Traditional techniques for evaluating economic data can create a distorted picture of economic growth and lead to poor investing decisions, notes Landon Whaley.

Headline risks are everywhere, much like busted brackets during March Madness. As an investor, you must keep your head on a swivel and human reactions in check so that you’re not drawn into well-written narratives that promise to unveil the mystery of financial markets. This week’s “Headline Risk” comes courtesy of the Old Institution and their outdated and dogmatic way of evaluating economic data.

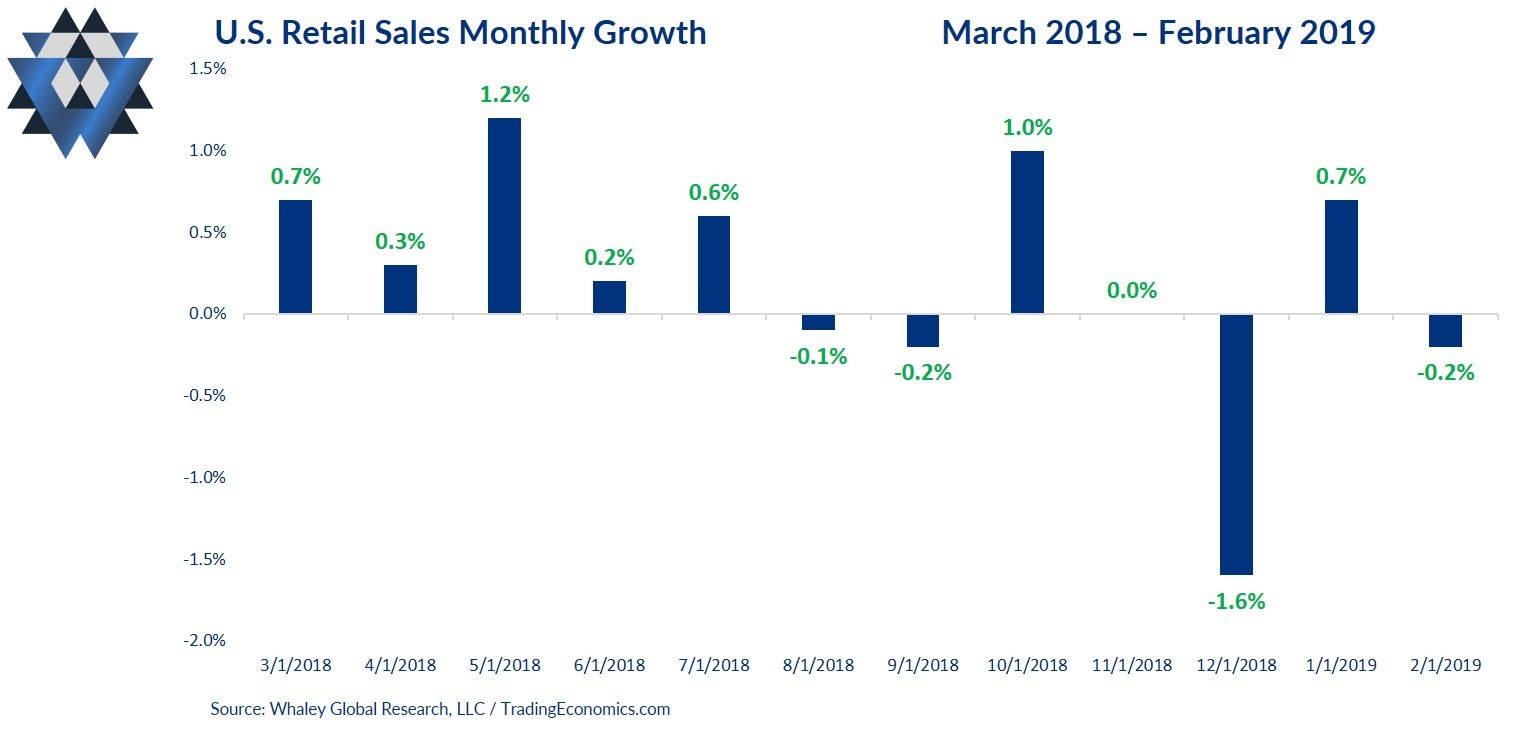

The media coverage last week was that February retail sales “fell 0.2%,” but this figure is based on the highly noisy and uninformative monthly growth rate. Reuters told us that retail sales fell “unexpectedly” and Jeffrey Bartash from Market Watch assured us that retail sales may have fallen in February but “… not all is lost: January sales turned out to be quite strong.”

The Old Institution is in the business of keeping you invested, come hell or high water, which is why Jeff led his article with what happened in January, rather than the more relevant February data point and the far more relevant rate-of-change of retail sales over the last seven months. That Reuters was caught off guard by February’s continued slowdown is evidence of the Old Institution’s obsession with monthly growth rates.

