LightPath (LPTH) pops-up sporadically. It seems there’s an overhanging seller who shows up, keeping a lid on things. I suspect once that seller or sellers are out of the way, the prospects of the shares responding favorably will be facilitated, writes Gene Inger.

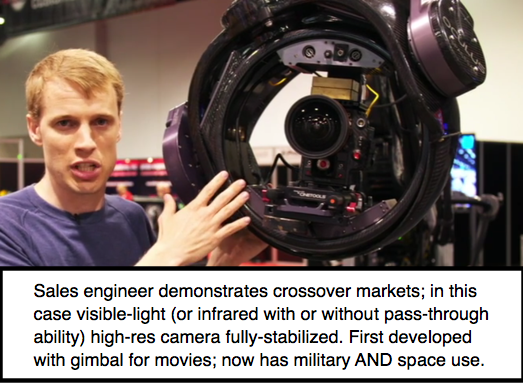

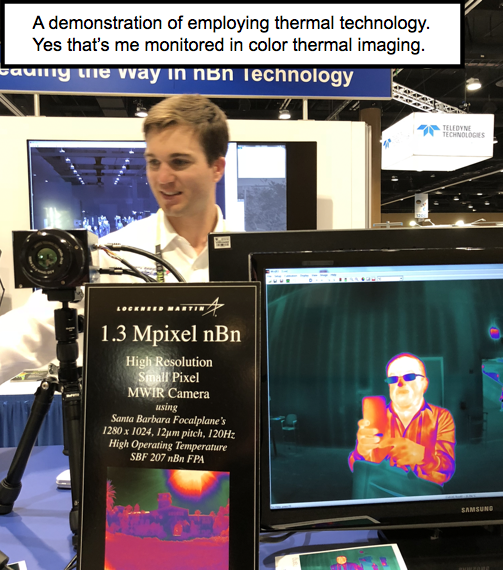

Most companies I chatted with at the SPIE Conference this week in Orlando were enthused to discuss their products fairly openly. It’s the International Society for Optics and Photonics. Very impressive and more sensitive-if-not-classified items were displayed by a variety of defense industry participants. And they were given too-low security, in my opinion.

At least one defense engineer I spent a good bit of time with concurred. Maybe this gathering was under the radar (good pun since there was plenty of it right there or variations like LIDAR, which also has military applicability). He was kind enough to highlight not just theirs, but also other sensor products (like target acquisition systems).

Bloomberg: US stocks drop on tech selloff as dollar rallies Friday.

There was more brain power assembled than I recall at any presentation or a Consumer Electronics Show. hence it was intellectually challenging, informational, and 'illuminating' at the same time.

My general belief regarding that portion of LightPath (LPTH) business related to China is favorable. My overall view is that a trend remains towards actual trade war avoidancerather than imposition: in general, Trump seeking better deals for the U.S.

As to LPTH it pops-up sporadically. It seems there’s an overhanging seller who shows up, keeping a lid on things. I suspect once that seller or sellers are out of the way, the prospects of the shares responding favorably to corporate progress will be facilitated.

In the case of China, there remains a significant probability that while the sides contest many issues, at the end of the day more areas will find an arrival at deals (often fairer to the U.S.). It’s not a complete trade break, and perhaps that’s especially in technology many are concerned about.

I might also add there’s now new leverage to offset one of China’s crown jewels supposed to be a compelling influence on the U.S. backing-off too.

That relates to rare-earth minerals and materials, which are largely core to many technologies. In fact they contribute to everything from chips to a portion of the advanced Boeing 787.

Calm down, because first of all they were originally mined in California, but EPA (etc.) closed that down due to pollution and so on. It can always be reopened.

A Chinese firm at one point tried to buy Mountain Pass (as some called it), but was denied on national security grounds. So now they seemingly are in control since our government then denied its U.S. operator continuation some years back.

Now it’s discovered that Japan has lots of rare earth-capable sites, perhaps even more so than China does. While China is also not necessarily eager to starting mining those, the ability to do so again provides an alternate source to materials coming from China, so you can anticipate that concern becomes a non-issue.

Illuminating synergism

Then there is LightPath, who does not use germanium but different rarer earth materials in their glass. Yes, I asked, they are U.S.-sourced.

I cannot attest to pricing and availability. I don't think this is an issue for those who use the Chinese materials. If the materials were not available or more likely encumbered with tariffs, then a company like LightPath would be in a stronger pricing and margin position versus competition using the materials from China.

I also looked at LightPath’s new visible and thermal-imaging assembly module. It’s very high resolution that was notably sharper in the corners than others I made a point of checking-out from a layman's perspective.

I would point out these are in-production and useful for surveillance both in commercial and military roles, including drones.

**

Daily action Thursday is not just about Chinese chips, or chip companies buying American parts. That's actually the optical story I had.

Now sympathy for Iran-sanction-violator ZTE is sweeping across China, with free chop suey (really) for workers at ZTE, and calls like they once did with Japan to boycott American as well as any other chip manufacturer that honors the embargo.

Shattering illusions

My comments about LightPath not selling to ZTE at all (although a couple of their customers may have done business; it's a big field when you get into various parts suppliers in the supply-chain of technology companies).

