Rising volatility appears to be on the horizon, Joe Duarte provides his approach to surviving and profiting from the increased risk to investors.

The Federal Reserve tried to put the best face it could on caving into the markets and President Trump last week. And while the stock market seemed to like the Fed’s new stance, at least initially, the bond market clearly didn’t, which sets up the potential for a volatile trading summer.

Certainly, a lot can happen this week given the G-20 meeting between President Trump and Chinese premiere Xi. There is also housing data and the final GDP print to watch, which could be market movers. Furthermore, there is a whole lot of Fed talk scheduled this week, which could make life interesting.

This is a good opportunity to take a deep breath. The key to success at the moment, is not to abandon stocks altogether but to formulate a plan to counter the possible increase in volatility if the algorithmic traders get confused and the market freaks out.

Bonds, Housing, and REITs Are the Key to the Puzzle

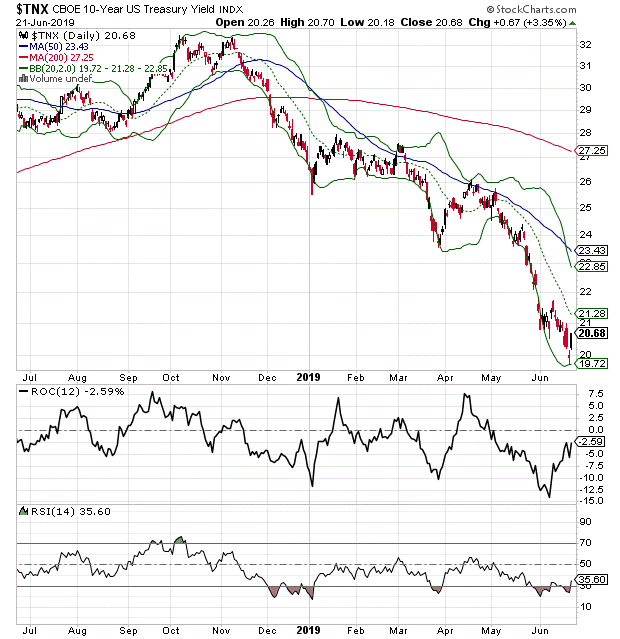

First, the bond and stock markets initially rallied on the Fed’s new easy money promise. But by Friday, bond yields moved decidedly higher with the U.S. Ten Year Note (TNX) yield bottom now seeming to be near 2% with key resistance now at 2.1% (see chart). If bond yields rise above this key level things could get very bumpy.

