All signs show continued upward momentum in Stocks, don’t fight it, but know how it will end, writes Joe Duarte.

The Federal Reserve cut interest rates and signaled that it’s on hold unless something extraordinary happens. But the markets, after the usual algorithm-related confusion are betting that stock prices can move higher.

Indeed, history shows that the odds of a market rally increase after three consecutive interest rate cuts by the Federal Reserve. That data, however, is based on rate cuts that have come when the economy is in an established down trend and the rate cuts lead to improvement in the economy, which in turn fuels a resurgence in corporate earnings and consumer spending.

A close look at the current U.S. economy – mixed PMI data, slowing although still present job growth, reasonable earnings, and a fairly stable consumer (regardless of recent retail sales figures) – suggests that the United States is not yet in a sustained downtrend, but in more of a flattening or slowing but still rising slope. So, perhaps the market is betting on the possibility that there are enough negatives around which can be turned around or improved upon to justify higher stock prices. Nevertheless, when you factor in the increasing weakness in the global economy, nearly zero chances of a rate hike in the next six months and strong seasonal tendencies for stocks you can make a case for a decent end to the year.

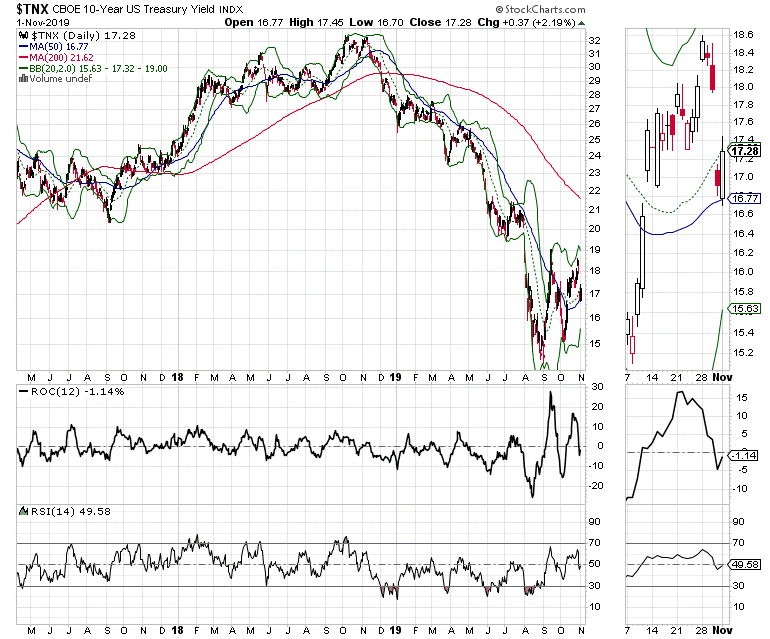

Bonds Get Spooked

Last week’s plunge in the U.S. 10-year Treasury note yield (TNX), after a collapse in the Chicago PMI may give the housing market a short term boost as mortgages activity usually responds to changes in TNX. As expected after the Fed’s rate cut and the Chicago PMI, TNX reversed its recent climb, which took the yield close to 1.9% (see chart below). That climb had begun to have a negative effect on housing data. But by week’s end the yield had begun to test the 1.7% area, which could bring in refinancing activity and spur new home sales.

Specifically, the huge two-day move for bonds, which if not reversed will likely have a positive impact on mortgage activity which is likely to become evident over the next two to three weeks. Still, even with the recent climb in rates pending home sales continued to climb as low housing supplies, well priced new homes, and low interest rates continue to push new home buyers and empty nesters into the market.

