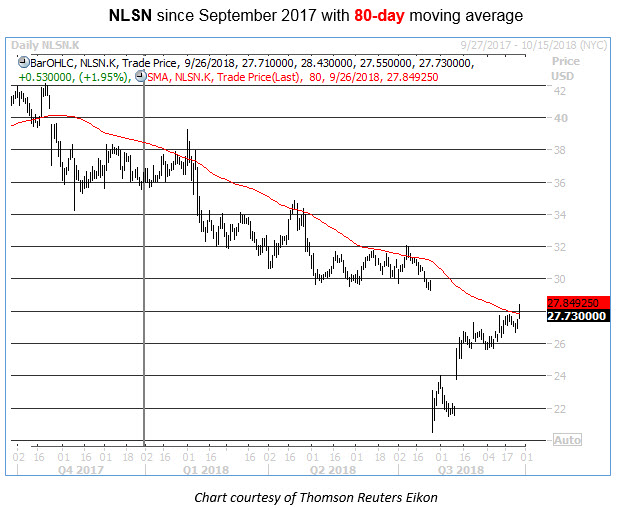

Global data giant Nielsen Holdings (NLSN) has been slumping down the charts in 2018. The stock has dropped nearly 24% since the start of 2018 and gave up support atop the $30 level just ahead of a massive earnings-related bear gap in late July, writes Elizabeth Harrow.

That steep sell-off pushed the shares to a record intraday low of $20.53, but NLSN has since climbed out of that post-earnings hole. Unfortunately for the stock, though, it has now rallied directly into a moving average with historically bearish implications.

Over the past three years, there have been no fewer than 11 prior instances of NLSN rallying up to test the resistance of its 80-day moving average after a prolonged period of trading below this trendline. (For these purposes, “a prolonged period’ is defined as 60% of the time over the two months preceding a signal, and eight out of the 10 preceding trading days). Five days after a signal, NLSN is more or less flat; the equity’s returns are 46% positive, with an average return of 0.06%.

However, looking out one month after an 80-day signal, NLSN's average return is a loss of 4.7%, with only 40% of returns positive (note that we have full one-month returns for only 10 of the 11 signals so far). Based on this historical data, which comes courtesy of Schaeffer’s Senior Quantitative Analyst Rocky White, it looks as though there's another leg lower in Nielsen stock's immediate future.

Based on the equity's current price, another “average” post-signal drop from here would place the stock around $26.43 by this time next month.

A round of long-overdue downgrades could hasten NLSN’s retreat from trendline resistance. Despite the stock’s pronounced underperformance, brokerage firms have handed out nine Buy or better ratings, compared to two Holds and zero Sells. Any negative notes from this group could spur fresh selling on the shares.

One potential wild-card factor for Nielsen right now is that the company is exploring a potential sale at the urging of hedge fund Elliott Management, with Bloomberg reporting late Tuesday that Blackstone and Carlyle could be among the interested bidders.

As such, we’d advise focusing on shorter-term October options for a speculative put play, where implied volatility is running about 9 points lower than the November series as of this writing (30.5% vs. 39.4%, per Trade-Alert data).

View Schaeffer’s Investment Research for stock and options ideas, options education, and market commentary here