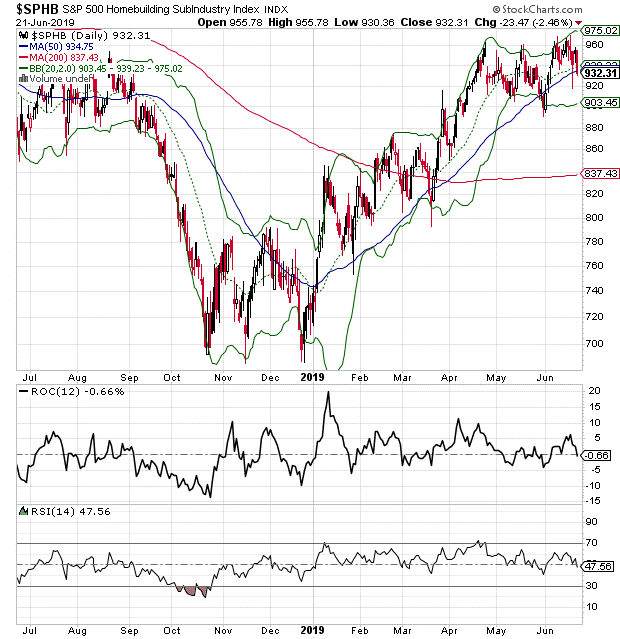

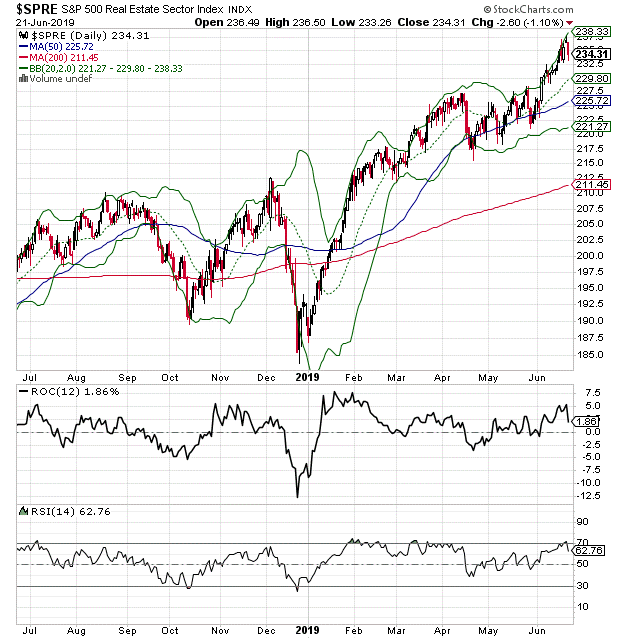

And although the market rolled over with the rise in bond yields, both housing stock indexes like SPHB and real estate investment trust indexes like SPRE took steep nosedives as bond yields rose (see chart below). This may be a prelude to a difficult market future if bond yields continue to climb. A lot may become clearer for housing stocks this week after earnings from Lennar Corp. (LEN) and KB Home (KBH) are released.

Of course, those two stocks may deliver pleasant surprises, especially if they provide positive guidance. Still the rapid decline in housing stocks and real estate investment stocks in response to rising bond yields suggests that the markets are more in tune with bond yields than with the Fed, which puts the central bank in an even more difficult situation.

In addition, the fact that the pre-Fed dive in bond yields during the month of May and June led to a moderate, but not spectacular increase in existing home sales is a clear indicator of the interconnection between the markets and the real world which have melded into the Market-Economy complex.

The bottom line is that consumers are now in tune to the effects of interest rates on their lives and are making big decisions such as if and when to buy a home based on the action in the markets more rapidly than in the past. Thus, if bond rates continue to rise, and the recent trading pattern in the market repeats, we could well see both a decline in the stock market as well as a potentially meaningful decline in the economy, which in turn would lead the Fed to ease rates with unknown consequences.

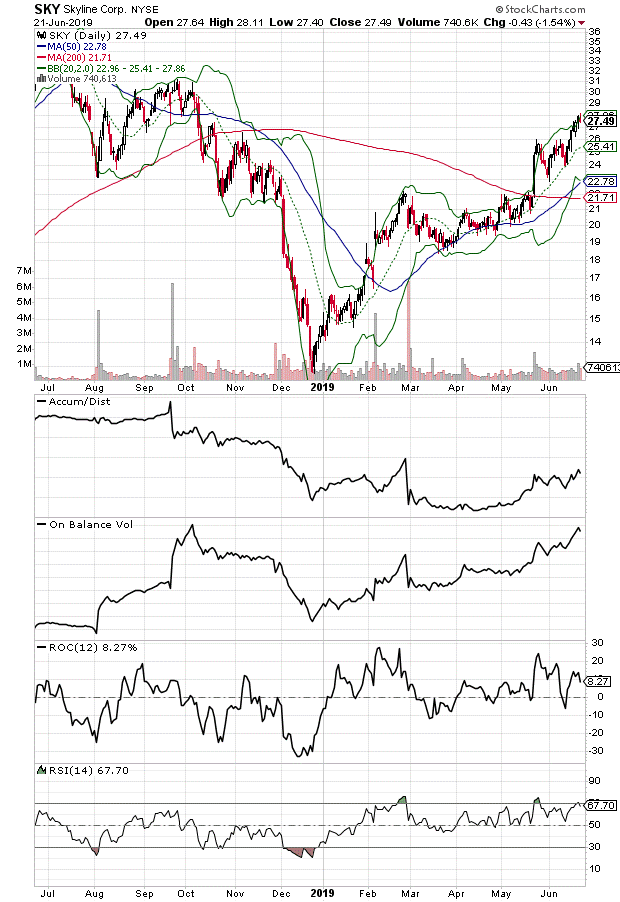

The Sky is the Limit for Skyline Champion

There is a bright spot in the housing sector, Skyline Champion Corp. (SKY) a builder of manufactured homes. The stock has bucked the general lukewarm trend among its peers due to poor housing affordability for traditional housing (see chart). Consequently, there is rising demand for SKY’s products.

