The meltdown in the banking sector caused the S&P 500 to shed 8%. That’s creating some fantastic buying opportunities, including in a “megatrend” dividend stock that will benefit as interest rates settle down: Crown Castle (CCI), notes Brett Owens, editor of Hidden Yields.

Well, that escalated quickly. Silicon Valley Bank found itself flush with deposits in 2020 and 2021 thanks to a Fed-fueled tech boom. The firm invested in “safe” U.S. Treasuries and mortgage-backed securities.

Then the Fed hockey-sticked interest rates. The bank’s portfolio was suddenly worth a mere 70 to 80 cents on the dollar. Venture capitalists got wind of this weakness and told their funded CEOs to pull cash out of Silicon Valley Bank. It was an old-fashioned bank run à la the 1930s.

Personally, I love investing in regional banks. But there’s a time and a place. At Hidden Yields, we’ve stayed away from the sector since April 2022.

That doesn’t mean there aren’t attractive opportunities in other stocks, though. A few months back, Matthew Thorton III plunked down $123,874 of his personal cash into a stock he knows well — CCI. Matthew, an executive at FedEx by day, sits on the Board of CCI.

Crown Castle is one of the three major cell-tower landlords in America and a Real Estate Investment Trust (REIT). It collects rents via its 40,000 towers (from carriers such as AT&T and Verizon). Think of CCI as a “toll booth” for cell phone traffic. Or in other words, CCI is basically a “growth utility” stock.

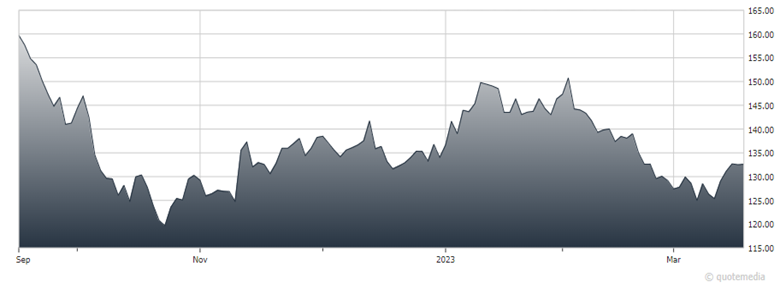

Higher interest rates are the reason these stocks—and really, all REITs – have been in the dumps. As they received more “rate competition” from bonds, investors moved their money elsewhere.

CCI has certainly been repriced. Now, it appears quite cheap! The stock recently yielded 4.8%, as much as it ever pays. The company has hiked its dividend by a fit 49% over the past five years, but the market treated CCI like a bond, selling it off as rates rose.

Now, with rates nearing their ultimate top, this is the time to scoop up megatrend-powered cell tower REITs like CCI. This stock is always expensive. Today, it’s finally cheap.

Recommended Action: Buy CCI up to $150.