The market remains defensive and dangerous. Barring Hurricane Florence affecting my flights I return to Florida via New York from Berlin on Monday. A tired roving analyst will nevertheless monitor Apple’s iPhone presentation then, writes Gene Inger from Berlin Thursday.

Look for an Apple (AAPL) trio including iPhone Xs Max. that would be the 6.5-inch essentially Plus version of the X. Apple’s 4th Generation Watch, new narrow bezel iPad Pro and more.

Meanwhile, techs are rebounding Thursday a bit from the continued drubbing, with a market that this week showed its inability to hold a broad rally. Keep in mind the DJIA is price-weighted, whereas the S&P is capitalization-based. Hence the up Dow and down S&P.

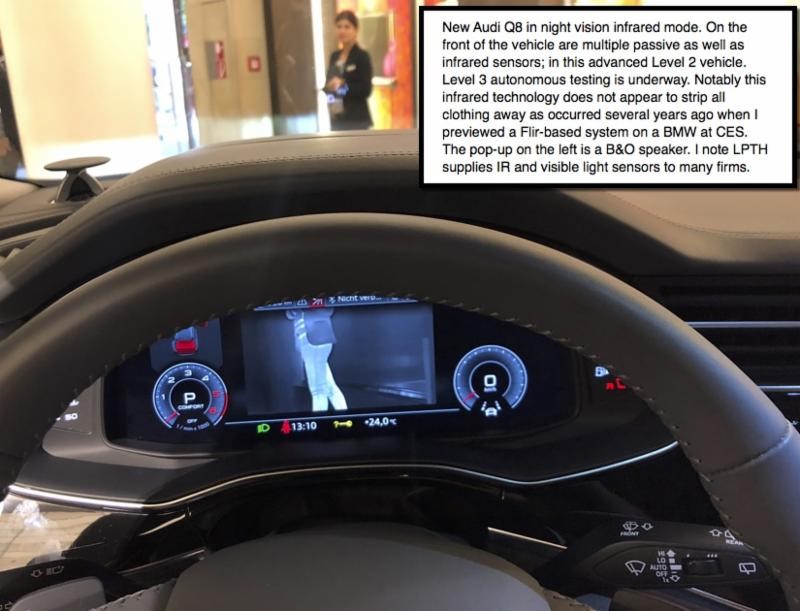

Plus, we’ll see the LightPath (LPTH) Q4 Fiscal 2018 fully-audited numbers. which will be uninspiring on the surface as the un-audited already suggested.

It is my suspicion that LPTH would have preferred to push any revenue from a slew of orders they announced in Q4 into Q1 of 2019. as more benefit may be expected for the 2019 fiscal year. Focusing on guidance for this and of course future quarters is what matters from LightPath’s conference call.

Keep in mind they have managed to maintain profitability while expending a lot on integration of ISP Optics, debt retirement and facility expansion. If that is now indeed mostly behind, what accrues to the bottom-line should start to expand.

Looking forward it’s very important that it be perceived as a stock priced at 7-8 times forward earnings. not 15-16 times, based essentially on what they have termed a transition period to integrate manufacturing and administrative offices, by consolidating ISP’s New York operations (to Orlando mostly, something I questioned well prior to the announcement because I thought it might make sense given costs to operate in a high wage/high tax state like NY).

Shareholders will be counting on CEO Gaynor to clarify whether they were too conservative in ramping-up new production lines to fulfill a large number of orders. and whether they have improved delivery times.

It is great that they have more orders than they can fill. (That’s the impression given.) But if they underestimated both demand and time to manufacture, it is something that probably has been addressed, and they will enlighten us.

Summary on LightPath: We surely don’t want LPTH to overstate order or business flow levels. They’ve been careful not to hype or overstate goals.

However, management needs to provide clarification regarding how they improved fulfillment so they don’t disappoint customers. They’re a good group that doesn’t intend over-promising and under-delivering their optical products. With the order flow they’ve outlined it seems like a time to deliver and have the courage to ramp-up enough to do it properly, while maintaining quality and innovative engineering.

Finally, a clear roadmap (as much as one can, with the myriad of changing technologies) of how this should impact revenues and earnings would help bolster shareholder confidence. It’s perhaps slightly shaken by share action after management’s acknowledgement of production rates.

That pace matters most to LightPath customers, but also to shareholders who desire manufacturing performance gains translated into profitability, as well as understand the unfolding ramp-up of 5G, autonomous progress, and new industrial and military applications.

If that’s clear and favorable, a time should come when the shares reflect that transformation of LPTH.

LightPath has consistently and properly termed the year after the superb ISP Optics acquisition transformative. Shareholders want to know that all this terrific energy translates into results, as well as wider awareness on Wall Street of what we think is still an under-the-radar stock capable of a real take-off if they can excel.

If so our reasonable 2019 goal is double current price levels. Investors require accretive performance in fiscal year 2019.