Are we in March or October? The way this market is acting, I wonder if this isn’t Halloween. A couple of weeks ago, the bull market was in its death throes. And now, in what may turn out to be the most bizarre event of 2018, asserts Joe Duarte, MD of Joe Duarte In The Money Options.

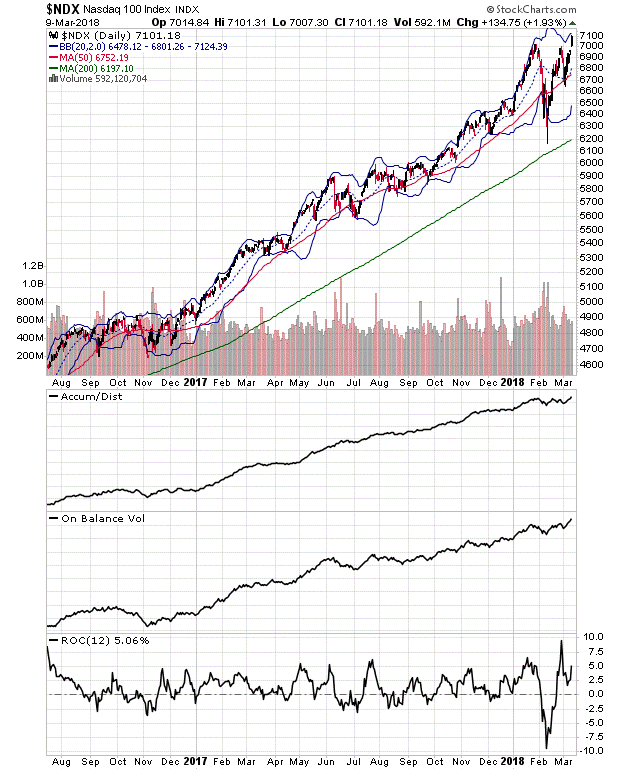

Based on a simple application of traditional technical analysis, it is plausible to predict that the Nasdaq 100 Index (NDX) - home to Amazon.com (AMZN), Netflix (NFLX), and the rest of the high flying 21st Century tech stocks, could rally to 8000.

And if the action of the last week is any guide to the future it may do so fairly quickly.

I am basing my prediction on the application of the Swing Rule, a simple to apply tool used by technical analysts to predict prices in a market that has recently bottomed and bounced back to a key chart pivot point. You take a former support level and subtract the bottom of the trading range, then you add the difference to the support level which is now a resistance level and you get your target.

By applying this simple technique to the Nasdaq 100 (NDX, above), on the back of a napkin, we get the following. The recent bottom was near 6150 and the recent high (former support level) before the crash was near 7000. The difference is 850 points. By adding the 850 points to 7000 (recent resistance level) you get 7850.

ince we’re just approximating and estimating, you can say that given the market’s recent volatility, 8000 is plausible.

But there is more bullish information on this price chart. Consider NDX closed at a new high on March 9, which was accompanied by a bullish confirmation from the On Balance Volume (OBV) and Accumulation Distribution (ADI) indicators.

Furthermore, ROC, a measure of momentum is also bullish, as it still has more room to the upside to go before reaching levels which have preceded market pullbacks in the last eighteen months. In other words, there is more upside room in this market, which is a short term bullish development.

So are there any negatives? Consider this. For one, the new highs in NDX have come very quickly after the recent market breakdown. That is a characteristic of a bear market rally, although it’s hard to call the current situation a bear market rally.

Secondly, even though ADI and OBV are bullish, the raw volume numbers are not that bullish, which suggests that as we’ve seen for the past few weeks, there are fewer buyers even if those investors who are buying seem to be very committed to their purchases.

In the right set of circumstances, as we saw recently, low volume buying is easily overwhelmed by high volume selling, which could lead to big trouble in the not too distant future, especially if the headlines turn negative.

