“Bear markets are fueled by the slope of hope and what ends up happening is hopes get dashed,” writes Jeff Greenblatt. He's presenting at TradersExpo New York March 10.

The crowd appears to have awakened upon return from the short Martin Luther King Day break. Last week equities surged on a report circulated by the business media that U.S.-China trade talks were making progress and would work on leveling the trade deficit over six years. Before the paint was completely dry, it was none other than Larry Kudlow himself that debunked it, saying there was no deal. He said there were important issues that still needed to be ironed out, least of which was some sort of regulation to the intellectual property problem.

The Chinese, for their part are demanding the return of their Huawei executive currently being held in Canada. That issue coupled with the fact Chinese GDP was the slowest in a quarter century spooked the crowd and the rally started rolling over on Tuesday. Bear markets are fueled by the slope of hope and what ends up happening is hopes get dashed and end up being completely retraced. What is the lesson? If you are going to follow reports like these, its imperative to understand these issues so one could develop discerning skills to consider what you are hearing is either hope or perhaps something of substance. That way you can immunize yourself from a lot of the insanity that gets reported from one day to the next. I’m not telling you to ignore the tape, its real. That being said, markets get very emotional and what appears baked in the cake today could be completely gone tomorrow. Remember, in a bear market, surprises come to the downside. One needs to adjust their trading time frame. Don’t get married to positions in bear market rallies.

But in the Tuesday aftermarket, IBM had a very good earnings report and was likely to influence the Dow early Wednesday. The crowd was more excited than expected, lifting the Dow Jones Index more than 300 points. But I told my posse late Tuesday to wait and see what happened after the afterglow of the IBM earnings evaporated after the first hour on Wednesday morning. Before the middle of the session, all the gains for the first hour were gone.

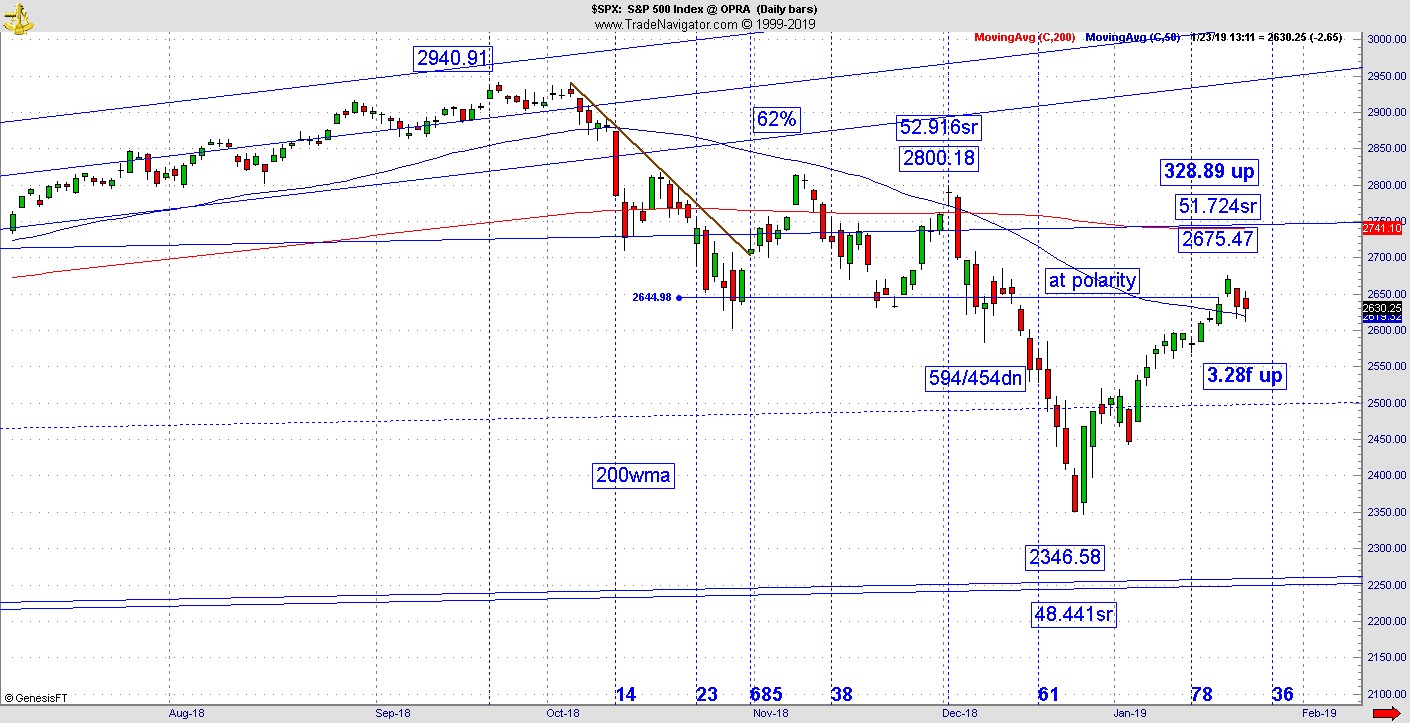

There were any number of readings on Tuesday’s charts but my favorite was what appeared in the S&P 500 (SPX), which stalled at first real resistance as polarity. This is a very interesting square root magic reading I will share in my session at the New York Traders Expo where the move up was 328 points and the difference in the square roots (the factor) is 3.28 (see chart below). That is correct and part of the underlying structure of financial markets very few people know about.

The next issue is not to go all in on every turn. How many false bottoms did we have on the way down? If you make it a habit to execute trades on secondary highs or lows, a lot of the stress and aggravation of getting stopped out over and over can be avoided. Once it appears a new trend could be developing, take exploratory positions intraday and let them grow. Here’s the dichotomy: If you short after a high (or low) with the idea of hitting a home run, chances are you’ll get stopped out. If you do the same with modest targets the market might surprise you and go a long way. That’s where we are at right now in terms of the current high. In a very strong bear market, its hard to say how good the readings have to be to tip the whole thing over. We might not need perfect calculations although the one on the SPX is very interesting.

Let’s change gears and follow through on a new discussion I started last week. As you know, we discussed the global debt issue which is now roughly $233 trillion. Throw in another $750 trillion in derivative as reported by the Bank of International Settlements, and we are looking at $1 quadrillion at least with sources reporting unfunded liabilities for another quadrillion. This is not an issue when bubbles are getting inflated the way they were the past few years. These things are not a problem until they are. In the famous pool table scene in Eyes Wide Shut the Sidney Pollack character tells Tom Cruise life goes on, until it doesn’t. But you already knew that. The derivative issue carries on, until it doesn’t. The point of no return could come in a rising interest rate environment. That’s why I’m concerned about it. For the long bond, there are now two weeks of follow through off a good vibration at a 29% retracement in 130 weeks (see chart below). The move lower in terms of price stalled as money could be rotating out of stocks right here. What everyone needs to watch is when the long bond takes out the bear market low from October. That isn’t happening anytime soon but the pattern is slowly working on it.

Oddly enough, the bond market has been elevated with the stock market getting hit again. What if that continues? This is purely speculation but we may need to see the market to continue in a rally either now or down the road in order for the crowd to wake up to the fact interest rates could get out of control. I don’t think the crowd is going to be too concerned about interest rates until such time the bond market gets close to retesting the October bottom. From here, that’s still quite a distance. If the bottom breaks, that could be the point of no return.

What about the stock market? In the final hour, the Dow Futures (YM) was wrestling with the 61% retracement of the drop off the high. If that survives, we are likely looking at a retest of last Friday’s peak. Any failure along the way would go a long way to stacking the odds the rally would be over.