Commercial traders are close to record shorts in precious metals, particularly gold, notes Andy Waldock on this week’s COT report.

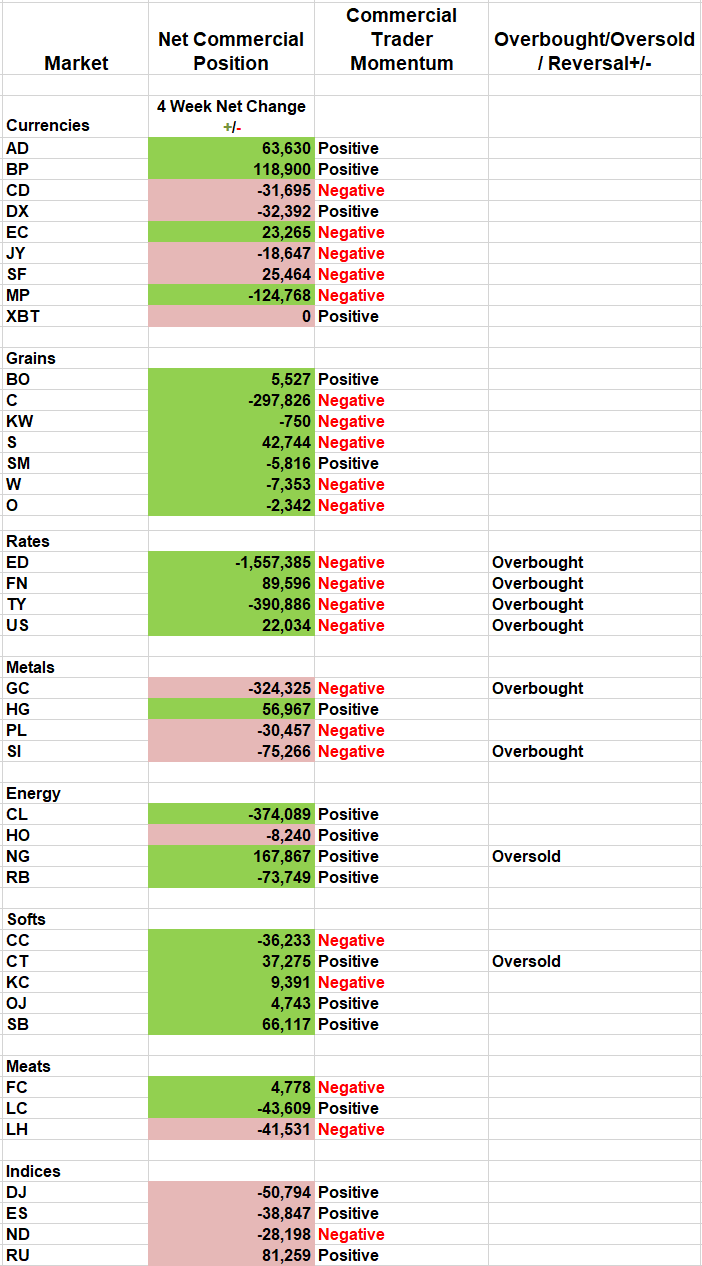

This week’s Commitments of Traders (COT) letter is a survey of current market action as no setups currently meet our entry criteria for new positions. However, there are a number of overbought and oversold markets, including the entire interest rate complex that remains overbought (see table below)

Interest Rates

Last week, the commercial bid climbed with Treasury prices with the long end of the yield curve attracting the most substantial commercial bid. The commercial bond traders who were so eager to get short mid to late June have now repurchased their short positions at a rare loss. This leaves the 30-year Treasuries reasonably balanced.

Commercial traders in the Eurodollar futures, on the other hand, have resumed their short selling on this rally and pushed their net short position to its largest size in the last year.

Metals

Silver miners backed off their short hedging last week as the market climbed above its 120-week moving average at $16.50. We did issue a short sale signal for Thursday’s trade in our nightly email.

Gold miners took the opposing action and accelerated the pace of their forward sales. They increased their net short position by another 10%, pushing it to another 52-week high. The gold miners’ current net position of -324,325 is less than 5% from their record. Also, keep in mind that this makes the speculators exceptionally long. Our COT Ratio shows that the speculators are now long six contracts for every short. This is their most lopsided position since November of 2012. The obvious question is, “Where will more buying come from?”

Copper users are taking advantage of the latest trade war, global economic contraction dialogue to anxiously lay in future supplies. The commercial traders increased their net position in copper by more than 34k contracts last week. This spike is nearly three standard deviations beyond their average weekly move over the previous year. The surge in buying also pushed the net commercial position to a new 52-week high. This is the type of aggressive buying we look for in anticipation of entering a long position.

Energy

Natural gas continues to see end-user buying at low prices and ahead of a typically volatile seasonal period. Commercial purchases pushed their net position to another new 52-week high, and it was once again accompanied by substantial activity. Look for swing lows to make opportunistic purchases ahead of hurricane and heatwave season.

Currencies

The British pound continues to slide lower in spite of stepped-up commercial purchases. The recent fall below $1.25 to the U.S. dollar has brought forth a surging commercial bid that is now is within a whisker of its net long record. This market is overstretched and should be running out of new sellers.

The Japanese yen has unwound violently over the last two weeks. The yen is now at its high for the year after being only mid-range just two weeks ago. The commercial currency hedging response has been swift. Their net position swung to the short side by 20k contracts, far more than their average week to week movement. While we aren’t overbought on the weekly scale, our daily readers were sent a head’s up that this market is primed and waiting for us to call the reversal.

Meats

Both cattle and hogs have fallen considerably from their early spring rallies fueled by African swine fever news out China, the world’s top pork consumer. Now that the speculators have been flushed from the market, prices are resetting for the longer term. The fundamentals haven’t changed. There will be a shortage of pork over the next year and then some. Processors are aware of this and have now come in with a bid to provide a floor for prices. Look for long entry opportunities. We’ll update, accordingly.

Here is what Andy had to say about seasonality and the COT Report at the recent TradersEXPO New York.

Visit Andy Waldock Trading to learn more. Register and see our daily and weekly signals archive for entries and stop loss levels sent to our subscribers.