The stock market remains in an uptrend, writes Joe Duarte, who recommends traders remain patient with bull phase.

The stock market remains in an uptrend and if there is a surprise to come it may well be a positive one. Yet, even as the technical signs point to higher prices, the daily headlines and the presence of high frequency trading (HFT) algos will likely continue to exert their influence on prices leading to choppy intraday trading on a frequent basis.

I’m neither for nor against HFT. Clearly, it’s a fact of life and it’s not going away. It’s important for individual investors to understand how the presence of HFT in the markets affects their money.

Last week I described how the HFT algos make money by purchasing preferred access to the markets by having faster connections to electronic markets and by being in place waiting for slow trades to arrive and trading ahead of them. And although this sounds nefarious, it is perfectly legal and does have a backhanded positive effect on the markets, which is that it accentuates the market’s trend and indirectly confirms the best way to trade, short or long, as you follow the algos.

In other words, when you watch the market’s action, there is no doubt as to the prevailing trend at any given time, with a few small twists. This is because by virtue of their preferred access and faster connections, the algos know every trader’s intentions before the exchange can execute the trade. Thus, they can act upon it before the slower trades gets to the exchange. This creates a situation in which the majority of trades trend similarly and, in a perverse way, reflect the intentions of the trading majority. Thus, the trend, for lack of a better word, is true, until it’s not. What that means is that up is usually up and down is usually down until the prevailing number of trades that are coming into the exchanges change course and the algos follow the new trend.

Another way to look at it is that when we have three to four good solid days of the market rising, it’s a realistic picture of the trend during that time. But when the buying dries up and the sellers come back, the down trend is then accentuated as the algos go with the flow since they know the flow before anyone else does.

So, in this herky-jerky market, what we’re seeing is a lot of short term bursts of buying and selling and occasionally some large intraday price swings but no breakout or breakdown in the market indexes. This is because any stock that sees any heavy volume, even for a short period of time is vulnerable to the actions of the algos as they accentuate the action at that moment. The quick reversals come when the original buyer or seller is done with his buying or selling and the algos jump to the other side of the trade. This goes on and, on all day, long and increases the intraday volatility which causes the market spasms and the frequent price gaps.

What this means is that any portfolio that is up at the start of the day could be well off by mid-day only to return to even as the day ends, unless the intraday volatility triggered any individual sell stops and the portfolio manager was forced to trade. Therefore, patience is clearly a virtue in order to stay afloat in this market.

Macro Bullets

- Calendar: The U.S. Employment report is due at the end of the week. Meanwhile keep an eye on the U.S. ISM manufacturing data and retail sales.

- Big Picture: The third year of the Presidential Cycle (2019) is traditionally bullish for stocks. The political winds may have changed somewhat after the release of the Mueller report summary. Keep a very close eye on U.S. China trade talks.

- Risk: Headline risk remains.

- Market Behavior: The trend is turning up. Volatility won’t go away. Algos are buying on dips. A sustained reversal of this trading pattern would be very negative moving forward.

- What to do: Stay patient. Expect volatility. Hedge when it’s called for but not excessively. Manage positions individually. Give stocks more room to maneuver by widening sell stops but sell if your stops get hit. Use options for high priced stocks.

Market Breadth Remains Positive – Index Technicals Improve

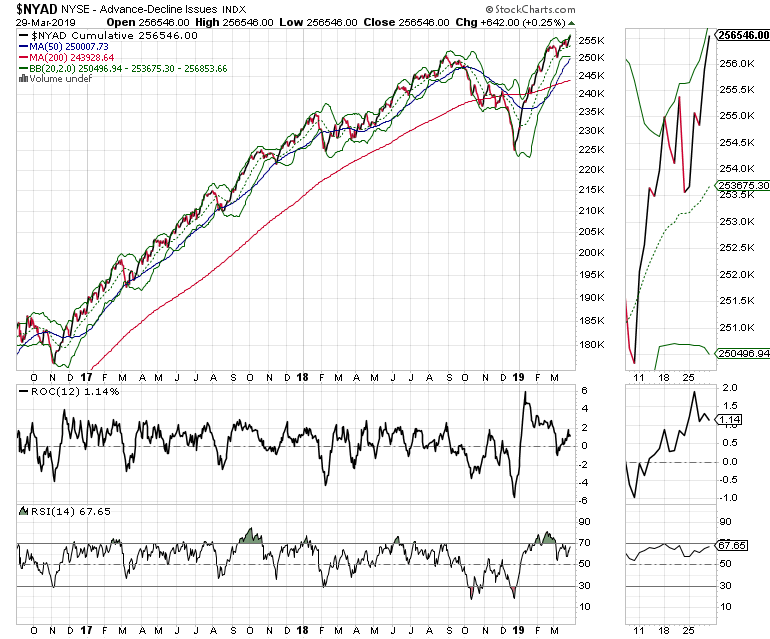

The New York Stock Exchange Advance Decline line remains in a positive trend, which is a big plus for this market, given this indicator’s record of predicting the overall market’s trend since the 2016 presidential election.

