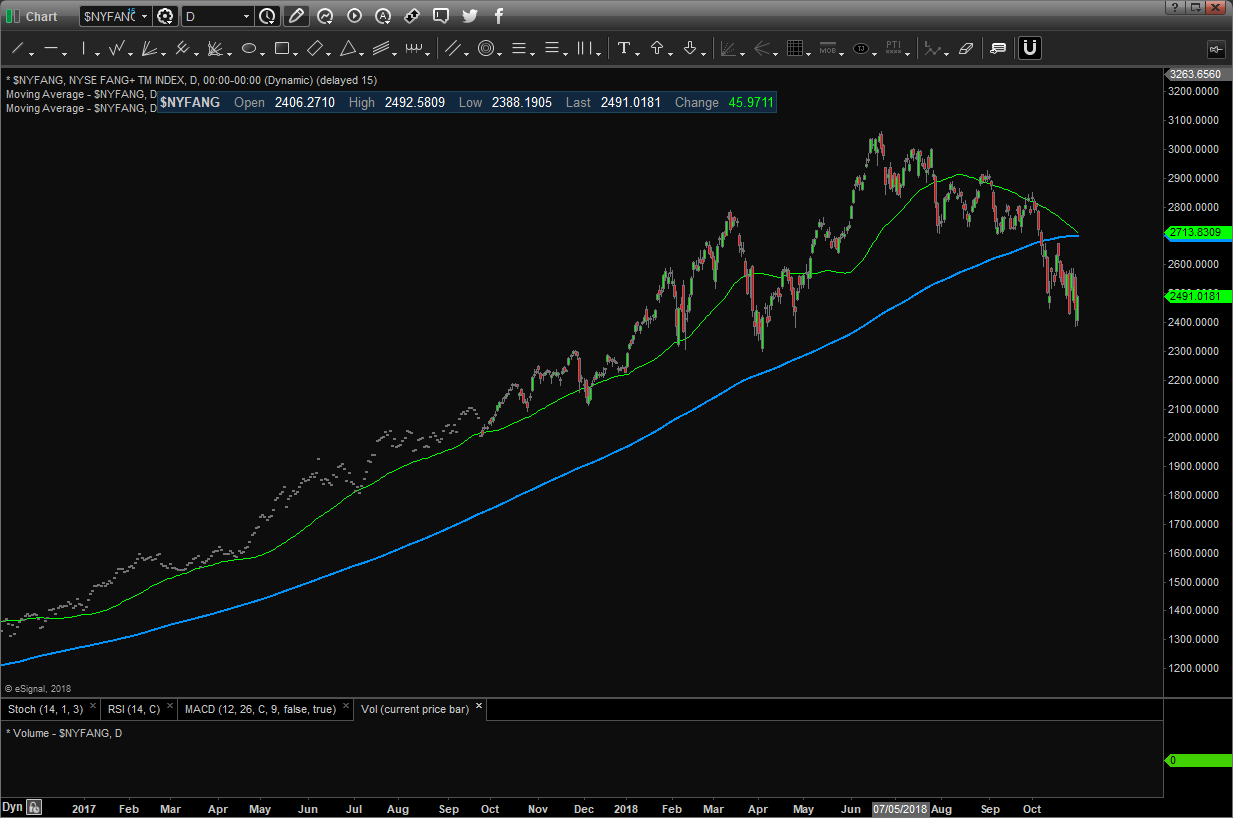

What about the NYSE FANG+ Index, a slightly broader index that includes those four names, plus Alibaba (BABA), Baidu (BIDU), Apple (AAPL), Tesla (TSLA), Twitter (TWTR), and Nvidia (NVDA)? You can see in this chart that it just shed more than 22% of its value since the summer peak.

As for the broader S&P 500, it lost roughly $2.1 trillion in October. And if you add in global market losses, you’re talking about more than $5 trillion in vaporized value.

Meanwhile, check out this ETF Screener table I created using the tools available at the Weiss Ratings website. You can see how ETFs that invest in materials, financials, technology, and other riskier sectors have gotten clubbed in the last several months ... while utilities, staples, healthcare, and REIT ETFs have performed great!

Data date: October 30, 2018

It all “fits” with my views that ...

A) The character of this market is changing

B) Yesterday’s leaders will become today’s laggards, while yesterday’s laggards will become today’s leaders.

C) You have to roll with that trend shift if you want to be successful, not just in the remainder of 2018 but into 2019 and beyond. Or in simple terms, caution is the “new sexy” when it comes to investing!

I went even further in my Weiss Ratings’ Safe Money Report, recommending an investment that RISES in value as financial stocks fall. It’s performing well for my subscribers given the sector’s struggles, and if you want more details, you can get them by clicking here.

Until next time,

Mike Larson

Check out Mike Larson’s Yield Picks OGS and GTY here.

Duration: 3:15.

Recorded: MoneyShow Dallas, Oct. 5, 2018.

Check out Mike’s short video, 2 Safe Yield Stock Picks at MoneyShow San Francisco here.

Duration: 4:42.

Recorded: August 24, 2018.

Check out Mike’s short video interview, Conservative Stock Picks for 2018 at MoneyShow Las Vegas here.

Duration: 3:33

Recorded: May 14, 2018

Check out Mike’s short video interview What Investors Are Doing Wrong and How to Fix It at MoneyShow Las Vegas here:

Duration: 2:22

Recorded: May 14, 2018.