Trinity Industries Inc. (TRN) came through in our annual seasonal stock screen we run at the outset of the Best Six Months of the year. It’s a rail transportation products and services company that operates in North America, outlines Jeff Hirsch, editor-in-chief of The Stock Trader’s Almanac.

We run our robust fundamental stock screen right after our Best Six Months Seasonal MACD Buy signal triggers, which occurred on Oct. 11, 2024. We are not evaluating company guidance, business models, or prospects. It’s a pure numbers game.

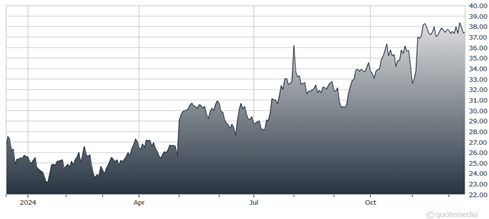

Trinity Industries Inc. (TRN)

We scan for companies that are exhibiting an acceleration of growth in revenue and earnings year-over-year and sequentially on a quarterly basis. To make the cut, these stocks must also be undervalued on a price-to-sales and price-to-earnings basis, as well as possess good margins, debt ratios, and cash flow. We look for stocks with mild relative strength that are underfollowed by Wall Street analysts. As market valuation goes higher, this becomes increasingly challenging, and a history of earnings surprises and estimates becomes even more important.

TRN provides rail car leasing and management services, railcar manufacturing, maintenance, logistics, and other railcar-related products and services. They operate in various markets, including refined products and chemicals, energy, agriculture, construction and metals, and consumer products.

TRN has a P/E ratio around 17 and a price-to-sales ratio under 1. The company also boasts a history of steady dividend increases, with a recent 3.2% dividend yield. It appears to be well-positioned to benefit from the expected increase in domestic industrial activity, oil and gas production, and shipping of commodities and refined and consumer products in 2025.

Disclosure note: I hold a position in TRN.