No change by the Fed today but notably (and of course) they expect to continue their gradual patterns, writes Gene Inger Thursday.

There is no real incentive to expect camaraderie with political parties for now. The public pain will probably extend even if deals are made in the backdrop.

The appropriations area might reveal actual cooperation. It may be that the stock market pundits will worry about all this, but ideally it’s not going to pummel the market (at least for now) as big bears would like.

Reuters: Fed leaves rates unchanged Thursday, says U.S. economy strong.

**

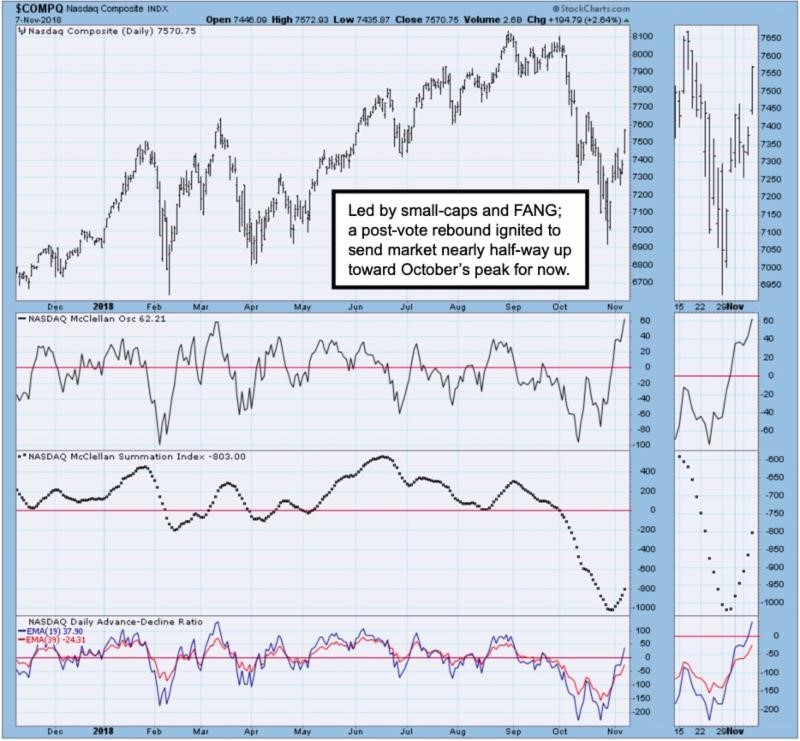

Bottom-line: One reason for this is realization that they can’t really replicate 2017’s dynamic post-Trump win rally we looked for; but you have elections behind us.

And, importantly the re-balancing at the end of October and the washout through October not only correcting FANG stocks, but completing the rolling bear corrections of many dividend-paying and speculative small-and-mid caps during most of 2018.

S&P 500 closes lower Thursday after Fed statement. Energy stocks the biggest drag as crude bottoms.

**

The longevity of upside is limited. It should not be excessively fought like a few permabears insist on doing at least until we get into 2019, or a shocker hits the market out of the blue.

Some of those naysayers were trotted-out in recent weeks, of course after the multi-month rotational correction.

**

Near-term a pullback from the favorable response to the midterm election is possible. And maybe we'll even see deficit hawks on both sides of the aisle, which at least part of the economic community would welcome. How to do that and at the same time get infrastructure going will be novel but can be done.

**

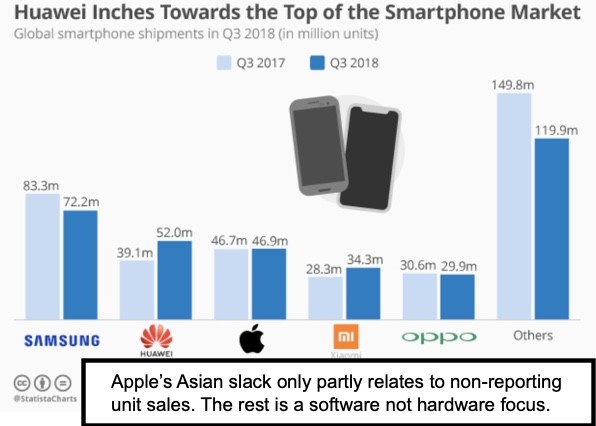

More tensions are forthcoming; and some sparring about China before a serious deal can be made. We believe both China and the U.S. want that; hence as the media will say Trump is the variable regarding a deal. It takes China to back-off on at least intellectual property theft, and provide assurances of a type that go beyond what we've seen so far.