The biotech sector could be heating up, reports Joe Duarte.

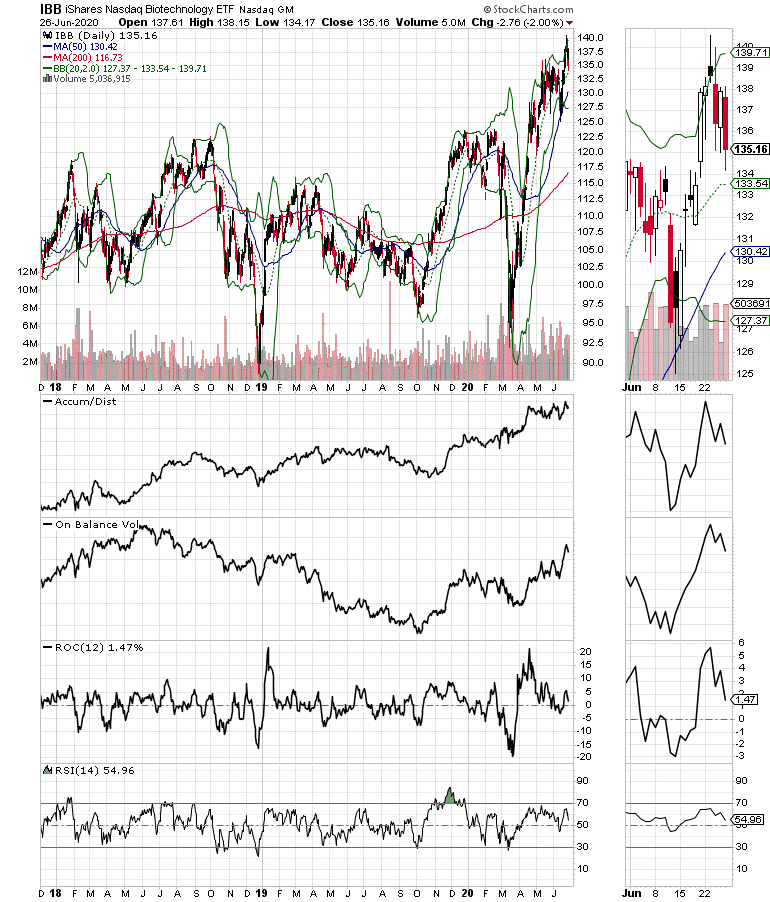

In preparing for this week’s column, as I reviewed the increasingly negative situation in the stock market, I noticed that the biotech sector, as in the IShares NASDAQ Biotechnology ETF (IBB), had a down day on June 26. But unlike other sector ETFs in the market, IBB managed to hold well above key support, and remained near its recent high (see chart below).

Indeed, both facts are indicative of a sector which is showing relative strength. Moreover, it makes sense to keep an eye on this general area of the market as it is likely to play an increasingly significant role not just in the fight against Covid-19 but also in the war on cancer, the battle against rare diseases, and increasingly on more common diseases where traditional treatments are running into limitations.

IBB is an ideal way to invest in biotech. For one thing it saves the trouble of having to research individual companies in the sector. And for another, its diversification among a fairly large group of biotech stocks can cushion the downside that comes along with bad news to any individual stock in the sector.

That said, I wouldn’t rush out and load up on IBB, or any other stock or ETF at the moment because of market risk. Nevertheless, given the recent momentum thrust in the biotech sector, in the wake of its outstanding fundamentals, a pullback of 10% or more could deliver a nice buying opportunity at some point in the future.

This would be evident, especially if IBB can stay above its 200-day moving average on a break below its 50-day moving average. An even better show of relative strength would be if IBB could actually hold above its 50-day moving average, especially if the market was to break down decisively.

To gain access to the rest of my current recommendations, including three inverse ETFs, which could rally in a big way if the market crashes, consider a FREE trial to JoeDuarteintheMoneyOptions.com.

For more details on the summer trading season catch my most recent Your Daily Five installment here. To subscribe for a FREE trial to Joe Duarte in the Money Options.com, click here. I have compiled a small list of companies whose stocks are showing relative strength and may be worth owning. The list can be accessed via a FREE trial to Joe Duarte in the Money Options.com To subscribe to my service, click here