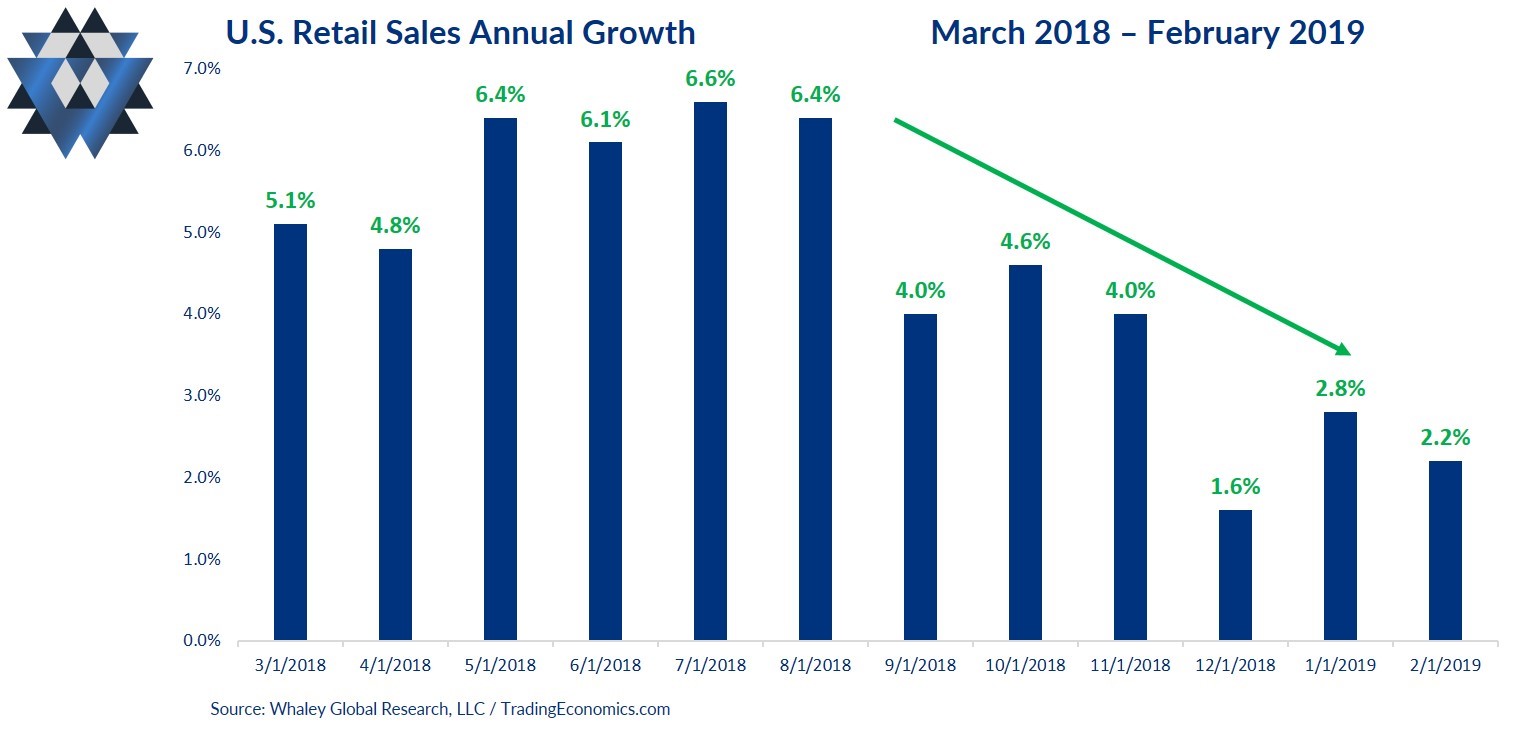

If you’ve been with us for any reasonable stretch of time, you know that one of the ways we are able to make macro calls and position correctly before markets move is by evaluating economic data in year-over-year terms. To us, it’s highly intuitive to watch the slope (rate-of-change) of annual data because this provides a clear signal for the data set in question, and it avoids the noise that necessarily plagues the growth rate from one month to the next. Yet what is intuitive to us eludes the Old Institution.

While navel gazing monthly growth rates that are jumping all over the place like a toddler on a sugar high, the annual growth rate of retail sales has been painting a very clear picture since last summer (see charts below). Headline retail sales growth has slowed in five of the last seven months, hit a recessionary growth level in December and, after a one-month bounce in January, is heading south again.

