It’s not wise trying to call tops and bottoms, especially in brutal bear markets. Seasonally, it is feasible to see the oil complex get to its extreme this time of year, writes Jeff Greenblatt Wednesday. And what am I looking for in 2019?

In recent years we’ve seen oil hit a cyclical low or bottom in November 2001 and 2002, December 2004, January 2007, December 2008, January 2014 and February 2016.

It doesn’t always work but we have an interesting setup right here that may work. If you are going to trade it, even as good as it looks, the best strategy is to wait for a secondary low to form.

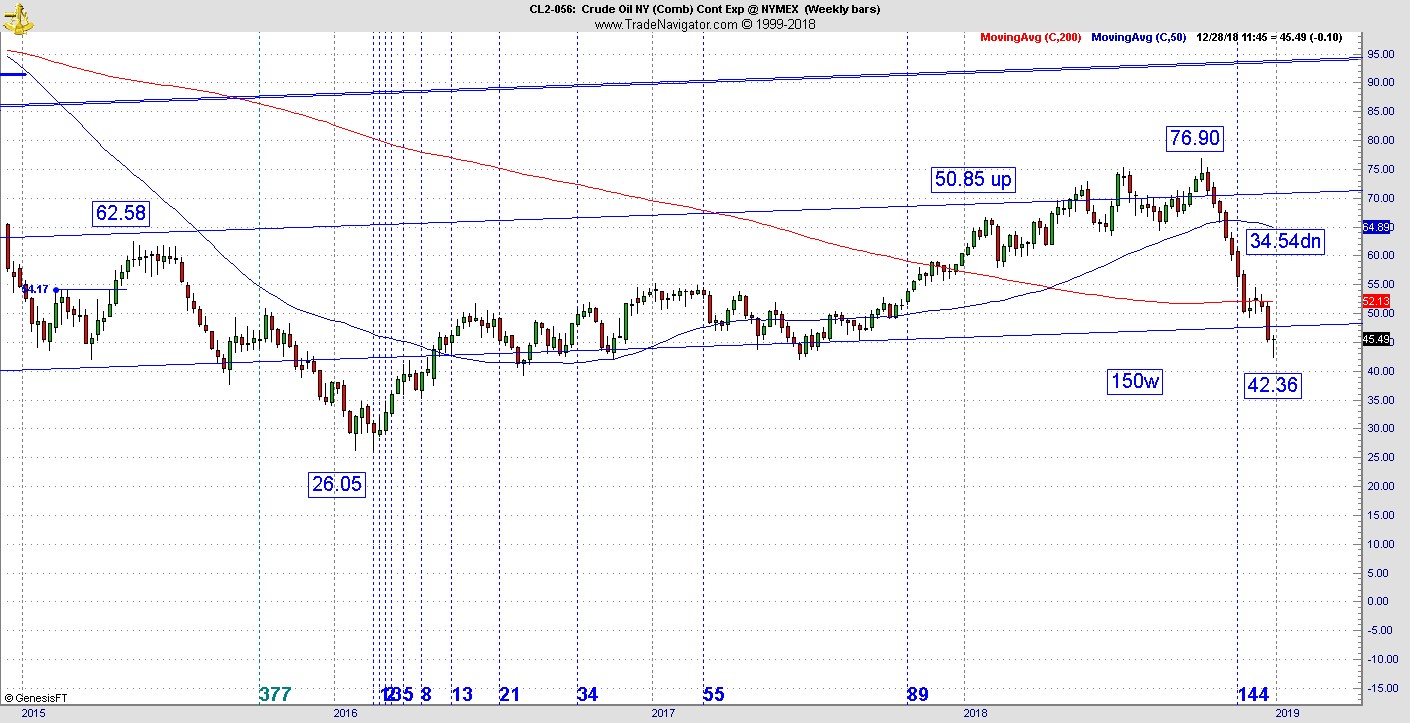

Here are some interesting readings. On the long-term continuation chart the move up from February 2016 low was 50.85. Now it’s 150 weeks from that pivot. Then when we scale down to the 360 min chart from the high in October they hit 232 bars, right in the Fibonacci 233 wheelhouse.

Let’s be clear about one thing. The weekly Kairos vibration is very good. It’s finally lining up with the seasonal aspect but we do have to recognize the 80-year generational turning cycle in the larger picture. I’ve talked about this for weeks.

Eliades speculated the stock market was in the meat on the bone portion of the presidential cycle from early November through next June but the challenge was how it would react up against these larger once-in-a-lifetime cycles. I wondered the same thing, as you know.

We got our answer. Santa was replaced by the Grinch. Is it really such a wonder the big Christmas movie this year is the Grinch? Does art imitate life or does life imitate art? In the case of Prechter’s “Socionomic Studies Of Society and Culture” it couldn’t have worked out more perfectly. So, isn’t it poetic justice the market stages a gigantic rally the day after Christmas?

**

What am I looking for in 2019? Not only is there geopolitical risk, there is domestic risk and now there natural disaster risk.

As if traders/investors didn’t have enough to worry about, the big volcano decided to blow out near Indonesia. I’m not an expert on such things but those who are believe there is the potential for another tsunami.

What I can tell you is when Krakatoa blew in 1883 Michael Snyder wrote the explosion was so loud it was heard 3,000 miles away and the tsunamis were 100 feet tall in some places.

I’m not making any predictions but those of us who live out west have heard all of our adult lives the Pacific “ring of fire” could activate at any time. Of course, none of us believe that and there is a term for it.

It’s called normalcy bias which is a mental state where even in the face of disaster people underestimate it.

In terms of our work, I have no idea whether a natural disaster will impact the bear. What I can tell you is there was a direct link financially across the globe from the San Francisco earthquake in 1906 and the panic of 1907. The world never recovered and in terms of social mood, these two events set the stage for WWI only 7 years later. So, we can’t rule it out.

Closer to home, Congress changes hands next week and the 24/7 news cycle isn’t getting any easier. Do you think people are fed up with it? Personally, I believe the scandal sheet in our politics is as responsible for this bear as the rise in interest rates. The market does not like uncertainty. The market certainly does not like the talk of impeachment, especially with such a pro-business president.

All bear markets have rally phases. We are overdue for one right now. But to think the bear could be over, don’t be silly. The problems that started this bear have not been resolved and are not even close to being resolved.

While no market goes straight up or down, 2019 promises to be a difficult year for the markets.