Marvin Appel’s State of the Market remains positive. Appel will be speaking at the TradersEXPO New York on March 12.

The fourth quarter near-bear market seems as distant as a bad dream now that stocks continue to rally with nary a sign of a retest of the Dec. 24 lows. However, 2018 began similarly before the market turned sour on very short notice, and as a result I remain cautiously optimistic.

It is rare to have a V-shaped recovery from a 20% market correction as we have had without some retracement or retest. The only episode I was able to find was in the wake of the 9/11 terrorist attacks in 2001; SPY hit a low on Sept. 21, 2001 and then rallied 20% until Dec. 5, 2001 with only a 4% retracement during that move. After peaking on Dec. 5,2001, SPY stalled around its 200-day moving average before making a new leg down to new lows beginning in March 2002.

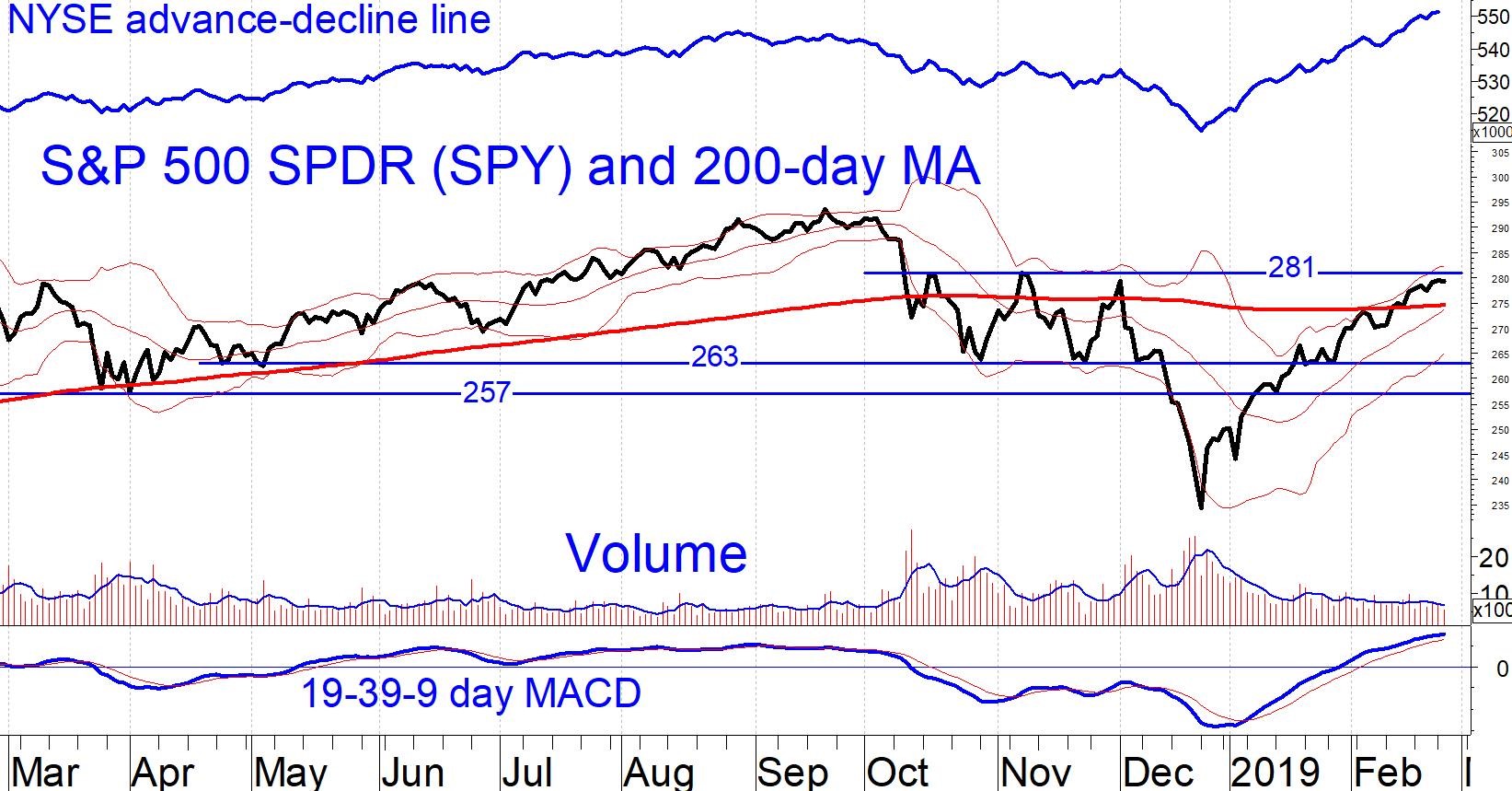

Could this be a replay? The S&P 500 SPDR (SPY) is stalling near potential resistance around 281 just above its 200-day moving average (See chart below). MACD is more overbought now than it was in March 2002. What is different this time, in a good way, is that the NYSE advance-decline line has reached a new record high (Market breadth was also good from September 2001-March 2002, but the advance-decline line was far from its 1998 high).

Our U.S. equity timing model remains positive, suggesting that risk over the next several months should be well contained.

-

-