U.S. Dollar Index strong as commercial struggles with negative interest rates, reports Andy Waldock.

We’ve developed a working thesis around U.S. Dollar Index inflows. Dollar inflows are based on more than just trade war isolationism and the repatriation of American business due to tariff impacts. Dollar inflows also include the growing bubble of negative rates in the Eurozone and increasing chaos in Southeast Asia, leading to stagnant equity markets.

A combination of these factors are manifested in the growing spread between U.S. assets and interest rate investment classes versus the global economic alternatives. Furthermore, U.S. investments are both transparent and liquid. This allows foreign investors to make quicker decisions while resting comfortably because the U.S. assets in their growing portfolios are readily convertible to cash, should the bubble burst.

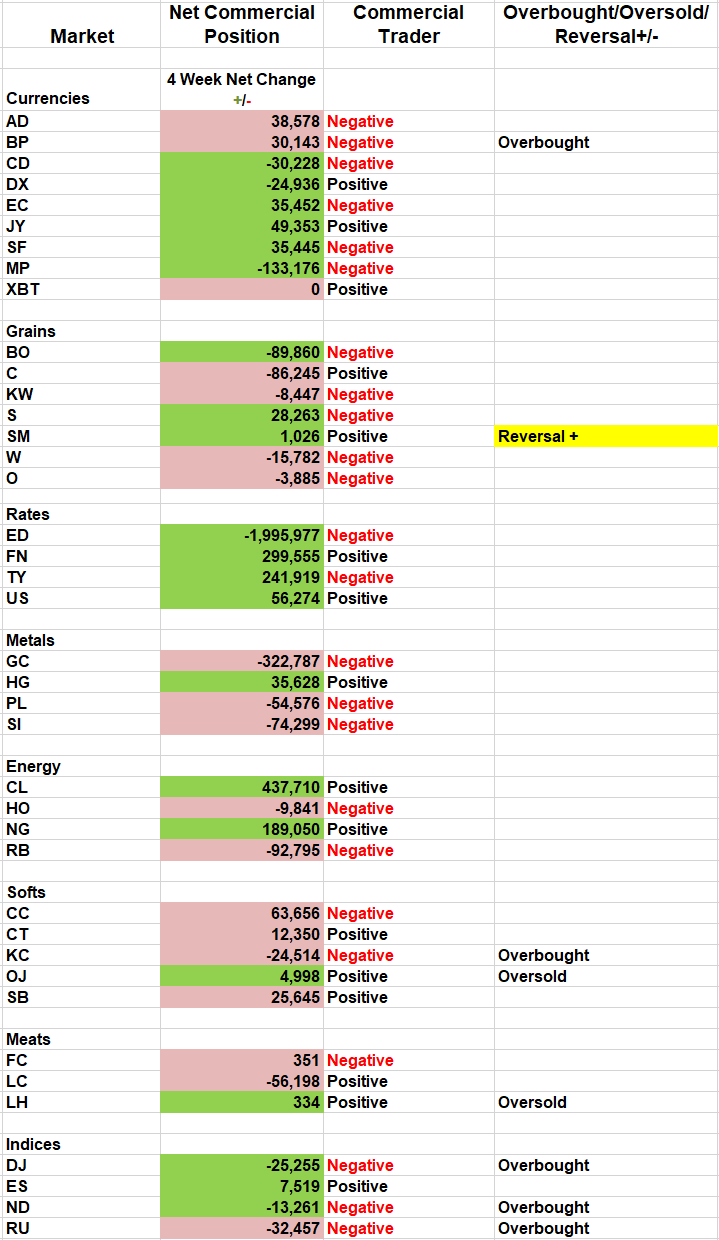

The outlook above reflects the U.S. equity markets and Dollar Index futures. The U.S. equity market bull run is beginning to take on mythological valuations as it continues to surpass historical measures. Meanwhile, the U.S. Dollar Index is within spitting distance of closing the year on its high. More importantly, the commercial traders who are typically “negative feedback” traders are not only buying the

Dollar Index near its high but “anxiously” buying (see COT Table below).

Regular readers know we use a combination of adjustments to differentiate from typical behavior and “anxious” behavior. The overriding thought is that when the people in the business feel pressed to get their trades done at current prices, it means they don’t think we’ll be here for long. In this case, commercial traders’ anxiously buying at the highs is a clear indication that they expect the U.S. Dollar Index to continue marching higher.

This background brings us to the British pound, Brexit and Boris Johnson. The commercial traders were large buyers of the pound in mid-August. We published a buy signal on Aug. 26 in our weekly Cot Signals stating that, “The British pound is finally making a move higher. We’ve been following the market lower for quite some time. We got an early jump on the trade mid-month in our Daily COT Signals. Now, the weekly signals have flashed a corresponding buy signal based on the continued purchases of the commercial traders who’ve found value in the pound below $1.23.”

Now, commercial traders are on the other side of the trade. They’ve paired their net long position from nearly 52k contracts in mid-October down to 30k (see table above). Commercial selling pressure has pushed their momentum into negative territory while late-arriving speculative bulls have pushed the market higher into overbought territory. This specific combination of commercial selling into a speculatively overbought market sets the trigger for a sell signal. We need the market to head lower, first. Then, we typically issue a signal in the daily COT signals followed by a Weekly signal if the trade is behaving as forecasted. Keep your eyes open for a short selling opportunity in the British pound, especially as we head into long-term resistance between $1.32 and $1.3375.

In other commodity markets this week, the coffee market has rallied sharply since mid-October. Commercial traders had been heavy buyers during the August decline. The market meandered aimlessly until finally moving higher and generating a daily COT buy signal on Oct. 19. The market has rallied more than 20% since this recommendation, and the commercial traders’ actions shout that this rally has neared its end. The commercial traders have set rolling 52-week net short lows in each of the last two weeks while selling more than 20k contracts. We’ll be watching this market closely for signs of a reversal and an opportunity to profit on the short side.

Here is what Andy had to say about seasonality and the COT Report at the TradersEXPO New York. Visit Andy Waldock Trading to learn more. Register and see our daily and weekly signals archive for entries and stop loss levels sent to our subscribers.