You have this: Chinese state-owned newspapers like the Global Times, “thanking Trump for helping China make a decision to rely on Chinese made chips and to advance their own solidarity with a reduced reliance on American components.”

Hah! We can say the same thing. Even better for the U.S. Thank you to China for awakening the U.S. to take measures to reduce reliance on all kinds of technologies assembled in China. Now we have to make it here.

Seriously, it’s China who actually said the foregoing sentence. In my always humble opinion, it fits well here too. More American ingenuity, not just our small interest in optics, but like I observed about security at that Orlando show: why not have more integrity and boost free-world manufacturing?

As to LightPath: But here we are seeing cheerleading on-air pundits protesting what China’s doing, and then being speechless when the CEO of Nucor (steel) appears to say let us get these tariffs moving fast to help our workers and earnings.

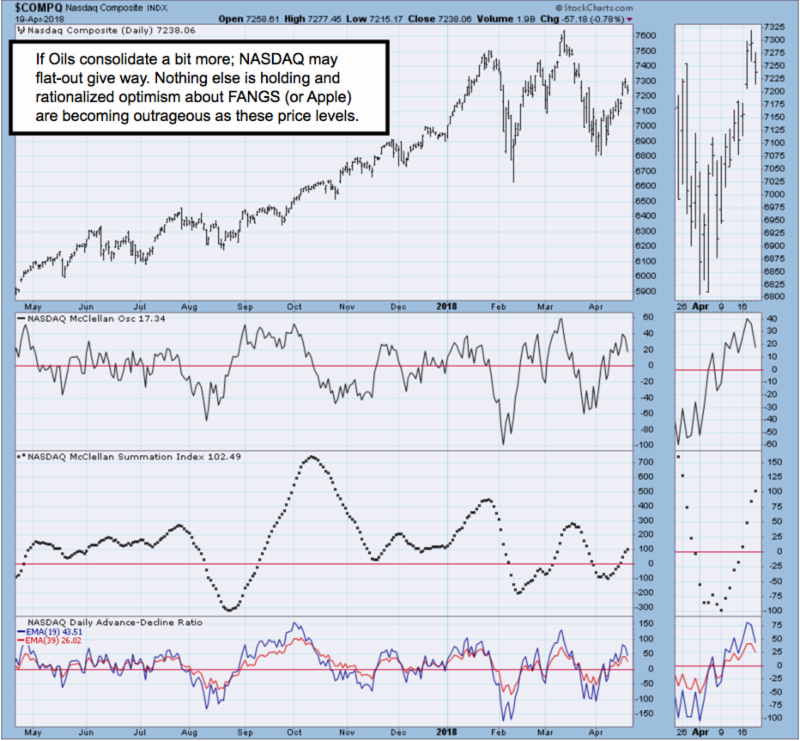

So just the opposite of those opposed to toughening-up on trade until a deal is made. And the cheerleaders are increasingly stuck in high-priced stocks that are cracking just like being victims of a Bull in a China Shoppe.

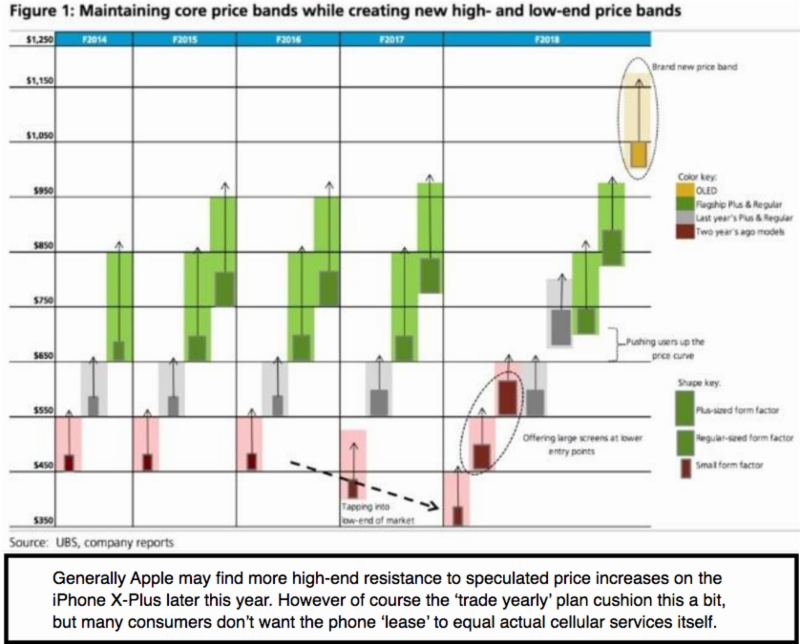

The Thursday Apple (AAPL) story was nonsense. Slower sales are normal this time of year. Yes, the shares are vulnerable; we’ve said that before. But in this case it is the one-month manufacturing delay in the new 7 nm wafer ARMS-license design that Taiwan Semiconductor will be making for iPhone that's behind the reported production delay. This in itself is not sales-related. The media and market did not react to that correctly. It is engineering delays.

S&P 500 (SPX).