American Superconductor Corp. (AMSC) is a small cap company on a growth tear. It is also a way to leverage the Artificial Intelligence (AI) theme in the power utility sector, says Bryan Perry, editor of Cash Machine.

The company provides megawatt-scale, power resiliency solutions globally for enhancing electric grid capacity. At a time when the demand to power the future of AI is the center of great discussion, AMSC is a key player in the enhancement of leveraging the grid.

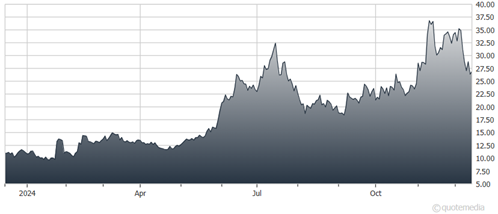

American Superconductor Corp. (AMSC)

Within the grid segment, AMSC solutions include identifying power grid congestion and poor quality, interconnecting wind and solar farms, quality control for the transmission of power distribution through cable systems, controlling power flow and voltage in the AC transmissions systems, and providing support services to wind turbine operators.

On Sept. 24, AMSC lifted its guidance to account for the Aug. 5 acquisition of NWL Inc. The acquisition of NWL, which has a three-year average of approximately $55 million in profitable revenue per year, will expand and strengthen AMSC’s military business. In addition to providing products that support the power grid and designing wind turbine systems, AMSC also manufactures ship protection systems for the US Navy.

On Oct. 30, AMSC posted revenue of $54.4 million (+60.2% year-over-year), beating estimates by $3.1 million. Earnings of $0.27 per share beat estimates of $0.23. Earnings are forecast to jump to $0.50 per share for 2024, up from $0.02 in 2023.