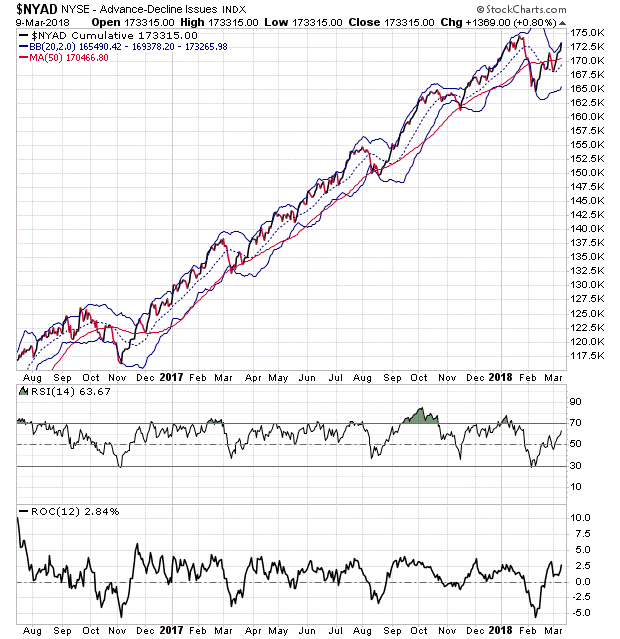

NYAD and SPX have not confirmed NDX highs

It wouldn’t be a Joe Duarte market column without the NYSE Advance Decline Line (NYAD), the most accurate indicator of the market’s trend since the November 16, 2016 presidential election. So here it goes.

The NYAD did not confirm the new high on NDX on March 9. This is not the end of the world, since a few more bullish days could lead to a bullish confirmation. Thus, I’m not ready to call this a divergence, yet. However, let’s say that NDX adds another 200 hundred points in the next week or two and the NYAD does not confirm, I would be very concerned.

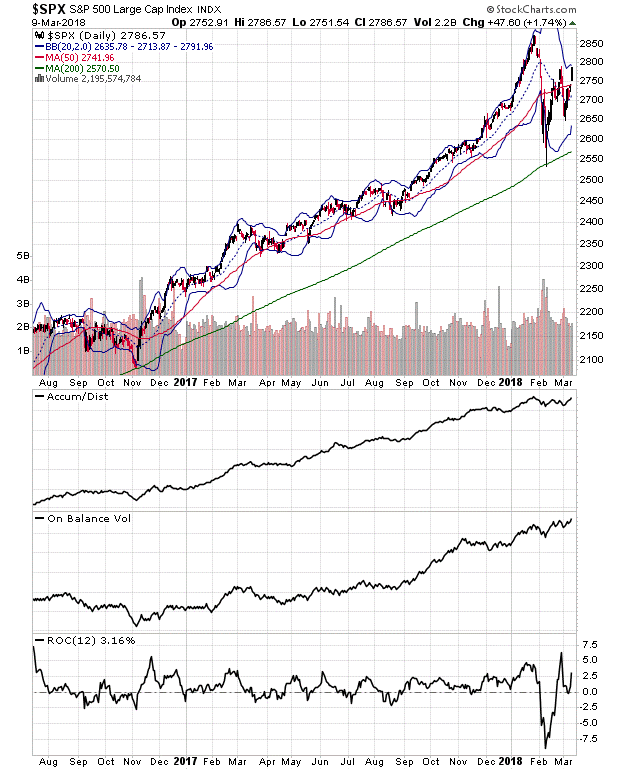

Finally, the S&P 500 (SPX), despite its robust rally off of its recent bottom is still well below its recent highs, which suggests some market sectors are sitting the rally out, a negative factor which sometimes cuts rallies short. Arguably, OBV and ADI are very constructive here as well, which means money is coming in. But as with NDX, the raw volume is less than convincing. So here again, we could face some selling if there are negative headlines.

Trust not this bounce fully

Given the lack of volume and the very rapid rate of ascent in NDX, I am reluctant to give this market the all clear. There is nothing wrong with trading the long side over short periods of time currently. Thus, day trading and position trading strategies with modest upside targets and somewhat tight sell stops while keeping big chunks of cash under the mattress and using option strategies may be the way to go for now.

What’s the bottom line? We are still in a bull market. But it’s getting very weird. Keep an eye on the Federal Reserve, the Washington soap opera and North Korea.

Joe Duarte is author of Trading Options for Dummies, now in its third edition. He writes about options and stocks at www.joeduarteinthemoneyoptions.com.