First-level investors often overreact to quarterly earnings reports. They get lost in the near-term details without considering the bigger picture, asserts Brett Owens, editor of Contrarian Outlook.

As a result, they get scared and sell when they should be buying — and purchase when prices are already high with the good news "priced in."

While we contrarians pay attention to details around earnings announcements, we don't react without thought, deliberation and consideration for the big picture.

Omega Healthcare Industries (OHI) just raised its dividend for the 21st straight quarter. Most dividend aristocrats gain their titles after a quarter-century - OHI is making an accelerated case to be crowned in just six years' time!

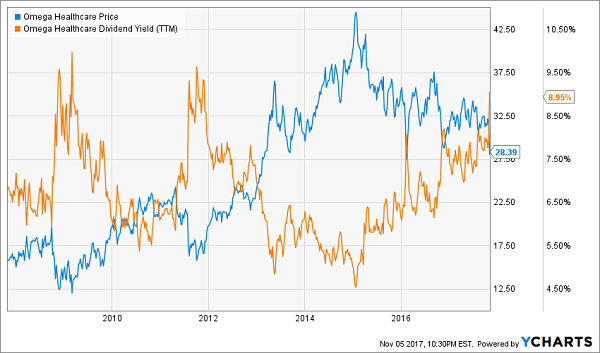

The stock now pays an amazing 9%. This is only the third time in the last ten years that OHI has paid this much. Each of the last two occasions were ideal times to buy.

Is this time different? A deadbeat operator is to blame (or thank) for the current sale. They are so late on their rent payments that OHI is exploring moving the operator's properties to a better partner.

In the meantime, rent is going unpaid and the company has lowered its 2017 cash flow guidance. It's actually assuming it will receive no rent from this delinquent problem child for the rest of the year.

Even with this "worst-case scenario" assumed, management remained confident enough to give investors their usual quarterly raise. They believe this is a one-time, isolated incident that is unlikely to be repeated.

Occupancy levels - a leading indicator of operator trouble - jives with their reasoning. Orianna, the operator in question, saw its occupancy decline from 92% to 89% in a year. This hurt its own cash flows and ultimately left it unable to pay its rent.

The rest of OHI's portfolio shows steady occupancy. Which indicates this is an Orianna problem, and not a broader OHI problem.

The big picture for skilled nursing facility (SNF) demand looks great. The industry, which is actually seeing supply decrease as demand increases, is projected to be in a supply deficit within the decade.

And while investors fret about bad apple operators, they're also missing the fact that total patient days at SNFs are increasing, and are projected to accelerate higher in the coming years.

CEO Taylor Pickett and his team have managed their operator relationships successfully for his entire tenure (as evidenced by their stock's amazing 5,000%+ returns over Taylor's 16 years at the helm!) It's probably not different this time. OHI is a great buy.