Several Asian economies are showing signs of weakness prior to the escalation of the Coronavirus, warns Landon Whaley.

Recently, we’ve spent a good deal of time breaking down developments in the United States, and rightfully so. However, it’s time for us to get back to our global macro pedigree, grab our passports and get a sense of what’s going on outside the United States. Luckily, we needn’t look further than last week to get a crystal-clear view of the global economic reality.

First, Chinese officials lowered the rate on the one-year medium-term lending facility by 10 basis points, the one-year Loan Prime Rate by 10 basis points, and the five-year Loan Prime Rate by 5 basis points. On the surface, this may not sound like much, but if you’ll recall, Chinese inflation has been on an absolute tear since early 2019 (driven almost entirely by food prices) and is currently within spitting distance of a 10-year high. The Chinese government wouldn’t be cutting rates and adding fuel to that inflationary impulse unless things were getting uglier.

Second, Japan reported a dumpster fire for Q4 GDP. The quarter-over-quarter growth rate contracted at -1.6%, but the annualized contraction was a whopping 6.3%. This is the second-worst GDP since the Global Financial Crisis and an even more horrific GDP report than after the Fukushima Daiichi nuclear disaster. The real kicker is that this growth rate reflected the Japanese economy before the Coronavirus.

It’s not just the big boy economies taking it on the chin right now. Singapore reported a contraction in January electronic exports of 13% and lowered its 2020 GDP projection to a contractionary -0.5% from the previous estimate of +1.5%. Following suit, Thailand cut its own 2020 GDP growth expectations by -100 basis points. These two economies won’t be alone; cuts to growth forecasts are coming for every economy in Asian in varying degrees.

For those of you not so much into data, but preferring instead to navel-gaze financial markets, they are signaling the same, “everything is not awesome” signal.

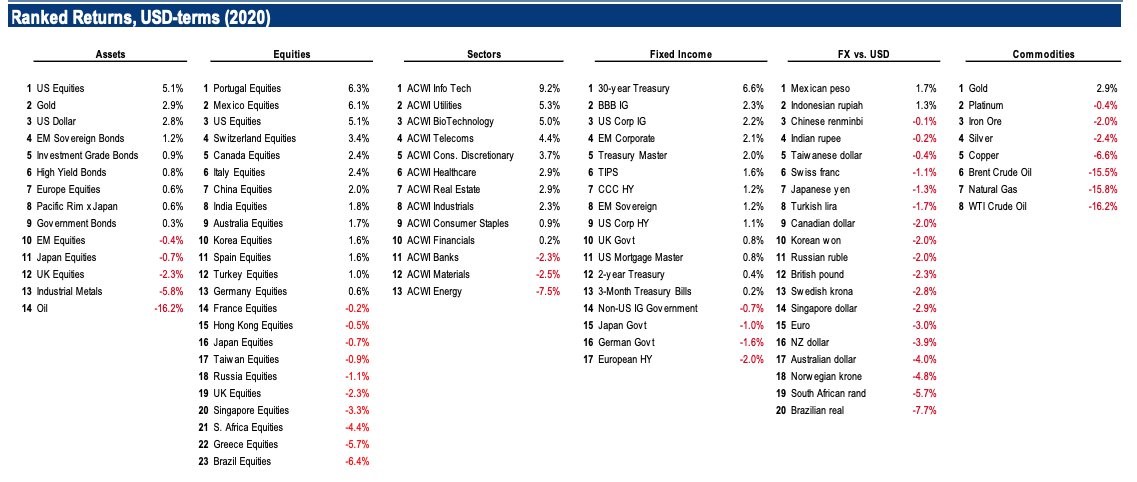

Bank of America just released a table detailing the year-to-date performance of 95 global asset classes. Beyond the fact that 50% of all assets are currently underwater, there is a far more critical takeaway. In the fixed income space, yields are lower today in 13 of the 17 (76%) bond markets represented (see table below). In commodities, the only commodity to gain ground this year is gold (+8.3%), which means 88% of the major commodity markets are negative. And finally, the U.S. dollar is stronger against 18 of the 20 (90%) global currency markets in the table.

Folks, there is only one Fundamental Gravity environment that is characterized by falling yields, crashing commodity prices, and a surging greenback, Winter.

So, to summarize the state of the world, the largest economy in the world (U.S.) has been in a growth slowing regime since Q4 2018, is currently experiencing a Fall Fundamental Gravity but beginning to transition back into Winter, and corporate earnings look like guano. The second-largest economy in the world (China) is closed until further notice thanks to the Coronavirus. The third-largest economy (Japan) just laid a -6.3% GDP egg, pre-Coronavirus. The fourth-largest economy in the world (Germany) hasn’t seen annual GDP growth higher than 0.6% for nearly two years, printed a pre-Coronavirus contraction in its January manufacturing PMI and saw an 18-point month-over-month decline in its highly reliable ZEW Economic Sentiment survey. Oh, and financial markets are confirming a global Winter Fundamental Gravity.

Trade accordingly.

Please click here and sign up to receive the latest edition our research reports as well as to participate in a four-week free trial of our research offering, which consists of two weekly reports: Gravitational Edge and The Weekender. Learn what we mean by Winter Fundamental Gravity and all our cyclical market measures.