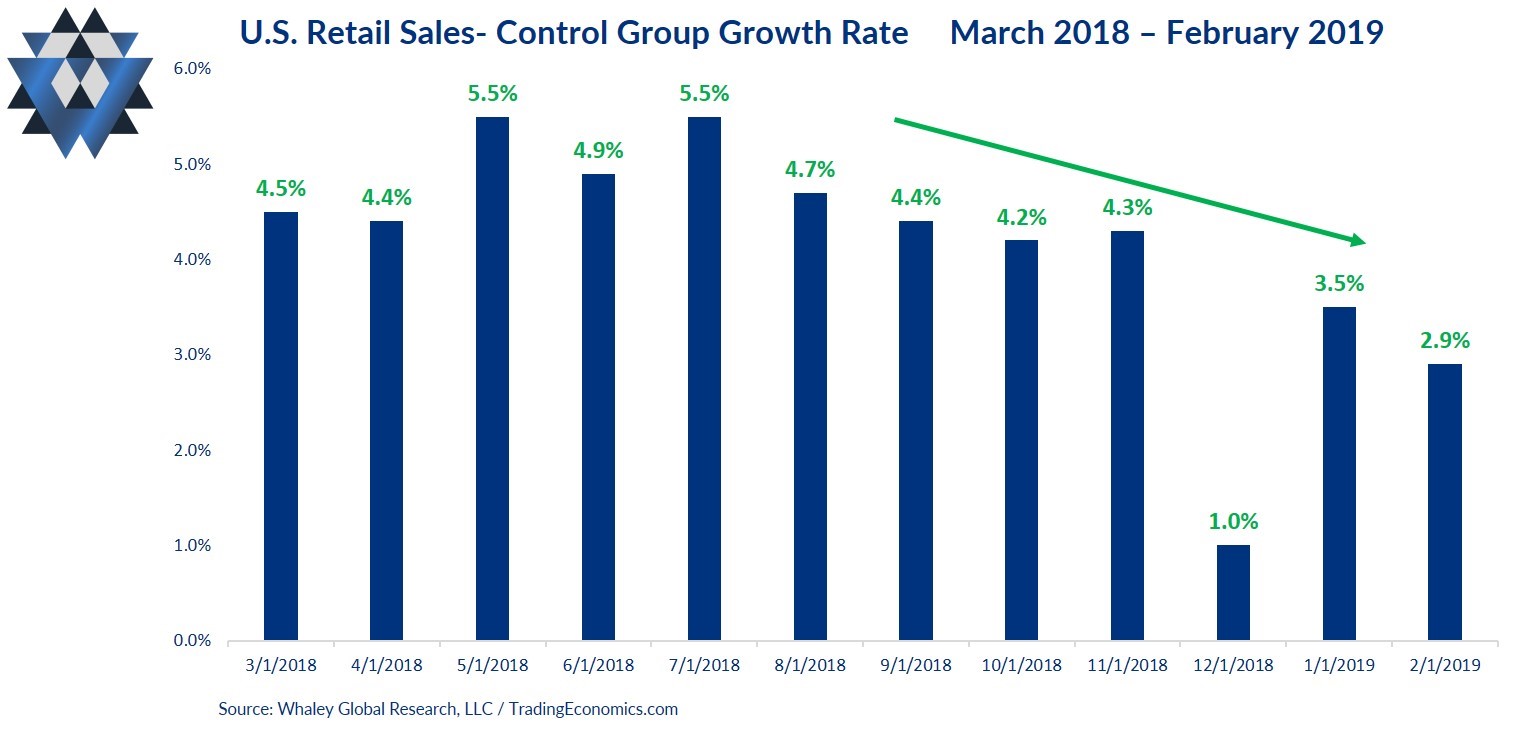

A quick perusal of the Old Institution’s coverage shows another glaring omission. These cats never, ever discuss the retail sales control group. Why does this matter? The control group’s annual growth rate is the most critical aspect of any U.S. retail sales report because it’s used in the actual calculation of U.S. GDP. Yet despite the high information ratio embedded in the control group’s growth, the Old Institution routinely ignores it. Luckily for you, we don’t, and can report that the control group’s growth rate slowed to +2.9% in February, marking the fifth month of slowing sales growth since it peaked at +5.5% in July (see chart below).

If you wait for the Old Institution to tell you what’s going on in economies, you’ve lost the investing game before it’s even begun. The way they evaluate data has them consistently missing critical economic shifts until months after the fact. There was nothing unexpected about the retail sales data, especially if you consider the plethora of other consumer-related data painting a similar picture. We covered a number of these data points in the Retail-iation macro theme update in last week’s Gravitational Edge.

The “Headline Risk” bottom line is that if you want to gain an edge over the Old Institution and its followers, then there is only one way you should be evaluating economic data: watching the slope (rate-of-change) of the annual growth rate.

Please click here and sign up if you’d like to receive April 1 edition of Gravitational Edge, which contains an update for all five macro themes as well as full breakdown for all 14 markets we believe are providing the best opportunities right now, bullish and bearish. By signing up, you will also receive the latest edition our research reports as well as to participate in a four-week free trial of our research offering, which consists of three weekly reports: Gravitational Edge, The 358 and The Weekender.