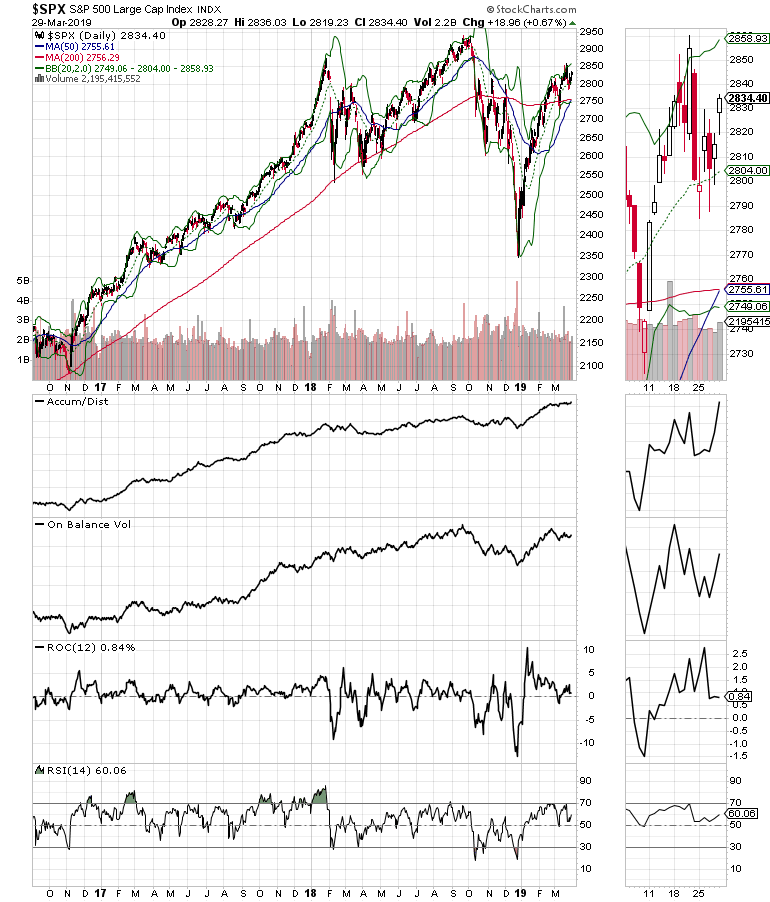

The S & P 500 (SPX) remains range bound with 2700 and the 200-day moving average providing a floor of support for now while 2900 remains an upside resistance barrier.

However, a most encouraging sign is the improvement in the Accumulation-Distribution (ADI) and On Balance Volume (OBV) indicators for SPX, which is a sign that money is coming back into stocks. Even better is the fact that the Relative Strength Index (RSI) has worked off its overbought state without a major market crash.

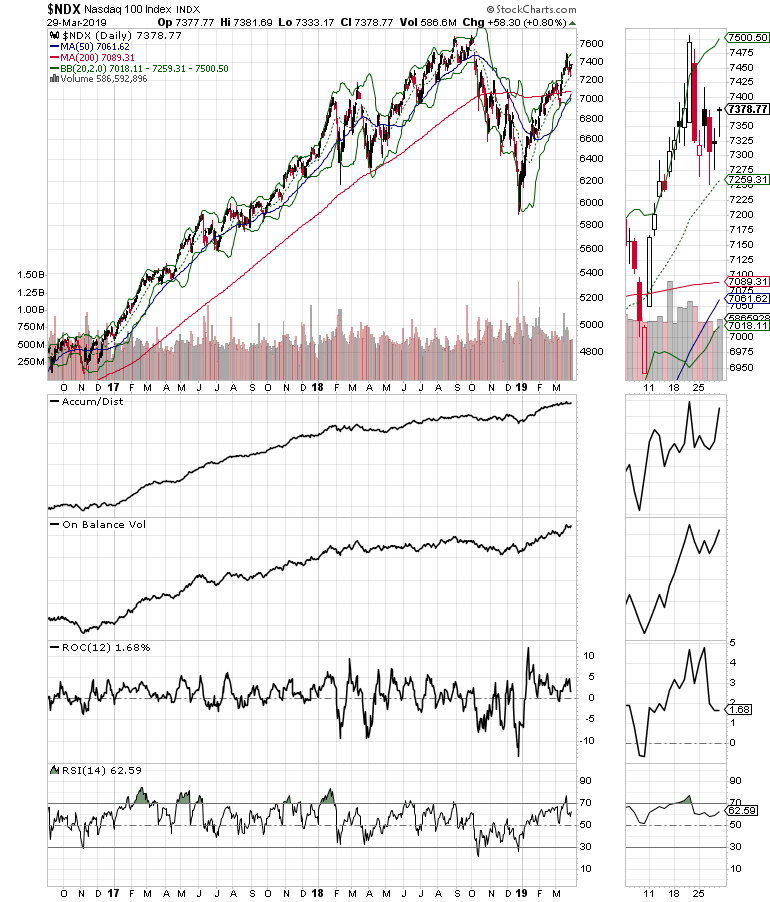

Meanwhile, the Nasdaq 100 Index (NDX) has support with 7200 and the 200-day moving average while 7500-7700 is overhead resistance. Here also the improving ADI and OBV mirror those seen in SPX.

Patience is Indeed a Virtue

Investors who can withstand the HFT induced intraday volatility in the stock market and remain patient are likely to be rewarded if the technical signs that suggest a move to the upside is brewing are correct. Of course, there are no guarantees, especially in a headline driven market. However, if there are no nasty surprises from the Federal Reserve and other external sources and the economy shows signs of improvement, expect a nice move up in stocks over the next few weeks.

That said, as long as the 20-, 50-, and 200-day moving averages for SPX and NDX remain reliable support levels, the trend remains to the up side.

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of “Trading Options for Dummies”