Our U.S. equity models remain overall bullish. I expect the favorable market climate to last at least several more months. Indexes such as the DJI and SPX appear near-term overbought. Stocks may pause, asserts Marvin Appel, MD, PhD, of Signalert Asset Management.

Last week the Federal Reserve increased its short-term interest rate target by ¼% to 1.25%-1.5%, as expected. The Fed expects to raise rates three times in 2018, but Fed funds futures are pricing in only two rate increases.

Either way, the stock market likes what it is seeing.

Our U.S. equity models remain overall bullish, and I expect the favorable market climate to last at least several more months. However, indexes such as the Dow Jones Industrial Average (DJI) and the S&P 500 Index (SPX) appear near-term overbought.

I would not be surprised to see stocks pause or even pull back slightly to digest their gains over the next several weeks.

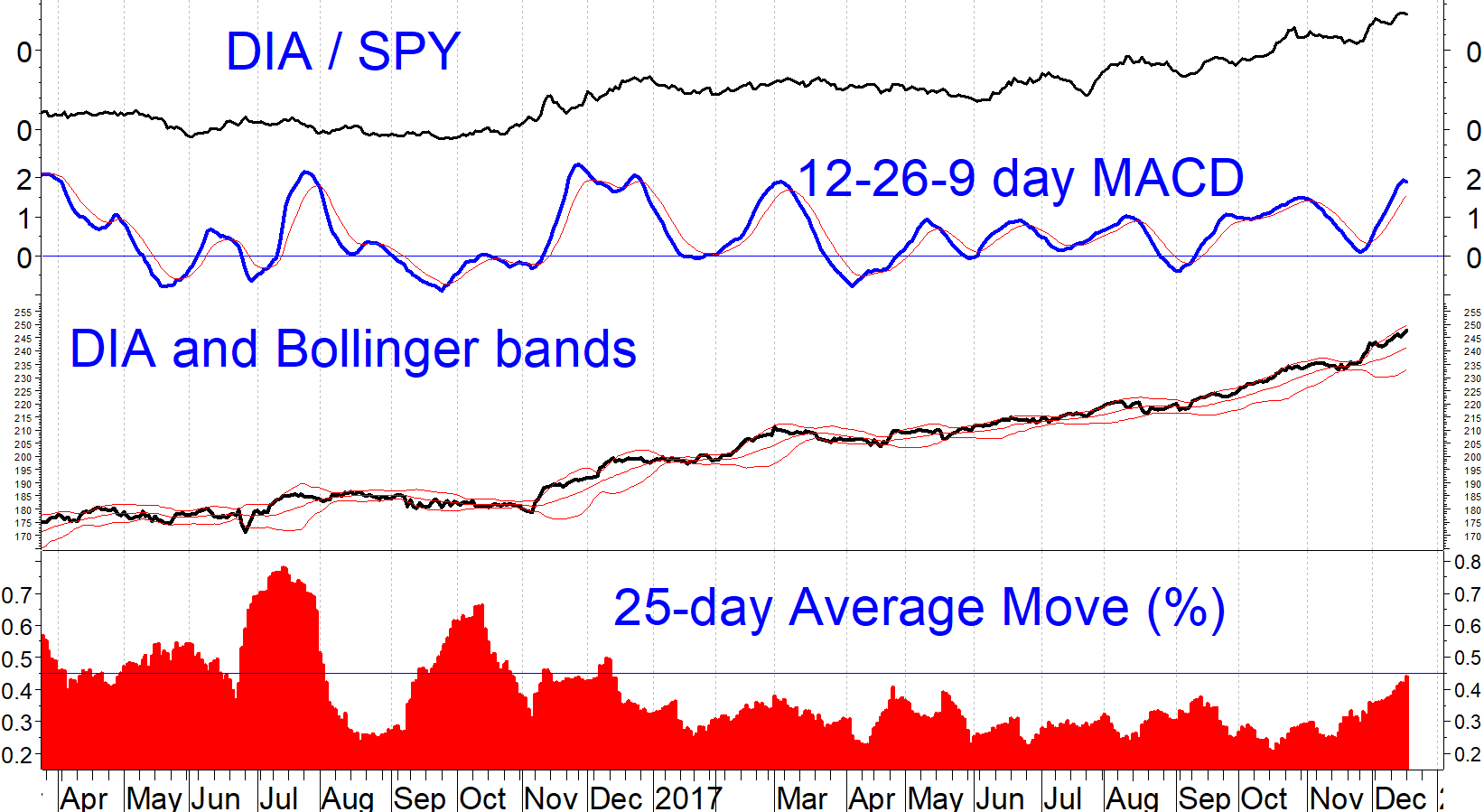

For example, the chart of the Diamonds ETF (DIA) that tracks the Dow Jones Industrial Average appears below. MACD is at a relatively overbought level and on Dec. 18 turned down slightly despite gains in the index.

Previous MACD sell signals in the past 20 months have led to pauses in the advance, and I expect the same to occur at the time of the next MACD sell. Also of note is that daily volatility in the SPDR Dow Jones Industrial Average ETF (DIA) is at its highest level in a year.

We may have to ride out some volatility, but expect to maintain full equity allocations for our clients for as long as our models remain overall on buy signals.

