One of our covered-call writing exit strategies is rolling-out-and-up, explains Alan Ellman of The Blue Collar Investor.

We use this position management technique when our short call is in-the-money (ITM) as expiration approaches, and we decide to retain the shares for the next contract month (or week). For example, had we bought a stock for $38.00 and sold the $40.00 call and the shares were trading at $42.00 as expiration approached, we could roll-out-and-up to the $45.00 strike prior to 4 PM ET on expiration Friday.

In this case, the cost-basis is $40.00, the value of our shares at the time of the exit strategy. What is our cost-basis if the $40.00 call was closed on expiration Friday and the higher strike wasn’t sold until the following week? This now becomes two separate trades. Let’s break down the calculations using a real-life example (provided by Steve) using Global X Silver Miners ETF (SIL).

Steve’s SIL Rolling Trades

- 7/6/2020: Buy 100 x SIL at $36.93

- 7/6/2020: Sell-to-open (STO) the 7/17/2020 $36.00 call for $1.45 (1.44% 11-day initial time-value return)

- 7/17/2020: SIL trading at $41.14

- 7/17/2020: Buy-to-close (BTC) The $36.00 call at $5.20

- 7/20/2020: STO the 8/21/2020 $45.00 call at $1.15 (SIL trading at $43.14, $2.00 higher than Friday)

- 7/20/2020: What is our cost-basis after selling the new $45.00 call?

SIL Price Chart During These Trades

SIL Price Chart July 2020

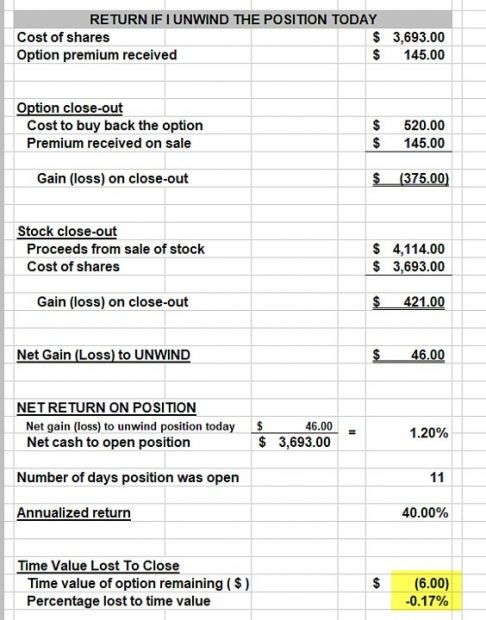

Cost-to-Close the $36.00 Call Using the “Unwind Now” Tab of the Elite and Elite-Plus Calculators

SIL Unwind Calculations

When factoring in unrealized share appreciation from $36.00 (contract obligation to sell) to current market value of $41.14, the time-value cost-to-close is $6.00 per-contract or 0.17%

Cost-Basis for the 8/21/2020 STO Covered-Call Trade

The realized profit generated from the original covered-call trade and share appreciation over the weekend are not factored into the cost-basis we use for the new August contract position. We always use current market value when initiating a new trade, in this case $43.14.

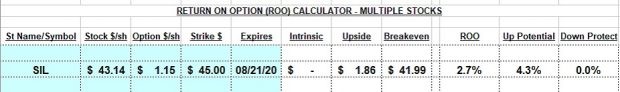

SIL Calculations for the August 2020 Contract

Using the “Multiple tab” of the Elite-Plus or Basic Ellman Calculator we see that there is a robust 2.7% initial time-value return plus 4.3% of upside potential if share price moves up to or higher than the $45.00 strike by contract expiration.

Discussion

Rolling-out-and-up implies closing the near-month call and opening the next-month call simultaneously. If the trades are executed on different days, the cost-basis on the new STO trade is based on share price at the time the subsequent trade is executed. Using this analysis will allow us to make the best trading decisions moving forward.

Learn more about Alan Ellman on the Blue Collar Investor Website.