Gold tends to be a safe-haven type of investment — something investors turn to when they don’t want their money associated with a certain company or government (bond/currency), notes Jay Soloff, editor of Investor's Alley The Market Cap.

After the financial crisis of 2008-2009, gold became an extremely popular investment. For a few years there, it seemed like there was a gold-buying shop on every street corner. Gold was bid up, at least in part, by a massive amount of buying by central banks who wanted to back up their currencies with physical assets.

For the last several years though, gold and other precious metals have been trading at less elevated levels. Then again, with the February 5th meltdown, is it possible metals will become more valuable to investors?

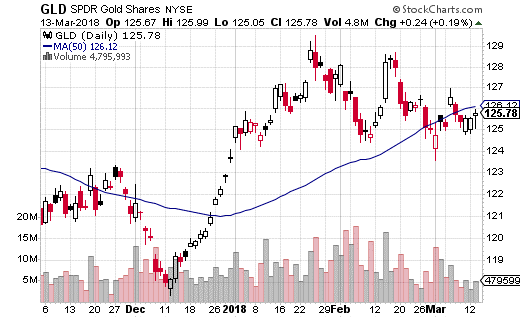

Below is the chart of SPDR Gold Shares ETF (GLD), one of the most popular ETFs out there and a very common method for investing in gold. You can see gold did spike during the market meltdown in early February, but has since come back down and is hanging out around the 50-day moving average.

Typically after periods of high volatility, investors start moving more of their portfolio to gold or other precious metals. Yet, in this case, gold lost its luster almost immediately after the market stabilized. Hence, while gold was still a quick buy during the crisis, it hasn’t been holding its own as a safety net after the fact.

Part of the reason could be the lack of any real fundamental concerns among investors. Inflation and tariffs (to some extent) are problems, but they take a long time to actually manifest as true issues. On the other hand, it could be that investors are using cryptocurrencies such as bitcoin as a store of value. After all, bitcoin is entirely decentralized.

So what’s that mean for gold? It’s certainly difficult to pick a clear direction for the precious metal, but it may be not be a stretch to suggest gold is going to move quite a bit from where it is — either up or down.

At least one size options trader believes this could be the case by June expiration. The trader purchased the June GLD 126 straddle (buying both the 126 call and 126 put in June) for $5.30 with the stock just below $126. The trade was executed nearly 2,500 times, so about $1.3 million in premium was paid.

In order to make money, GLD has to be higher than roughly $131 or below $121 by mid-June. Above or below those strikes, the position will generate $250,000 per dollar higher or lower. If GLD is at $126 at expiration, the trader loses the entire premium.

Given the uncertain future of gold as a safe-haven, I think this trade makes a lot of sense. However, I’d prefer to cut down the cost of the trade by doing a strangle instead. The only difference is you’re buying out-of-the-money calls and puts instead of at-the-money options in order to cut costs.

For example, buying the June 123 put and 129 call (the 123-129 strangle) only costs about $3.00. So you’re cutting your premium by almost half.

Breakeven points become $120 and $132, do it does widen the targets a bit. Still, I think it’s a reasonable trade off to widen out the breakeven points by a $1 in order to cut almost $2.50 off the premium price. Ultimately, it reduces risk more than it reduces return potential — and that’s clearly a good thing.