The QuantCycles Oscillator has produced several short-term charts that exhibit extreme levels and trading opportunities.

Leading biotechnology firm Amgen Inc. (AMGN) has traded in a stable range for most of 2019. The QuantCycles Oscillator expected a narrow steady rise in AMGN in the last month that would grow sharper later this month. The recent sell-off in AMGN has pushed the daily oscillator into extreme oversold territory just as it forecasts a sharper uptrend (see chart below).

This led us to drill down further to see what the four-hour chart shows. The short-term oscillator indicator a more recent bullish turn as AMGN approaches extreme oversold territory. This confirms our initial buy signal and includes a sense of urgency as it indicates an interim top will hit in three days.

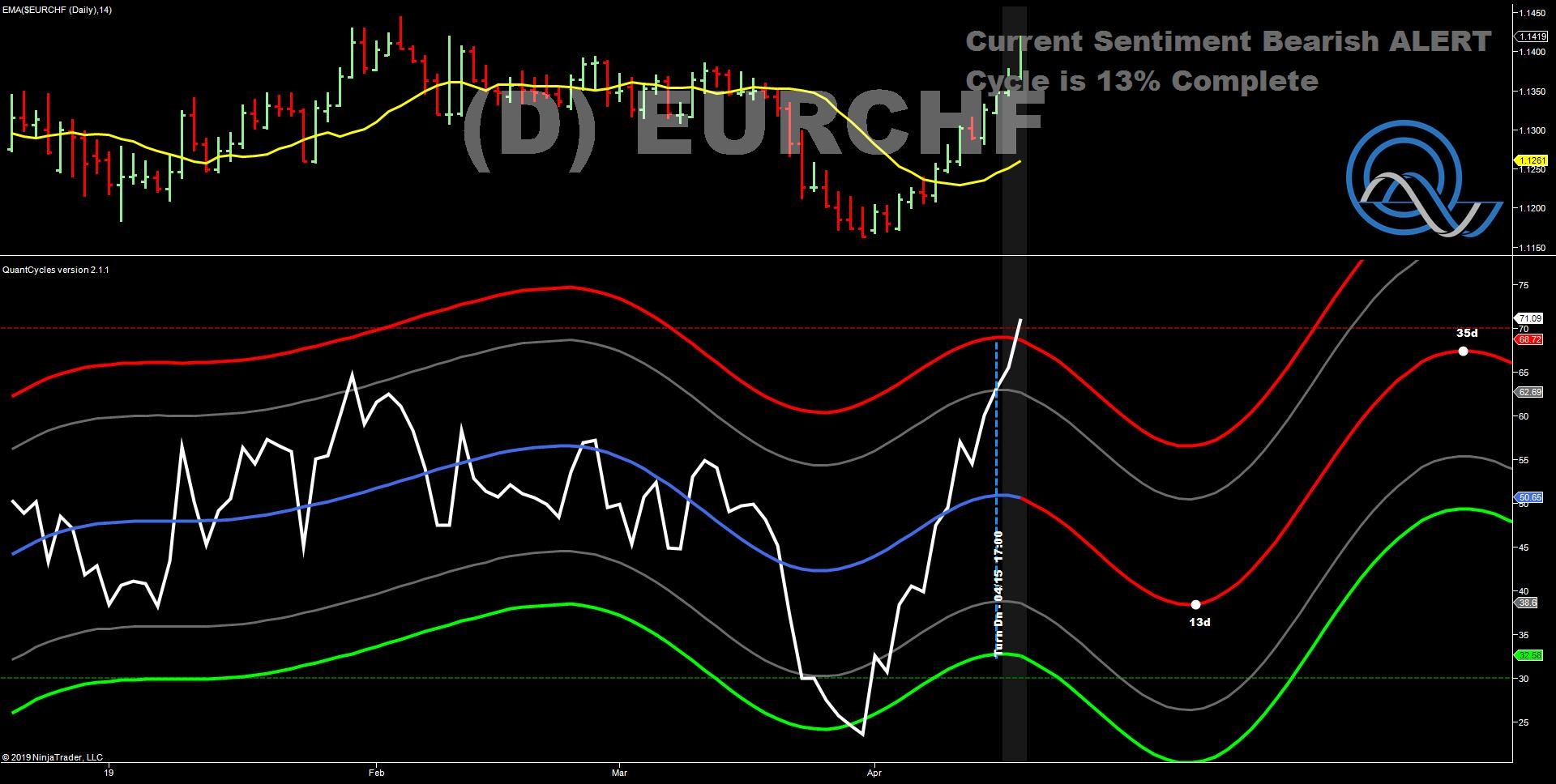

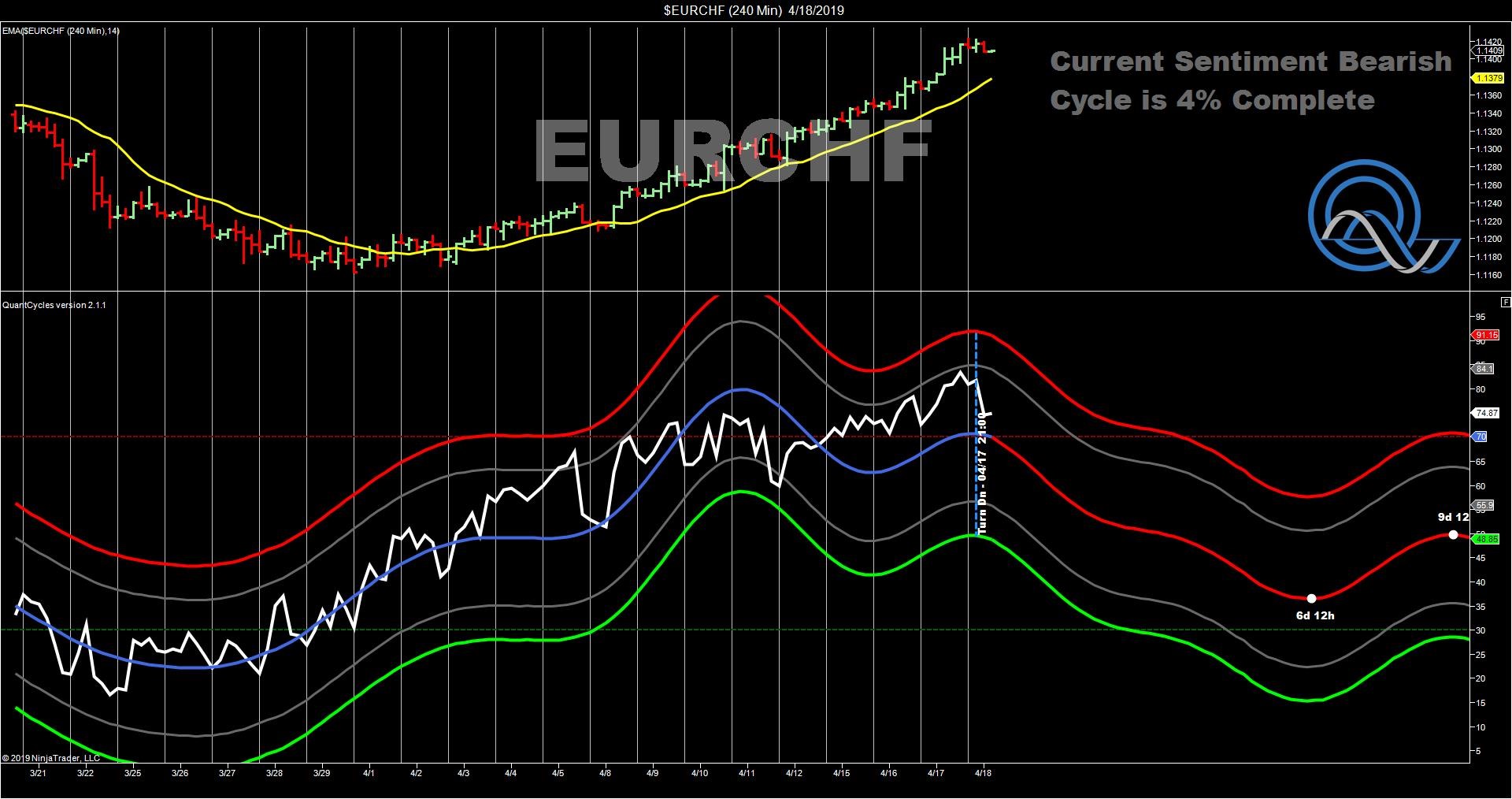

EuroSwiss cross

The recent sharp rally the EURCHF (euro-Swiss) currency pair has pushed it into extreme overbought territory in our daily QuantCycles Oscillator. This move happened just days after the oscillator indicates a top and reversal lower (see chart). The weakness is expected to persist for nearly three weeks before turning higher. This is a strong sell signal in the EUR/CHF.

A look at the four-hour chart confirms the sell signal. While EUR/CHF has not touched the extreme overbought level, it is overbought and is sitting on a more recent reversal lower.

John Rawlins described the value of the QuantCycles Oscillator recently at The Orlando MoneyShow.

The QuantCycles indicator is a technical tool that employs proprietary statistical techniques and complex algorithms to filter multiple cycles from historical data, combines them to obtain cyclical information from price data and then gives a graphical representation of their predictive behavior (center line forecast). Other proprietary frequency techniques are then employed to obtain the cycles embedded in the prices. The upper and lower bands of the oscillator represent a two-standard deviation move from the predictive price band and are indicative of extreme overbought/oversold conditions.