Covered-call writing can be crafted to meet a myriad of goals in a wide range of market conditions. In May of 2020, the 10-year Treasury bond yield was 0.65%. Bank interest rates in several countries were negative, explains Alan Ellman of The Blue Collar Investor.

At the same time, dividend yield on Dow 30 and S&P 500 (SPX) dividend-bearing stocks were triple that of the 10-year Treasury. I see this as an opportunity…a three-income stream opportunity derived from share appreciation, option-premium, and dividend capture.

Three-Income Strategy in Low-Interest-Rate Situations

Blue-chip stocks frequently are cash-rich and generate dividends on a quarterly basis. They have a long history of success and, in addition to the dividends, most have exchange-traded stock options associated with them. This proposed strategy consists of the following steps:

- Buying a portfolio of the best-performing Dow 30 stocks

- Selling out-of-the-money call options

- Capturing corporate dividends

- Managing our covered-call positions

Stock Selection

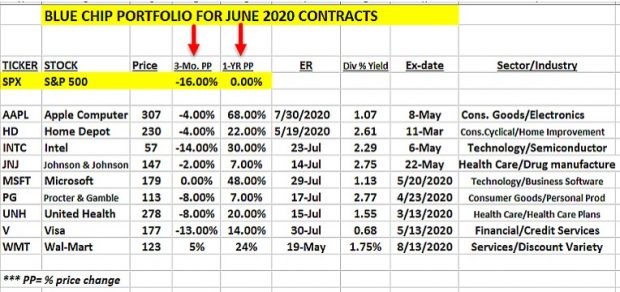

We select the top-performing Dow 30 stocks that have been out-performing the S&P 500 in both three-month and one-year time frames as shown in our BCI Blue Chip Reports.

Top-Performing Dow 30 Stocks for the June 2020 Contracts

Option Selection

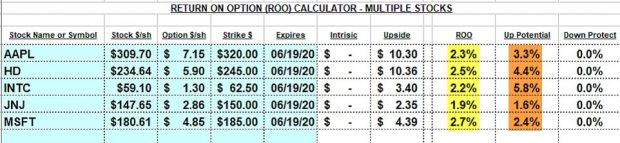

For this article, I used the first five stocks in the report and checked the option-chains for out-of-the-money strikes that generated 1%-2% for one-month initial time-value returns. I entered the option-chain information into the blue cells of the multiple tab of the Ellman Calculator.

Portfolio Calculations: 5 Stocks

The average one-month return on the option was 2.3% with an additional upside potential average of 3.5%. The maximum one-month return on this portfolio is 5.8% without exit strategies. On top of these income streams, we can add the dividend income offered by these companies.

Important Dates

Ex-dividend date

In order to capture the corporate dividends, we must own the shares prior to and on the ex-dividend date. A free and reliable resource is:

www.dividendinvestor.com.

Earnings report date

We should never have an option in place that expires after an earnings report date in a contract month. We should wait for the report to pass and then sell the call option or not use that stock until the report passes. A free reliable resource for ER dates is www.earningswhispers.com.

Exit Strategies

Once we have entered a covered-call trade, we move to position-management mode. A complete detailed discussion of exit strategies is beyond the scope of this article, but these include:

- 20%/10% guidelines

- “Hitting a double”

- Rolling down

- Selling the stock after closing the short call

- Mid-contract unwind exit strategy

- Rolling-out

- Rolling-out-and-up

Discussion

In a low-interest-rate scenario (can be used in others, as well) especially, we can set up a low-risk, three-income stream strategy using blue-chip stocks, out-of-the-money call options, and dividend capture for each position. As always, the three required skills are essential for achieving the highest returns:

- Stock selection

- Option selection

- Position management

Learn more about Alan Ellman on the Blue Collar Investor Website.