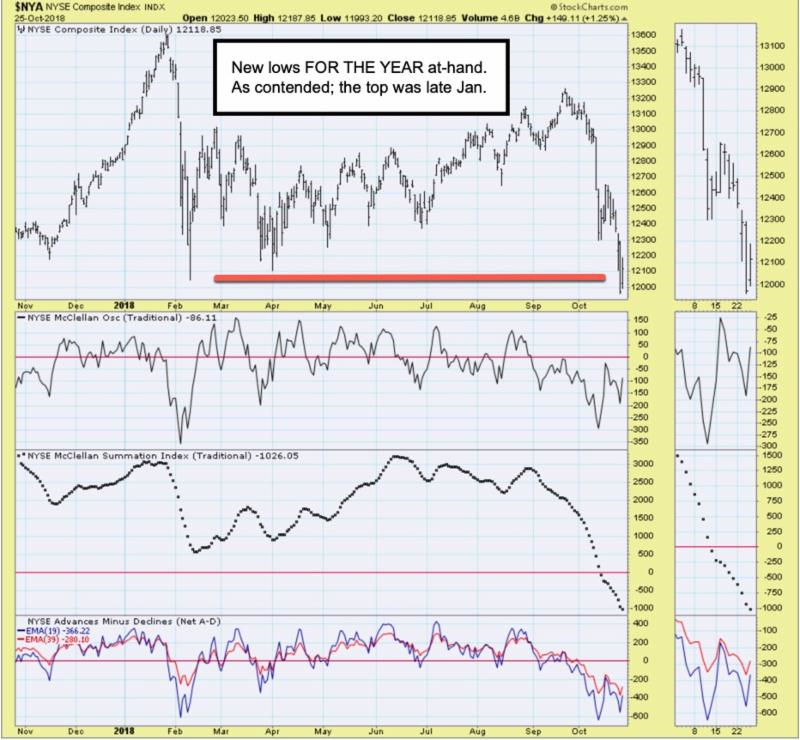

At extremes you get snap-backs that are almost rubber-band like from a daily basis standpoint and based on an A-B-C decline. And yes, selling (by smart money) in January’s parabolic thrust and again during rinse & repeat rebounds not into weakness, writes Gene Inger.

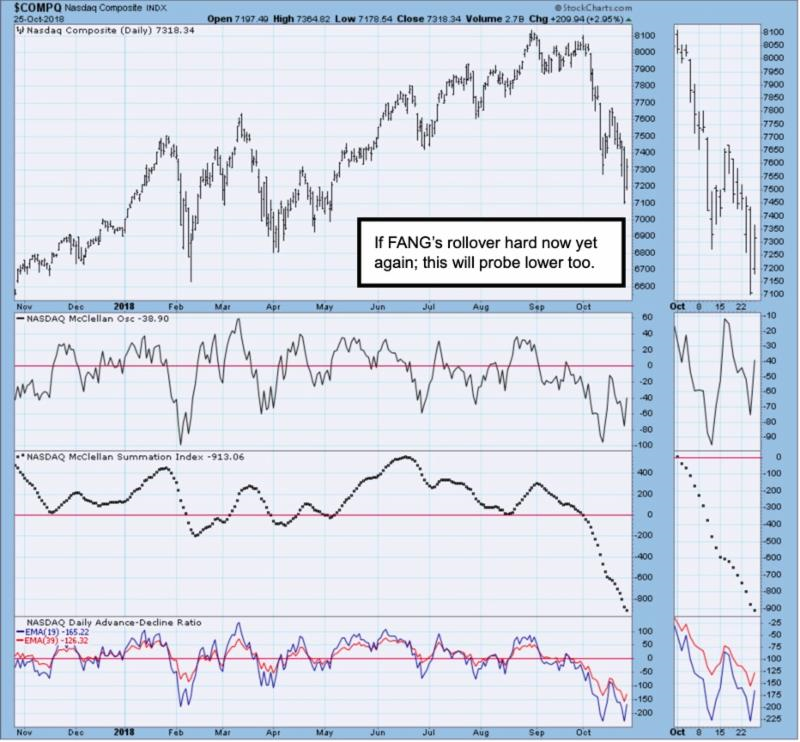

Only funds saddled too heavily with little cash or worse, leverage in-place in FAANG-types, were of course compelled (or freaked) into liquidating into weakness.

What we had on Thursday was such a snap-back, with pre-earnings reports late fading.

Reuters: Wall Street falls Friday after earnings disappointments. S&P eases off correction levels.

**

Where does this leave things now? Still overpriced for many sectors, while of course other sectors have corrected through the year and are less risky, or almost attractive.