The stock broke out to a new high on June 21, as the market finally seems to be recognizing that the company is in a great niche during difficult times in the sector. As its competitors struggle with higher labor costs, land shortages, and higher material costs, Skyline seems to be in its sweet spot at the moment sporting rising profit margins.

Moreover, because of its very affordable average unit cost of $61,500, SKY is seeing an increase in product demand and has been raising prices while managing its supply chain, employment costs and expanding its financing options to customers. And due to rising demand SKY has recently opened a plant with several hundred employees, in Leesville PA which is now fully operational.

If the current trend in the shares continues, we could see the price move to the low 30s over the next few weeks to months barring a major market event. I recommended the stock recently in Joe Duarte in the Money options.

Flavorful Stock Gains

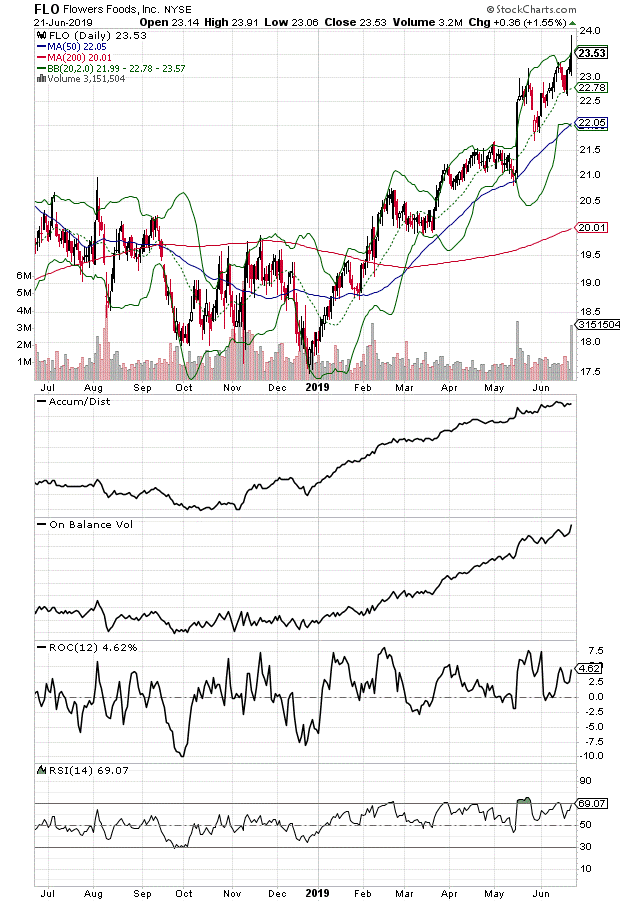

Elsewhere the food sector has been a hit or miss affair all year, providing both satisfaction and heartburn to investors as some stocks have failed to hold on to short term gains while others have beaten even the most bullish expectations.

One example of a pleasant surprise remains Flowers Foods (FLO) a dividend paying baker with hot store brands such as Dave’s Wicked Bread and Nature’s Own along with its sinful and impulse satisfying TastyKake offerings. The stock made a new high on June 21 as investors are once again looking for steady stocks in what could be stormy seas (see chart). In other words, in this market it’s not about a company’s glamour, apps or hipster potential but about its ability to generate revenues, deliver earnings and paying dividends.

I have eight high yielding dividend stocks at the Joe Duarte in the Money Options dividend portfolio at the moment.

