We recommend riding out any volatility that may arise, even if caused by diminishing prospects for tax reform if the president’s plan should run into trouble, asserts Marvin Appel, MD, PhD, of Signalert Asset Management.

State of the Market: After touching new highs on November 8 the S&P 500 Index (SPX) is opening lower today.

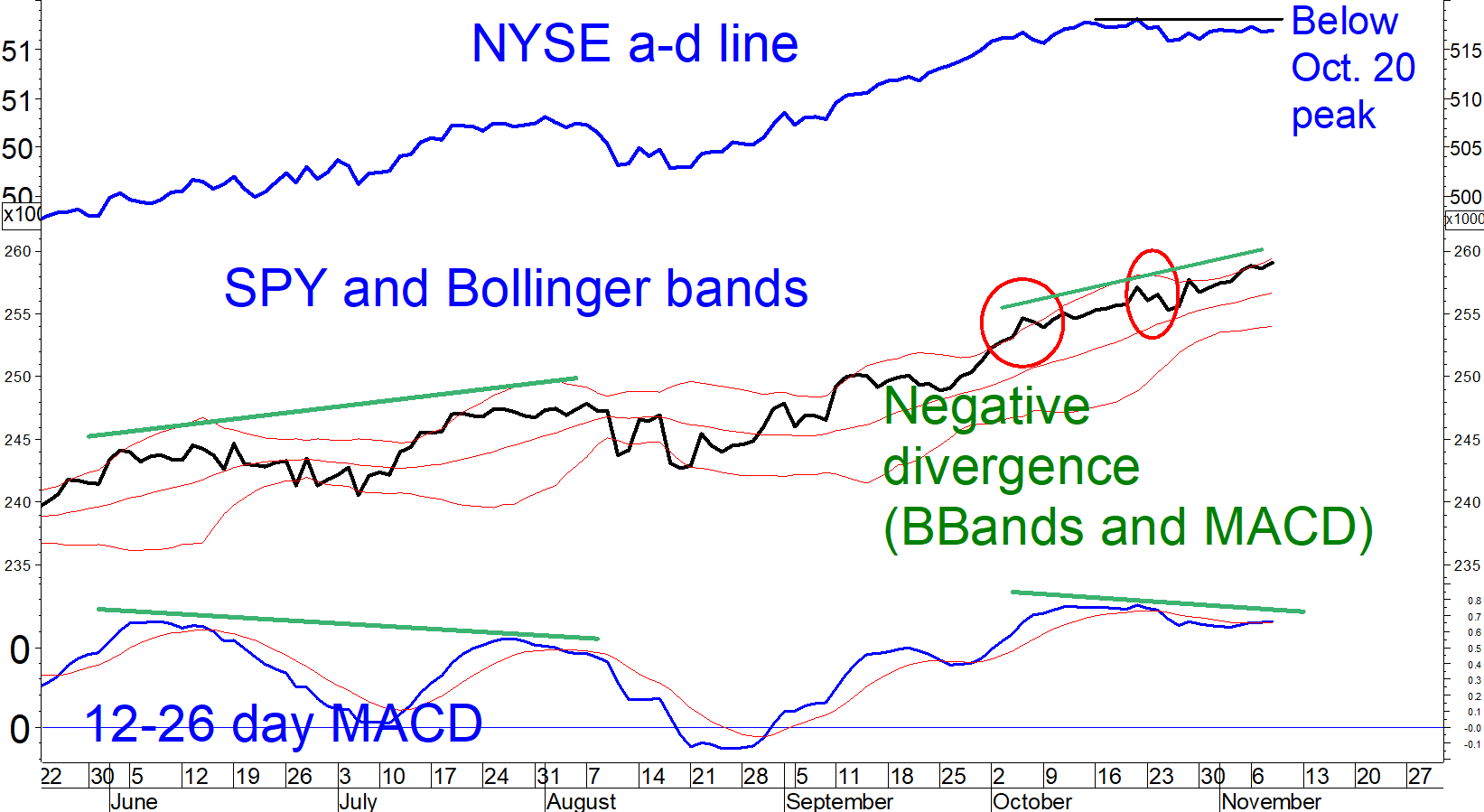

The NYSE advance-decline line hit its peak on October 20 and so did not confirm the price gains in the S&P 500 that have occurred since then. This is consistent with the notion that stocks may face headwinds for the next several weeks as they work off an overbought condition as indicated by MACD and Bollinger bands.

Our models remain overall bullish, so any downside risk should be modest. We recommend riding out any volatility that may arise, even if caused by diminishing prospects for tax reform if the president’s plan should run into trouble.

The chart below shows that in October there was a negative divergence between price (which made a new high) and Bollinger bands (where price touched the upper band in early October but not in late October).

Nonetheless, S&P 500 SPDR (SPY) climbed to a new high on Nov. 8. MACD is relatively overbought and may form a negative divergence (bearish).