There isn’t justification for higher multiples. And known unknowns percolate about 2019 relating most to whether a deal with China is coming. And of course, implications of midterms. That’s obviously based a lot on whether the perception persists about a new growth leg ahead.

**

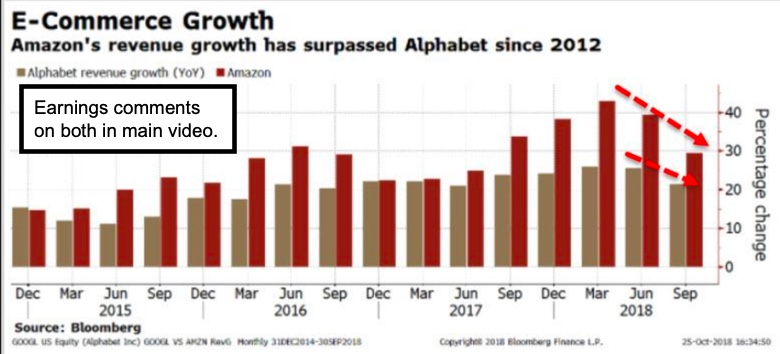

Both Google (GOOG) and Amazon (AMZN) beat on bottom-line but were shy on the top-lines (both of them). Some selling took place even in others that made their numbers (top and bottom) but still had sell-the-news reactions.

Weak Amazon, Alphabet results ignite growth worries Friday: Reuters.

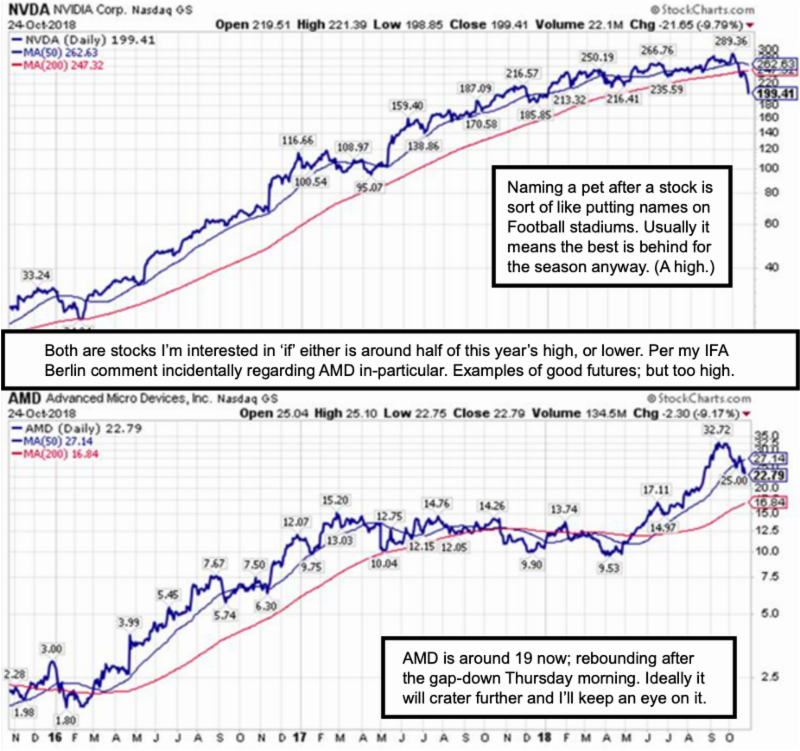

I expressed yesterday my views about Advanced Micro Devices (AMD), down and a tiny recovery Thursday and will monitor forward action.

Its classic nemesis is Intel (INTC) of course. It rebounded (made numbers) and remains too pricey. (It was a stock that I liked in the very low 30s, disliked around 50. And for now, it is not compelling.) Texas Instruments (TXN) similarly is not compelling for now.

**

The behavior of Google, Amazon and others suggests a downward open on Friday barring some surprisingly favorable news, which is not anticipated. I encourage a continued defensive stance with realization that the lower S&P 500 (SPX) goes for now, the lesser the risk. Obviously, we’ve urged lightening-up on rallies all year, starting with the parabolic spike of late January.

It was just a bit comforting to hear a Morgan Stanley analyst on financial TV comment that the smart move was to have been a seller in January and again in mid-Summer. I don’t know if he was or wasn’t. But I was grabbing lunch (and heard it on TV) which brought out a pleasant grin.

**

So, I don’t envy those hand-holders who constantly rationalize (or fix blame in other directions) staying put. I do realize many manage huge funds that are absolutely trapped in enormous positions and really are not experienced in late cycle behavior (much less Bear environments). They basically don’t know whether to leverage up more or bail out to preserve the remains of capital since many stocks are at or near (or below) yearly lows.

I anticipated they would find themselves in such a pickle and tried to warn.