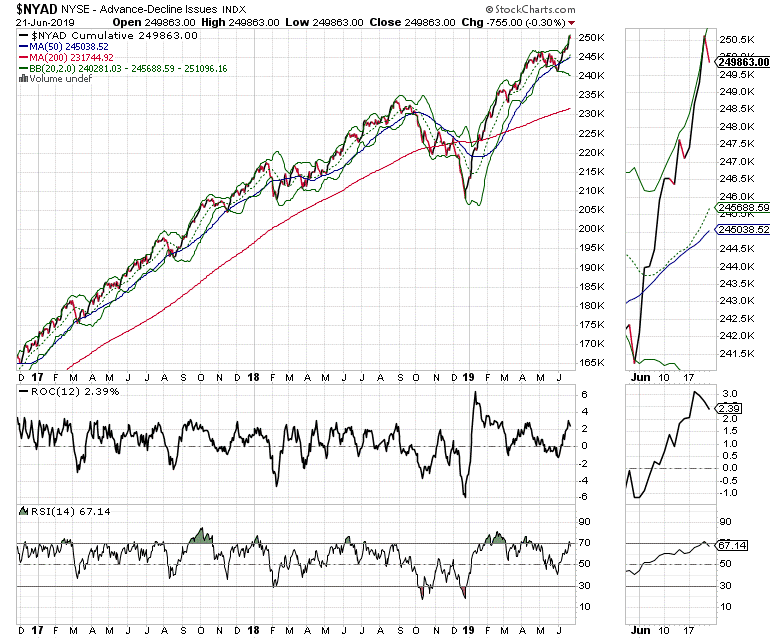

Market Breadth Remains Agreeable but is Still Not All There

The New York Stock Exchange Advance Decline line remains the most accurate indicator of the market’s trend as it has been since the 2016 election. This past week it made another new intraweek high but could not hold it on Friday. Nevertheless, it is still pointing to higher stock prices, barring a major market meltdown.

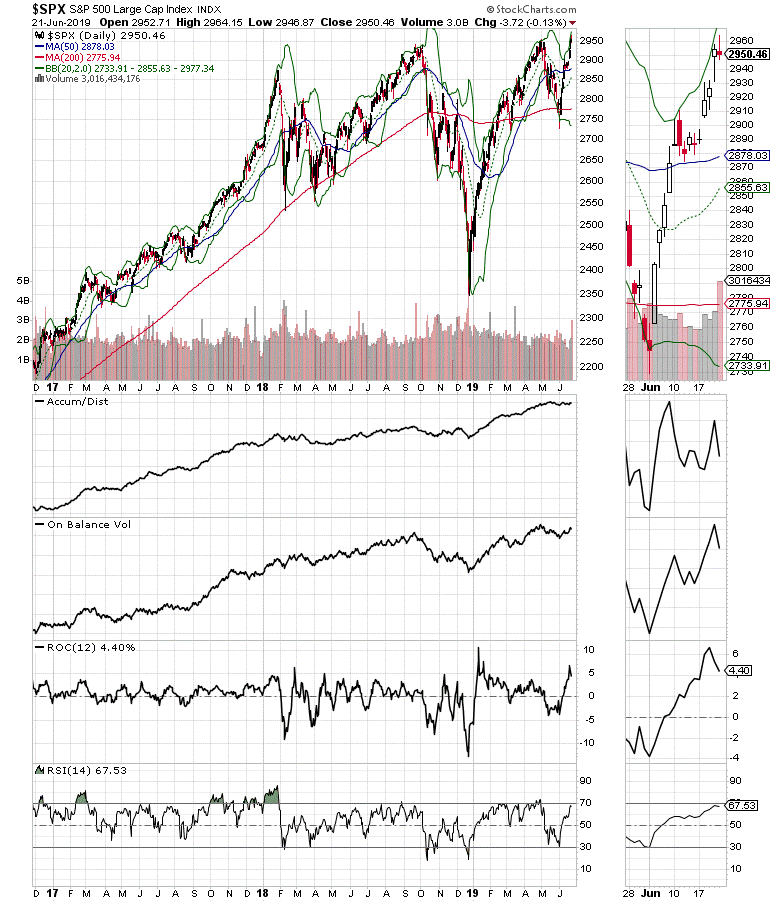

The S&P 500 (SPX) confirmed the new high in NYAD but also failed to hold onto it on Friday. Nevertheless, the bulls still get the benefit of the doubt here, although there was a clear shift back into defensive sectors by the end of the week.

