The biggest story unfolding in the Commitments of Traders (COT) report is still the sugar market, reports Andy Waldock.

The biggest story unfolding in the Commitments of Traders (COT) report is still the sugar market. Both the commercial and large speculative trading group set opposing record positions last week. Again, we expect this market’s conflict to resolve itself by moving higher and washing out a large portion of the speculative short interest. See our comments from last week.

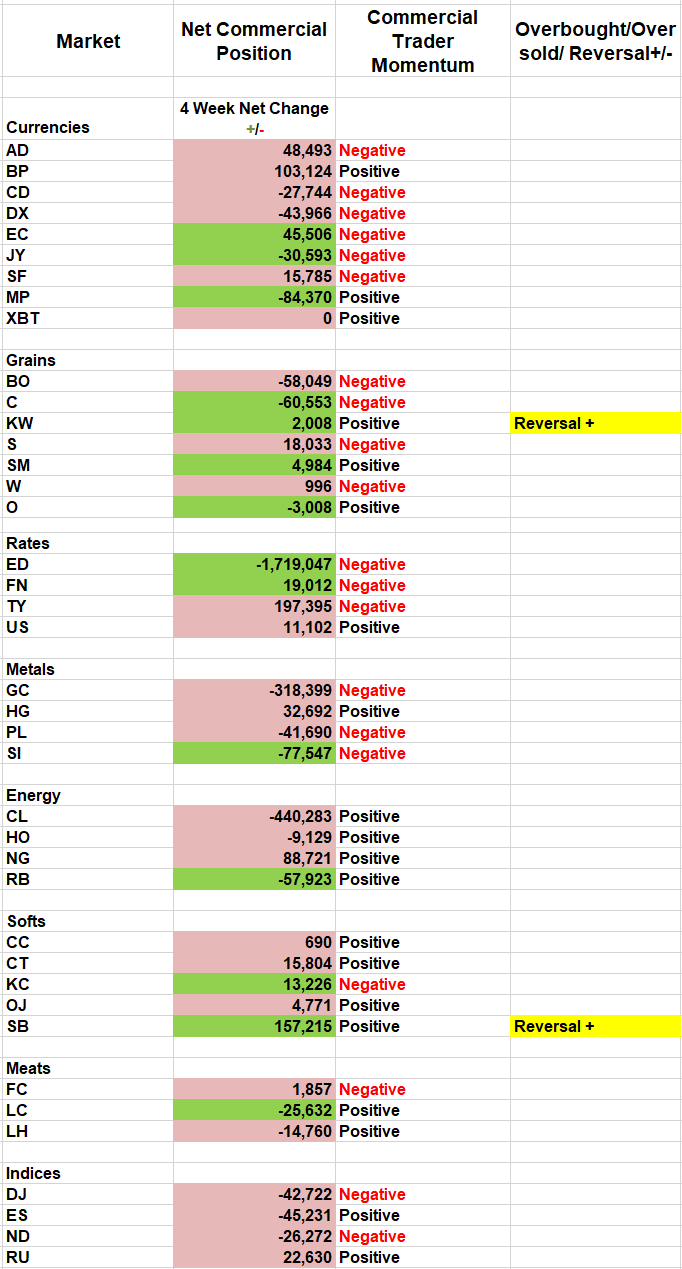

“We use the COT report to determine if a market that has moved into overbought or, oversold territory is due to continue or, reverse. Our primary data stream of the COT report monitors the commercial traders who produce or, refine a commodity, and the speculators attempting to catch the next new trend. Markets are rarely in trend mode. If a market is not in trend mode and the commercial traders within that market are anxious to hedge their needs at a given price, it's because they don't expect prices to be in the same area by the time their hedge is due in the physical market. We quantify "anxious" through a combination of proprietary TradeStation indicators available on our site. This week we have a classic setup involving commercial trader behavior and seasonality in the sugar futures market. …”

We see this as pent up buying potential. Commercial traders have taken the opposite approach, as sugar has become a value proposition, nearing its lowest prices in 10 years and ahead of anticipated seasonal strength. We'll side with the commercial sugar processors who are locking future supplies as fast as they can. Commercial traders not only set a new net long record, but their purchases for the last week were more than two standard deviations above their average. The commercial net position surge is just one of the ways we define "anxious." Finally, the sugar market tends to strengthen from mid-September through mid-October. We plan to piggyback this trade in our seasonal strategies.

Stay tuned for a buy stop run in the sugar market as it punishes the overly greedy speculators.

Open Positions:

- The long Euro short Swiss spread (EUR/CHF) continues to work in our favor.

- The five-year Treasury note protective buy stop can be lowered to 119-25.

- The unleaded long position is the week's big score and is now up more than $6,000. Prudence dictates raising the protective sell stop to $1.6370. That locks in more than $4,500. Optimistically, a close above last week's high $1.7785 pushes the market to $2. This is based off the downward sloping trend line beginning with the late April high.

- The March sugar buy signal is in line with the current seasonally expected window of strength. On a side note, our day trading algorithms are starting to pay dividends. In part, thanks to the crude oil volatility.

Here is what Andy had to say about seasonality and the COT Report at the TradersEXPO New York.

Visit Andy Waldock Trading to learn more. Register and see our daily and weekly signals archive for entries and stop loss levels sent to our subscribers.