Even with the Fed’s bailout of the junk bond market, it is not a wise investment, warns Mike Larson.

First, the junk bond market boomed. Next, it went bust. Then, the Federal Reserve bailed it out. Finally, that sparked a new mini boom.

More than anything else in recent weeks, the boom/bust/bailout cycle is what mattered most to Wall Street. The manner and timing of the cycle holds important lessons for investors like you — lessons that will help you build and protect your wealth in the months ahead.

If you aren’t familiar with the junk bond (high-yield) market, let me briefly explain a few things. It’s where companies at greater risk of default borrow money from institutional and individual investors.

Those companies may have excessive debt loads, significant earnings and cash flow issues, and/or serious industry-related challenges. But whatever the problems, the result is that they have to pay higher interest rates to obtain funding. Their bonds also receive lower credit ratings from agencies like Moody’s and S&P — less than “Baa3” or “BBB-”.

In a world of near-infinite QE and near-zero interest rates globally, the juicier yields offered by junk bonds looked very attractive. So, investors dog-piled into junk securities and funds that owned them in the last several years. That demand drove borrowing costs for high-risk companies into the gutter and issuance of even the trashiest junk bonds through the roof.

Analysts who were paying attention (and weren’t hopelessly conflicted because our firms weren’t getting rich off the boom) knew this was a disaster in the making. That’s why, as we began transitioning into the latter stage of the credit cycle in 2018, I warned investors to stay away and stick with Treasuries instead.

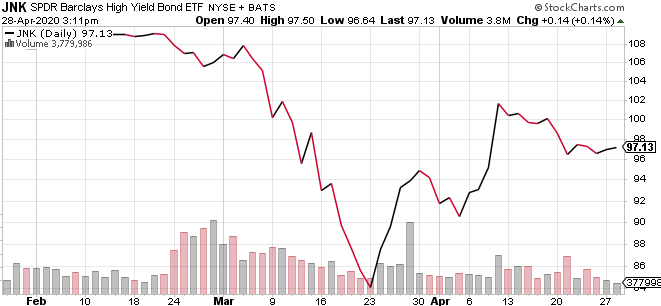

When the Coronavirus pandemic news turned south in February, junk bonds began to collapse. The SPDR Bloomberg Barclays High Yield Bond ETF (JNK) plunged from just over $110 to around $83 in only a month (see chart below).

That was the fastest, sharpest drop since fall in 2008 during the Great Financial Crisis.

Yields on old junk bonds shot up. Issuance of new junk bonds collapsed. The share prices of companies with extreme credit risk followed suit. And then the Fed stepped in, saying it would buy ETFs that own junk bonds and bonds that used to be (barely) investment grade but got cut into junk territory due to the virus outbreak.

Bloomberg News wrote a scathing story about the moves headlined “No Junk Debt Is Too Risky: How Fed’s Bailout Changed Everything.” The piece noted: “After years of risky companies taking on unprecedented amounts of debt, weakening lender safeguards and blurring earnings math to appear more creditworthy, some now argue the Fed is turning everyone into a winner, distorting asset prices in the process.”

As prices of junk bonds rose and yields on junk bonds fell, companies stepped into the breach and sold $34 billion worth of risky debt. That made April one of the busiest months for high-risk bond sales ever.

The Fed also bailed out the same gunslinging, high-risk, leveraged buyout, private equity and hedge fund firms who helped create Corporate America’s extreme debt and leverage problem in the first place!

Maddening? Sure. It goes against decades of central banking tradition. It also encourages reckless future behavior on a grand scale because even those who take wildly excessive risks know that when the going gets tough, they’ll get tossed a life ring. The formal term for this is “moral hazard.”

But what can you do as an investor in response? What’s the takeaway here? There are four:

1. The Fed can and will try to bail out markets or asset classes in tough times. And the list of those getting bailed out in this cycle is much, much longer than the last cycle.

2. But contrary to the popular Wall Street consensus view, that isn’t a vote of confidence and reason to throw caution to the wind as an investor! Rather it dramatically underscores the depth and breadth of our market and economic problems. And it doesn’t “fix” those problems at all! No wonder that ...

3. Even after the bailout-related bounce back, JNK has still lost around 10% of its value so far in 2020 and more than 5% over the past 12 months. That compares to gains of 23% and 38% for the iShares 20+ Year Treasury Bond ETF (TLT) over that same time frame.

Meanwhile, even after the significant bounce off the March lows, the S&P 500 is essentially unchanged since January 2018. That’s 27 months and counting of nothing for investors who just bought the averages. But “Safe Money” assets like Treasuries, gold, mining shares, and defensive, higher-yielding, recession-resistant stocks have wildly outperformed.

4. Unless and until the fundamental economic, sentiment and valuation backdrop starts to improve, it’s just too early to “Follow the Fed” and buy trash bonds, stocks or other assets.

5. You have to stick with investments that have staying power, solid gains potential and that spin off dividend or interest payments you can rely on.