This medical related stock could benefit from increased resources dedicated to dealing with the Coronavirus pandemic, reports Joe Duarte.

Agilent Technologies (A) is not a household name. It’s a public research, development and manufacturing company that was created in 1999 when Hewlett-Packard (HPQ) spun it off.

Agilent is one of those old fashioned science companies which designs and manufactures the machines and related materials, such as chemical reagents, DNA analysis tools, and other things used in scientific research and applied laboratory work.

The rap on Agilent—because of its focus on science— is that they don’t put as strong of an effort into their business plan execution as they do making excellent scientific equipment; if they did, the stock price would be higher. Specifically, Agilent has a spotty record when it comes to steady earnings and the next quarterly report, due May 21, 2020 may be another disappointment.

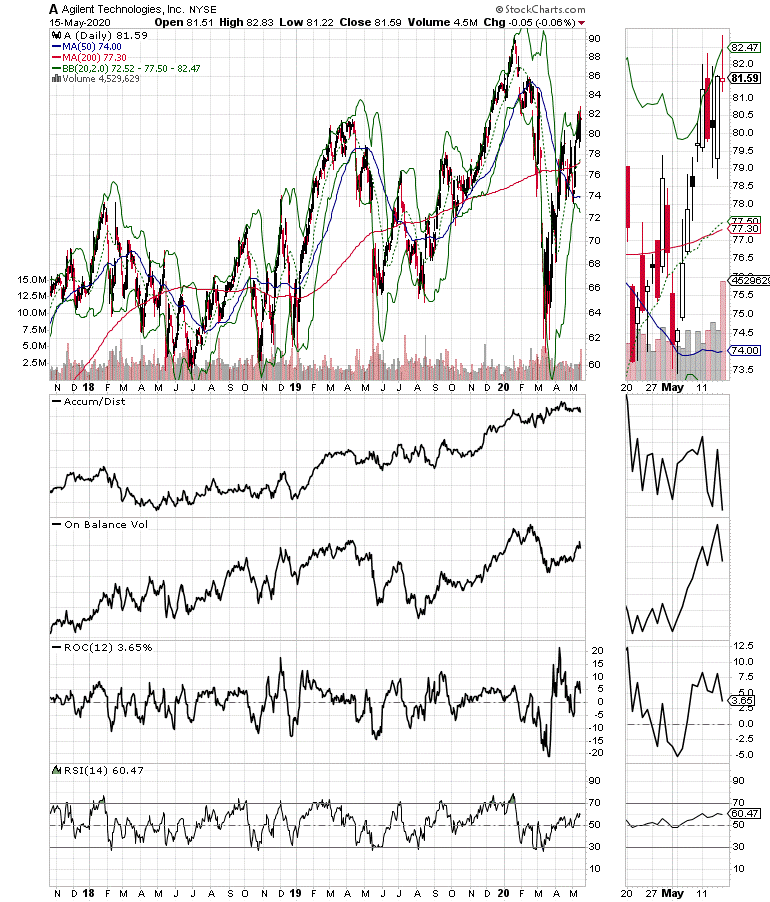

So why am I recommending it? For one thing, the stock is acting very well on a price volume basis. Indeed, the shares are in the early stages of what could be a meaningful breakout (see chart below).

From a fundamental standpoint, Agilent is an example of the type of company which is benefitting from the Covid-19 pandemic due to the fact that it designs and manufactures machines and related materials, such as chemical reagents, DNA analysis tools, and other things used in scientific research and applied laboratory work. It likely will benefit from resources pouring in to find treatments and eventually a vaccine for Covid-19.

From a technical standpoint, On Balance Volume is very strong and if the stock can take out the resistance near the $82 area, it could move decidedly higher.

Still, some caution is warranted as much depends on the earnings report, especially on future guidance. I am especially concerned about Agilent’s China business segment and its future, although they may deliver a pleasant surprise. That said, if management has made the right decisions and it is able to not just deliver a good quarter but reassure investors about the future, the stock is poised to deliver a pleasant surprise to shareholders.

If you’re not a subscriber yet take a 30-day Free Trial HERE. Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here. I’ll have more for subscribers in this week’s Portfolio Summary. For a 30-day Free trial subscription go here. For more direction on managing the GILD trade, go here.