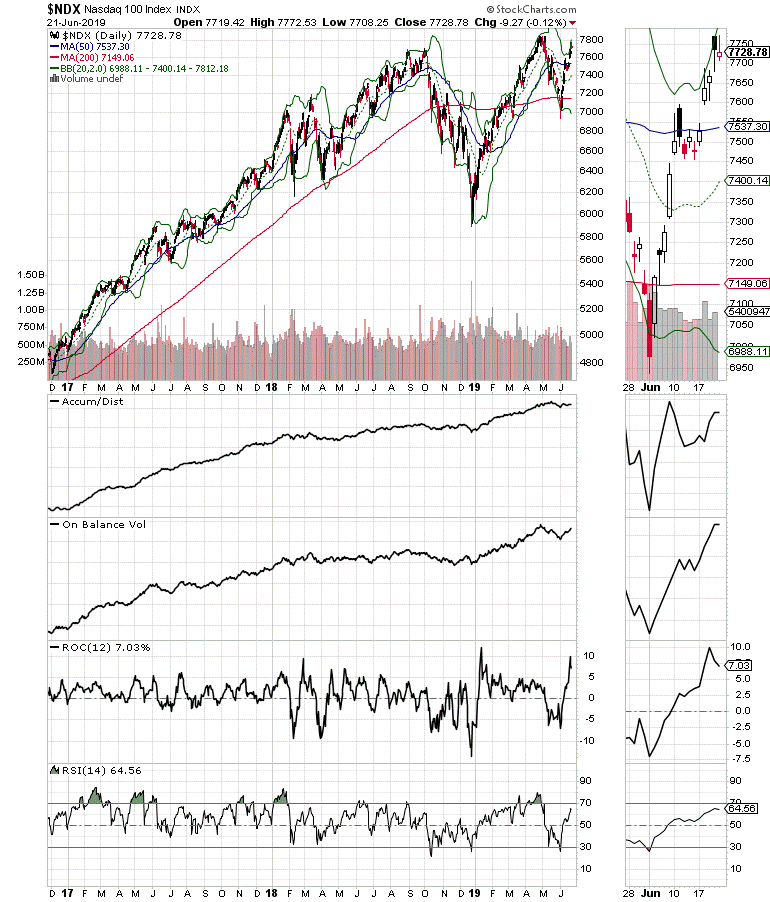

The Nasdaq 100 index (NDX) is still lagging NYAD and SPX but is within reach of a new high. Still, the technology sector is not as vibrant at the moment as it was just a few weeks ago before the U.S.-China trade war began to squeeze into tech company market expectations.

As a result, in this market, it makes sense to move toward defensive stocks that are holding their own.

A little Patience

Volatility is likely to increase again with the bond market looking ready to retrace at least part of its recent gains. As a result, paying attention to what positions are working and rapidly moving away from clear losers will go a long way.

One way to cull the herd is to consider using sell stops at 3-5% for stocks and then letting them go once the stop gets hit. Mental stops are more useful in this market in order to avoid the algos hitting your positions and then rallying them after they get you out. But that requires vigilance and planning so setting alarms and having a good chart reviewing routine is important.

No matter what, letting the winners run and dropping the losers quickly is more than ever a viable strategy to consider in a market that looks set to start churning vigorously.

Finally, keep a close eye on the tech sector. If there is a pleasant surprise at the G-20, it is possible that this now very beaten area of the market could once again blossom. I recently recommended three tech stocks which are holding their own.

Visit Joe Duarte in the Money Options via the link below for a free trial subscription and full access to these and other great stock picks and option strategies.

I own SKY and FLO as of this writing but in an algo market who knows where I’ll be in a week.

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here.