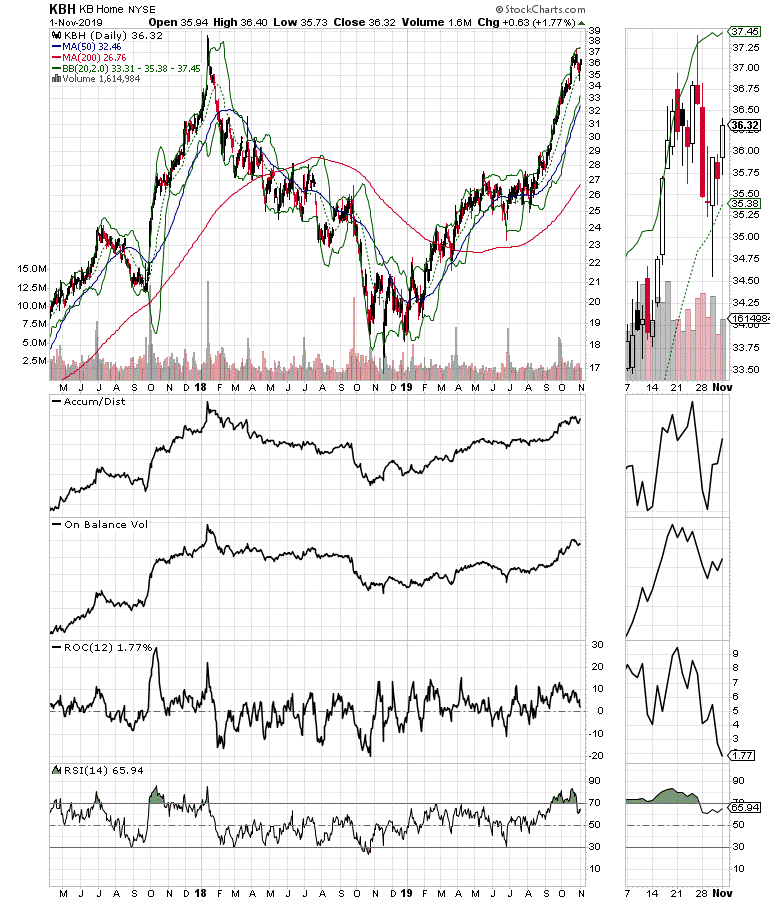

And just as I recently wrote, shares of KB Home (KBH), a stock which is becoming a bellwether for homebuilders, pulled back slightly during the rise in TNX, but after testing key moving average support, and a softening of yields, the stock once again moved higher (see chart below).

In other words, the Markets-Economy-Life complex adaptive system is still functioning. Millennials are coming of age as boomers downsize. Further of benefit to homebuilders are the general supply and demand fundamentals of the market. Big expensive existing homes are out while smaller more affordable functional homes are in. Homebuilders have adapted to these conditions and are responding to what the customers are looking for. Thus, barring a rise in interest rates, a major economic or political disaster, the housing sector looks set to do fairly well for a while.

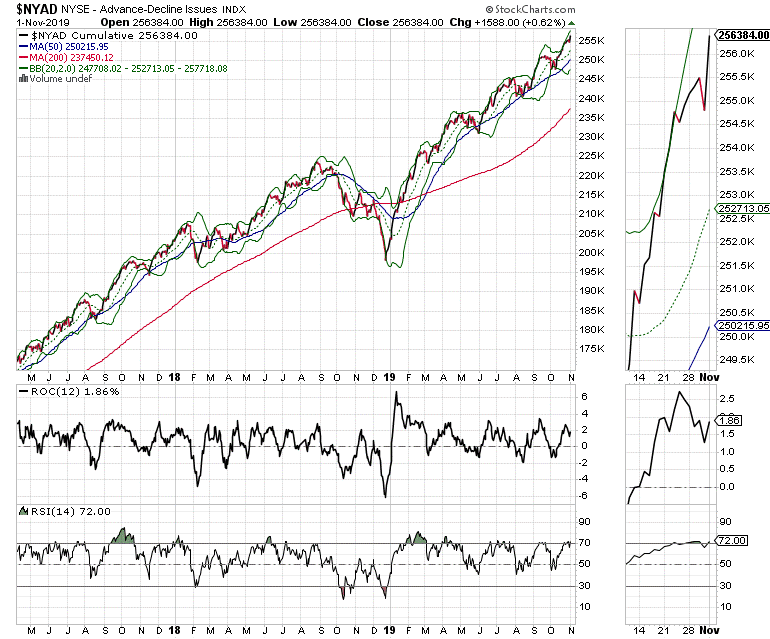

Another Week, another New High on NYAD

The New York Stock Exchange Advance Decline line (NYAD) remains the best predictor of the trend in U.S. stocks since the 2016 presidential election and last week was no exception. Although NYAD had a slight midweek pullback, it ended Friday’s trading session with a bang, scoring yet another new high and pointing to higher stock prices in the short to intermediate term.

