For the past several months, the lithium industry and the companies in it have been getting pretty beaten down. Albemarle (ALB), the biggest producer, is down over 20% in 2018, observes Jason Williams, contributing editor to Wealth Daily.

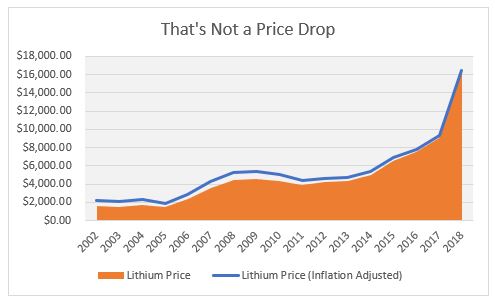

Analysts have been drumming up fear since late last year. They’ve been reporting that lithium demand is not growing. They’ve said producers are extracting too much and there will be an oversupply very soon. They’ve told us prices for the metal will drop astronomically and the companies that mine it will go bankrupt.

But newly released information suggests they’ve been 100% wrong this whole time. And it’s got me convinced that lithium and the companies that produce it are poised for their biggest growth spurt yet.

First off, as far as demand dropping, that’s not the case. It’s only getting stronger. Case in point: Volkswagen AG has awarded about $47.7 billion in contracts to suppliers. That’s a pretty big bet on the future of driving if you ask me.

And VW needs every one of those battery cells, too. This isn’t some power play to lock up supply and make it tougher for competitors to get them. By 2025, the company plans to have 80 new plug-in EV models on the road. And it plans to sell about 3 million of those EVs annually by that time.

That’s just one car company. You better believe that all the other big motor makers are working on their own electric fleets, too. And that’s some serious demand.

Then there’s China. It’s the biggest EV market in the world after overtaking the U.S. back in 2015. Last year some 777,000 new-energy vehicles were sold in the country. The government is giving massive support to EV and battery companies. Its goal is to hit a sevenfold increase in new-energy vehicle sales by 2025.

Albemarle announced first-quarter earnings and it blew estimates and previous years out of the water. The firm reported adjusted EPS of $1.30 per share. That’s compared to analyst estimates of $1.20. Unadjusted, they came in at $1.18 compared to just $0.45 in Q1 of last year. That’s massive growth of 162%.

Sales grew, too. They were up 14% over the prior year and above analyst estimates by nearly $20 million. And they were led by the lithium segment with net sales of $298 million, or 36.3% of overall revenues. That represented growth of nearly 40% over the previous year. Kind of makes you wonder about that demand slowdown and oversupply that analysts were talking about.

How are they selling that much more lithium if demand is dropping? How are earnings growing if prices are falling? Simple answer: It’s not dropping, and they’re not falling.

And management at the company is extremely confident in the coming year. They’re predicting full-year EPS in the range of $5.10 to $5.40. That means they expect the next three quarters to be even better than the first.

Revenues are expected to be strong the whole year, too, with full-year guidance coming in between $3.2 billion and $3.4 billion. That equates to three more quarters of sales above $820 million this year.

That doesn’t sound like an industry with dwindling demand and too much supply to me.

And yet Albemarle’s price has continued to fall. It’s down 25% in 2018. And it brings it back to prices we haven’t seen since the start of 2017. I call that a buying opportunity. It’s textbook value investing.

Everyone is scared. So we should be bold. Albemarle and its industry peers have fallen out of favor with the crowd. But when the crowd runs one way, intelligent investors run in the opposite direction.

That’s why I’m recommending setting up a long position in Albemarle common stock. The value is there. And once the fears abate, the stock price is going to recover that 25% and then some.

Starting to average your way into a position now and adding on any future dips will set you up for a strong rally in the near future. Albemarle and the lithium industry still have their best days ahead.