Last week I described the current market as a bear market in spirit. And I’m sticking with that notion, especially after the recent geopolitical events and the potential for very dire events which may or may not follow, asserts Joe Duarte, MD.

As difficult as it may seem to accomplish in the midst of daily 200-plus Dow Industrial point moves in any direction, a slow and steady grinding it out approach will win this investing race.

But if you stick with the charts instead of the day to day event driven volatility and barring a sudden and significant decline to new lows, it seems plausible to now consider that we may have seen the bottom in this market for the next few weeks and perhaps months.

Still, I’m not giving the market an all clear as even the notion that a true price bottom is now in place remains uncertain and the future remains murky at best. As a result, the best any investor could hope for at the moment is portfolio stability – the return of your money not the return on your money – which may be achieved in multiple ways ranging from hedging to considering the possibility of going to an all cash position.

Perhaps the best solution is what I’ve been advocating over the last few months, high levels of cash, short-term trading, and relying on small positions in select individual stocks, ETFs and increasing the use of options. In that vein, it’s important to know what’s working in this market – and the answer is variable to say the least.

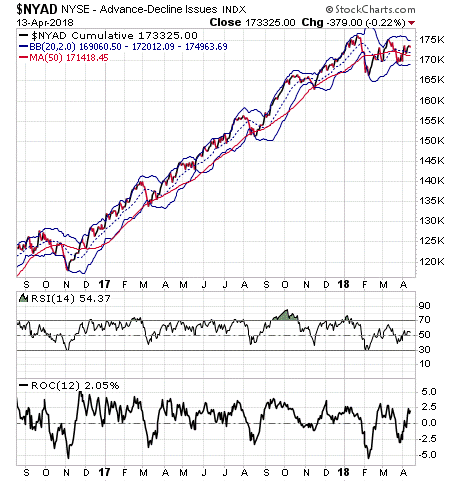

Market’s breadth suggests investor paralysis

Investors are in a state of total paralysis. Just when it seems a trend will assert itself, it turns out to be yet another false start. That’s why the New York Stock Exchange Advance Decline line (NYAD), the most accurate indicator since the presidential election, seems to be stuck in the mud. In fact, it’s that lack of sustained direction in NYAD, which suggests that for now, we may not go too far, up or down, at least on a closing basis, despite the overall noise and intraday gyrations of the market.

Here is the big picture. The market is suddenly trendless as investors don’t know what to do given the intraday volatility and the rising geopolitical uncertainty. Note the completely neutral finish on NYAD for Friday, April 13. Specifically look at the ROC and RSI sideways close, a sign of total investor indecision.

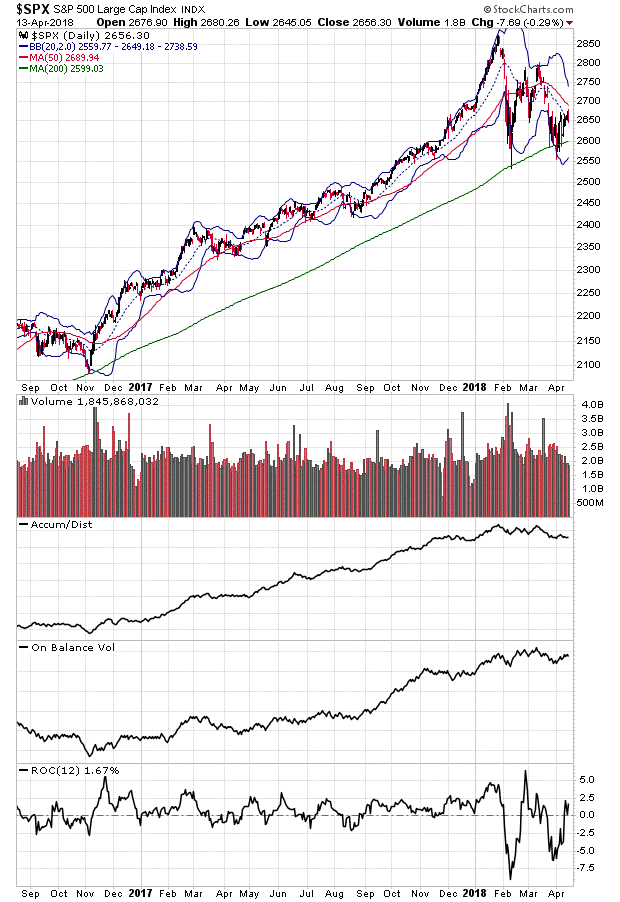

Volume suggests hands in pockets mode for traders

There is an old Wall Street adage which notes that low volume trading means that traders are keeping their hands in their pockets. This is increasingly evident in the present market as trading volume continues to sink – note the slow and steady collapse of activity in the S&P 500 (SPX) during the month of April.

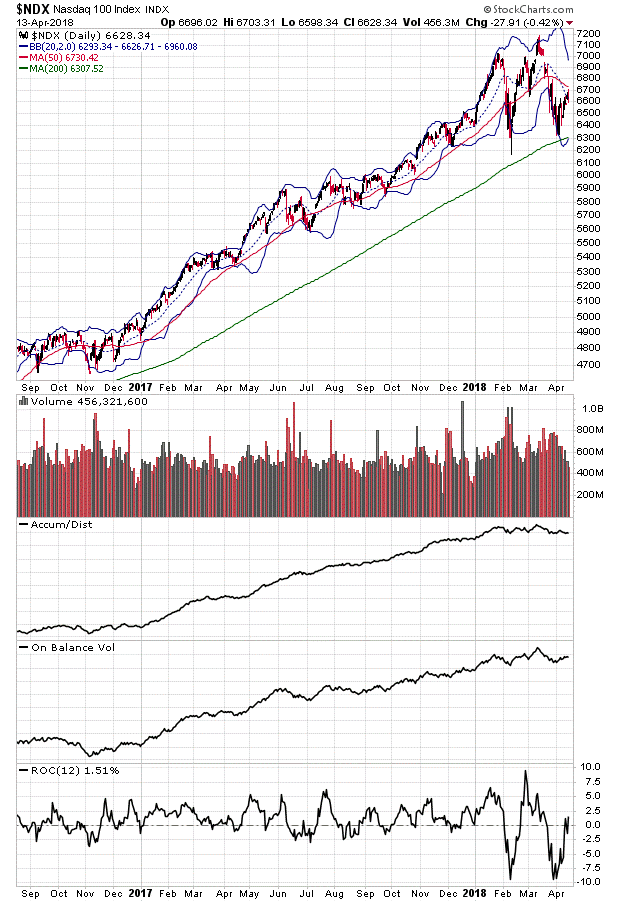

Furthermore, the decline in trading volume is evident in the Nasdaq 100 Index (NDX). Finally, note the complete lack of conviction displayed by the Accumulation Distribution (ADI), On Balance Volume (OBV) and ROC indicators. In a nutshell, few are trading, few have any conviction, and momentum is flat.

Joe Duarte is author of Trading Options for Dummies, now in its third edition. He writes about options and stocks at www.joeduarteinthemoneyoptions.com.