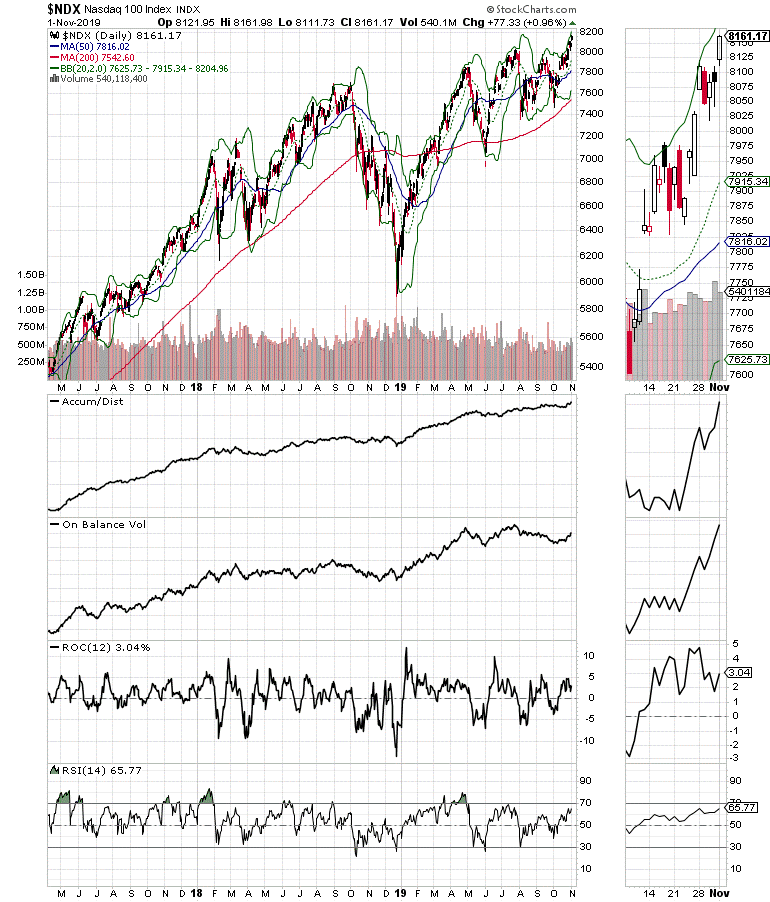

Furthermore, the new highs on NYAD were confirmed by new highs on the S&P 500 (SPX) and the Nasdaq 100 (NDX) indices. When indices and NYAD make new highs in tandem it is a bullish signal for the next few days to weeks.

And when you add the generally bullish seasonal tendencies of stocks to rally into the end of the year, the odds of a move higher in stock prices increase further.

What it all boils down to is that as long as there is no major downturn in the job market, the U.S. economy could continue to be a steady performer.

History is on the Side of the Bulls

The stock market is looking for reasons to go up and investors who fight this general tendency will likely miss out on some gains. Of course, there will be some bad days. And certainly, any bad news from Washington, the trade war, and the usually boogey men that lurk around could derail the whole thing at any time.

Nevertheless, when the Fed is pushing money into the system and investors ignore the bad news on a regular basis, it usually means that we are entering a momentum run. That momentum runs can make investors a lot of money is a positive. The downside is that all momentum runs end badly, which means that when this one runts is course it will hurt a lot, like they all do.

What it all means is that as traders you roll with the trend and you watch for signs that things are about to change. For now, it looks as if this momentum run is just getting started, but you still need to protect your downside.

I own KBH and PFE as of this writing.

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here.