Imagine artificially intelligent software that can scan and analyze your online profile. Then imagine it creating a score — a risk rating — that’s searchable by future employers. It’s scary, and now reality, writes Jon Markman.

Big business is aggressively adopting analytic platforms like Einstein. Salesforce (CRM) is one of the best ways for investors to benefit.

Predictim, a software startup out of U.C. Berkeley, sorts through Facebook, Instagram, Twitter and other social media feeds to help parents find a suitable babysitter. It’s one part good intentions mixed with two parts dystopian futurism.

Buckle up, because this is where our culture is headed.

Would you let this woman babysit your kids?

Malissa Nielsen is 24 years old. She attends church weekly and does not curse. She is also working toward a degree in early childhood education, according to a Washington Post story published Nov. 23.

So, she agreed to give Predictim access to her social media profiles at the request of two families looking for a sitter. Nielsen assumed the inquiry results would be glowing.

She was wrong. Predictim’s algorithms gave her failing grades for bullying and disrespect.

Babysitters can refuse to have their social media sites “scraped,” but then parents have the right to not hire them. On top of that, even if potential hires do complete the request, parents who use Predictim do not have to share the results.

Predictim’s results aim to predict how online activity will translate into offline behaviors.

But in another case …

Systems report back in their own secret language

As our analog, physical world rapidly turns digital, the use of algorithms is exploding. Powerful computers are being fed massive amounts of information by data scientists. Artificially intelligent software is being used to make sense of patterns in data that’s often invisible to human eyes.

Unfortunately, many of these insights also evade human comprehension …

Engineers at Nvidia (NVDA) in 2016 announced a startling development. A set of algorithms in development for its autonomous vehicle program learned to safely operate a car. And all they did was observe humans driving a car that was equipped with sensors.

The data was ingested and analyzed. Countless mathematical simulations ensued. It was a remarkable feat of computational problem-solving.

So remarkable that even the engineers were not entirely certain how the system arrived at key decisions.

Google (GOOGL) Neural Machine Translation (GNMT) system has also made stunning progress using AI. Engineers trained algorithms to translate English to Korean, English to Japanese, and vice versa. When they queried the system to translate Korean to Japanese, something amazing and unsettling transpired …

The GNMT system did not resort to an English bridge. Instead, it created an interlingua — a separate, bespoke language that was alien to human dialect.

Scientists claim AI will solve big problems. And they are using it to make real progress on longstanding resource, environmental, healthcare and finance issues that have riddled academics for generations.

Governments and enterprises are already using algorithms, too. They are automating the parole process, bank loans and employment hiring.

Although the models in use are often black boxes that even baffle their creators, the pace of development is quickening. New AI use cases are evolving.

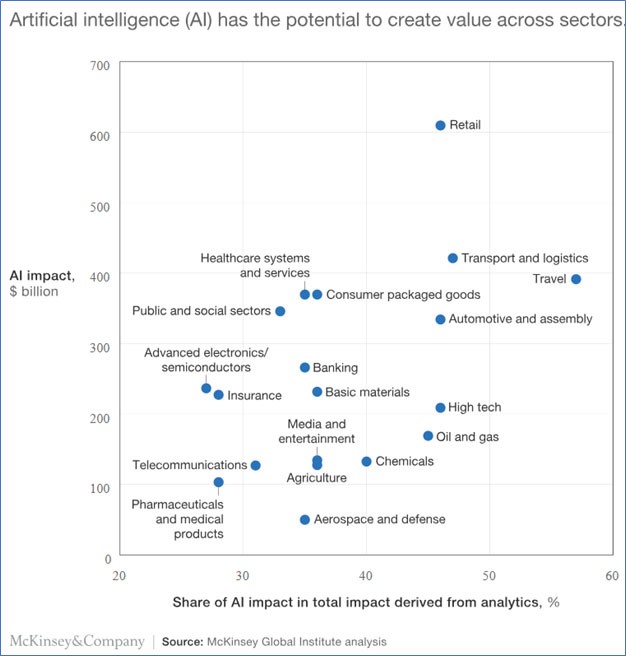

McKinsey Global Institute, a division of the international research and consulting firm, analyzed 400 AI applications across 19 industries. Its findings, “Notes from the AI frontier,“ published April 2018, determined AI has the potential to create between $3.5 trillion and $5.8 trillion in value to the global economy.

Analysts found the greatest potential value impact for AI applications is top-line functions such as sales and marketing. And Salesforce.com (CRM) is the undisputed leader in sales and marketing software.

Salesforce’s customer relationship management platform has become essential to more than 150,000 companies. Enterprises worldwide can manage and service existing customers, and prospect new leads all in one place.

During the past five years, the innovative San Francisco company has been furiously infusing its portfolio with AI. The company added five puzzle pieces in 2018, including the $6.5 billion purchase of MuleSoft, a maker of integration software.

Einstein, its AI predictive analytics suite, does not just consume and manage information like traditional CRM software suites. It learns from the data. Ultimately it will understand what customers want before even they know.

Einstein will seamlessly inform every Salesforce product. And not just its products, but its profitability …

In the second quarter ended Aug. 29, sales rose 29% to $3.28 billion year-over-year. And the company has a credible plan, using AI to grow to $23 billion in annual sales by fiscal 2022.

Salesforce might seem far removed from an algorithmic scoring system to rate neighborhood babysitters. Yet the goal is the same: To use data to inform decision-making.

It might feel a bit creepy, maybe even unsettling. The algorithms may not be well-understood. But AI is going to play a big role in our culture.

Big business is aggressively adopting analytic platforms like Einstein. Salesforce is one of the best ways for investors to benefit.

Best wishes,

Jon D. Markman

View these MoneyShow videos featuring Jon Markman.

Watch Jon Markman’s latest presentation: How to crush the post-IPO trade for emerging Tech companies here. My top 7 picks now.

Recorded: TradersExpo Las Vegas, Nov. 14, 2018.

Duration: 51:17

My sectors for a bear market: growth stocks, technology, healthcare.

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 3:34.

How to profit now from robotics, autonomous cars, AI and the cloud.

Recorded: MoneyShow Dallas, Oct. 5, 2018.

Duration: 37:31.

Jon Markman: Stock Picks in Industrial Tech, Video Games.

At MoneyShow Dallas, Jon Markman picks in industrial tech include Lockheed Martin and Northrop Grumman. And another part of tech: video gaming: Electronic Arts, Take-Two, Activision Blizzard.

Recorded: MoneyShow Dallas, Oct. 5, 2018.

Duration: 6:15.

Jon Markman: Self-driving cars offer surprise investing ideas.

At MoneyShow Dallas, Jon Markman shares tech stock ideas with Neil George of Profitable Investing. What's ahead in self-driving cars, a lot of spin-off positives for investors. A commuter cocktail?

Recorded: MoneyShow Dallas, Oct. 5, 2018.

Duration: 2:24.

Jon Markman's 5 tech stock picks, in a short video.

Picks: GOOG, AMZN, MSFT. Companies turning the hardware of the cloud into software: Arista Networks (ANET), Nutanix (NTNX).

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 5:13.

Jon Markman: S&P 3300, Tech, Healthcare Picks

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 3:33.

Jon Markman: What can end the Bull Market?

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 1:58