Figure: SPY, MACD, Bollinger bands and A-D line.

Although prices can remain overbought for extended periods, any deterioration from overbought levels is likely to extend at least 2%. The lower Bollinger band at 254 is a potentially strong support area.

In the setting of an overall bullish market climate, bottom fishing at 254 would be recommended.

High yield bond update

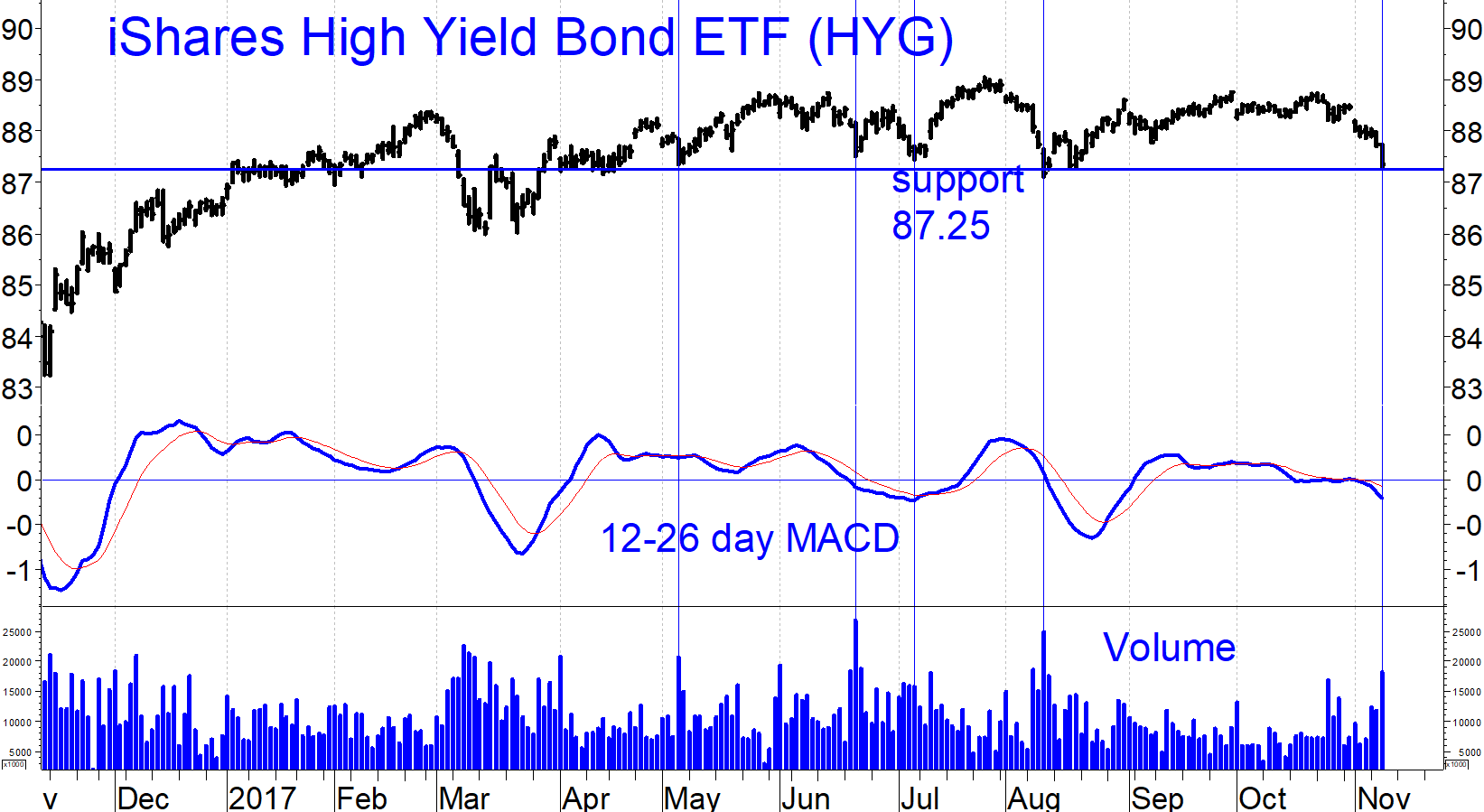

The iShares Corporate High Yield Bond ETF (HYG) has been selling off since Oct. 20. Fortunately, open-end high yield bond mutual funds are holding up better. HYG has now fallen to a potential support area around 87.25 with a coincident spike in volume (see chart).

In May, June, July and August similar pull backs bounced from this support level. Our high yield bond timing models remain on buy signals, and as long as that is the case risk should be contained. You should continue to hold high yield bond fund positions (or take profits on at most a fraction of them).

Nonetheless, we recently took profits on some of our clients’ high yield bond fund positions in order to avoid giving back gains coming into the next sell signal, whenever that may occur. It could take several months before we learn whether or not that proves to be a successful decision.

Subscribe to investment newsletter Systems and Forecasts here…