High yield bond update

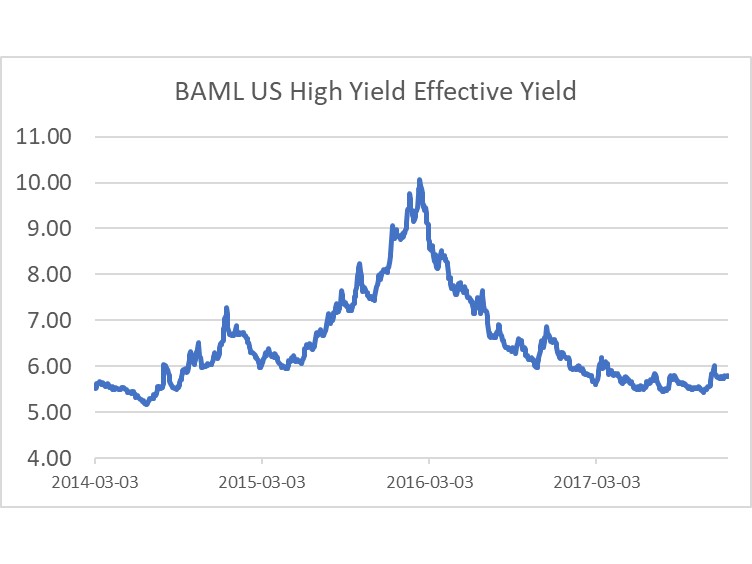

Our high yield corporate bond models remain on buy signals, but it is hard to get excited about them when yields are so low. The chart above shows that high yield bonds are paying less than 6%, near the all-time lows of 2014 and 2013.

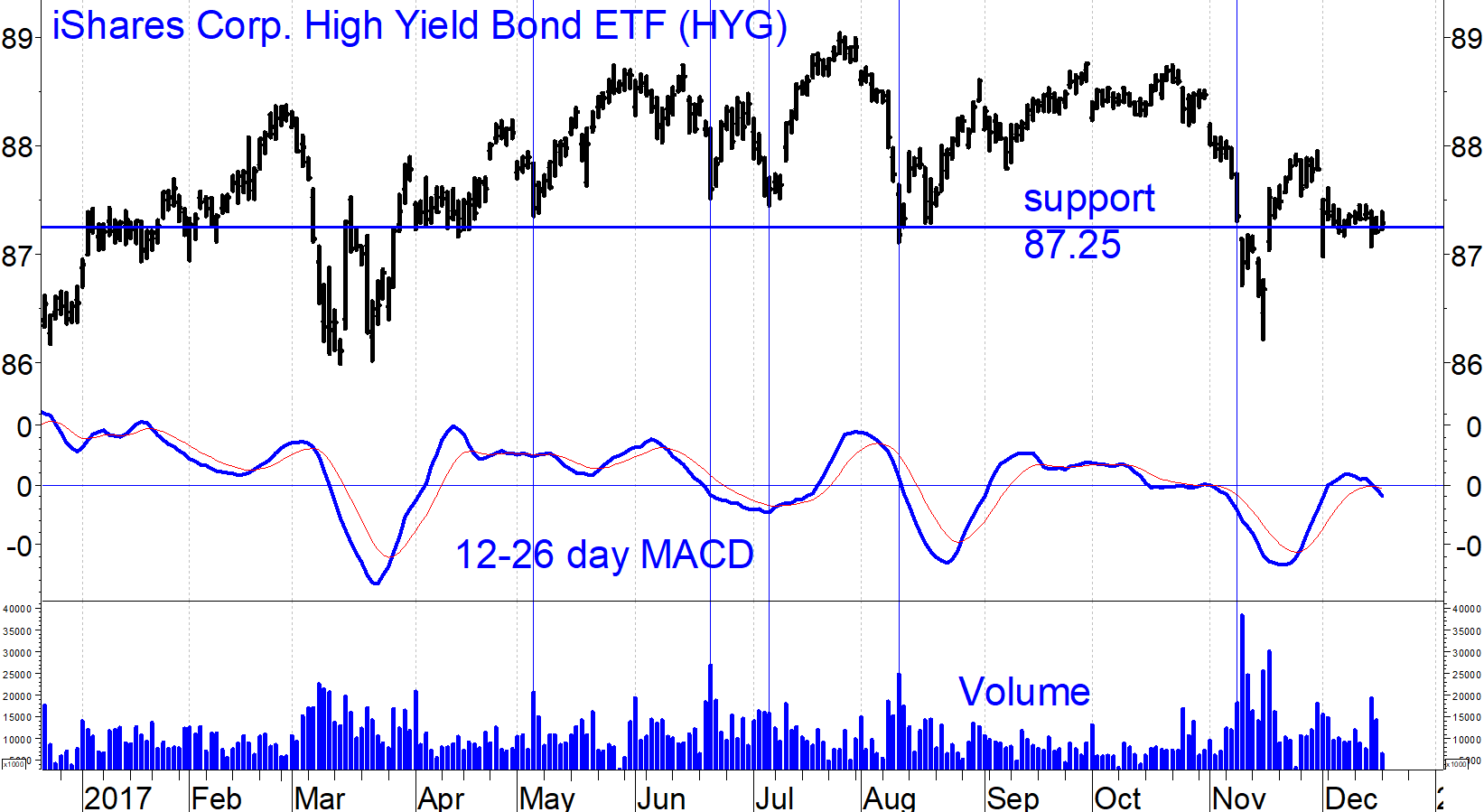

The chart below shows how the iShares Corporate High Yield Bond ETF (HYG) has been moving sideways all year. That means that high yield bond investors have profited to the extent of interest income.

The chart does not suggest the likelihood of a high yield rally because MACD has had difficulty getting above zero despite the recovery from an oversold level in November.

For now, low junk bond yields remain justified by the favorable economic climate and prices should remain stable.

However, when sell signals do arise you should take them very seriously.

Subscribe to investment newsletter Systems and Forecasts here…