Fresh out of college, Jake Bernstein developed observations about abnormal behavior in his work at a Chicago mental hospital. Decades later, those experiences helped this trading legend spot abnormal market behavior and opportunities. You can too. Second of three weekly parts.

In part one of this three-part series I recollected my experiences and observations of aberrant behavior in psychiatric patients hospitalized at my first place of employment. Some people have told me that I do the same kind of work now but I get paid much better. All joking aside, my observations at the hospital led me to understand the importance of anticipating behavioral changes by studying precedent behaviors that alert us to pending changes.

Some of my best market indicators are based on the ability to anticipate change in market trends rather than react to it. In other words, so-called leading indicators are much more effective than lagging indicators. Lagging indicators, by definition change in response to changes in market trends. As such, they are always late. In this category we include traditional moving averages, stochastics, and the numerous variations on the theme of moving averages. While some of these approaches are profitable they frequently present with low accuracy and large drawdowns. My testing shows that even the best lagging indicators achieve profitability 30% to 40% of the time it.

Leading indicators, on the other hand are much better at signaling trades very early in their inception.

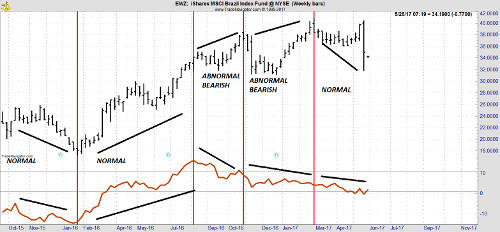

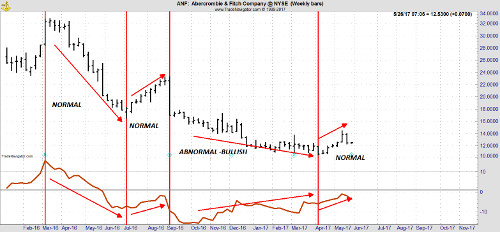

Perhaps the single best indicator in this category is momentum, also known as rate of change. When used with an objective set of rules, momentum can alert traders to pending changes in trend. In the normal state, momentum and price should move together. When price makes a new high, momentum should make a new high, and vice versa. However, when price makes a new high for a given period of time but momentum does not, the behavior is considered abnormal and often leads to a change in trend.

I have developed a specific, and 100% objective methodology for isolating such pending changes in trend and for triggering trades in the direction of the new trend early in its inception. This procedure is totally mechanical and can easily be programmed into trading software thereby alerting the trader to pending trend changes and trading signals. I want to share the concept with you by showing you some examples.

Here are two annotated charts illustrating concept discussed above.

In part three of the series we will look at some specific examples of divergent momentum and outcomes associated with momentum divergence triggers. Meanwhile, you may wish to examine some charts and see for yourself how the concept discussed above plays out on an actual chart. Look for examples on your own.

Subscribe to The Jake Bernstein Online Weekly Capital Markets Report and Analysis here…