It was about 20 years ago when my wife said she was incredibly worried about me as I was able to understand Alan Greenspan’s doublespeak, explains Jeff Greenblatt of Lucas Wave International.

Greenspan had the unique ability to talk in riddles and many had no idea what he was saying as the business media always played a guessing game while they showed that clip of him carrying his famous briefcase. The difference between Greenspan and the current Fed boss is this one tries to be transparent, yet the results are the same. Nobody knows what he’s talking about. Take these three statements from Powell and I’m paraphrasing.

The housing market has fully recovered. In the next breath he says the Fed will not lose sight of the fact millions are out of work. Finally, we have upon us the most severe economic downturn of our lifetimes. I ask you: how could the housing market be anywhere near full recovery during the worst economic downturn not only in our lifetime but in the entire history of the republic?

I’ve seen other headlines that suggest we are not in recession but in the early stages of a new economic upturn. This reminds me exactly of the period after the '29 crash when the most popular tune of the era was “Happy Days Are Here Again.” What people saw as the light at the end of the tunnel turned out to be an oncoming freight train.

The long-term cycles for the stock market have a hard down in 2022 to complete this phase. We knew that prior to the quarantines.

The solution to our economic problems is amazingly simple. A major snowstorm is forecast for New York City. While outdoor dining might work here in balmy Scottsdale, Arizona, it is absurd that any politician would expect or decree restaurants to survive with outdoor dining in places with real winters. Open the restaurants, open small business, and let people go back to work. It is equally absurd that a Fed chairman would have the nerve to go on international television and tell the world the housing market is recovered.

I’m not rooting for it but I’m going to send a message to the politicians of the world. When people have nothing to lose, they will lose it. Why is it we can go into a box store but can’t go into a restaurant or other small business? Congress has been slow walking the next stimulus bill for months. Now we are told if they do act, the stimulus check to Americans might only be half of what it was earlier this year. Whatever they do, it will be too little, too late.

If the political establishment won’t take responsibility history suggests the public will eventually take that into their own hands. You don’t need to me to issue any type of clarion call, but this does tie into our market work. The stock market is now a couple of weeks away from hitting the golden spiral 618th week off the 2009 bottom. This falls out awfully close to the time Congress is supposed to count the electoral votes to decide the presidential election.

So, it’s time for me to put my cards on the table if I haven’t already. With everything that has gone on this year, if we don’t have a black swan event by January 20, it will be a miracle. My sources suggest we’ve already averted a major black swan event scheduled for this week and all I can say is it concerned China. With everything Powell said, it's what he didn’t say about the geopolitical situation that has me most concerned. Bottom line: The Fed can spin this anyway they want but until state governments decide to let people go back to work, there will not be any recovery.

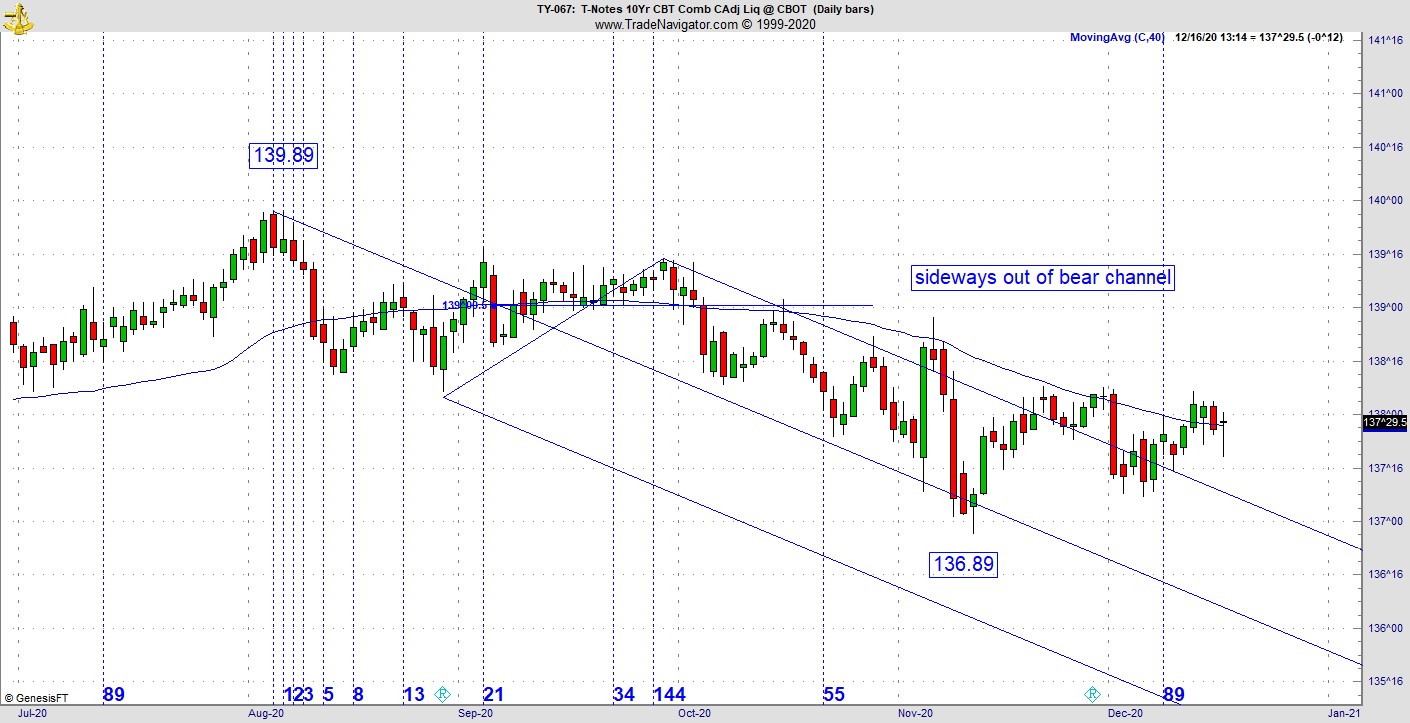

Let’s examine a couple of charts. A couple of weeks back we looked at the 10Yr note. It has been sitting on the weak side of a bear channel since October and now breaking out of the line and starting to move sideways. This would alleviate any concerns about higher rates anytime soon.

The US dollar has been down ever since it retested the September 25 high after it squared out at 94.28 at 28 days. It should hit the bottom of this larger orange channel line. That means the greenback has lost over 13% of its value since March. While the stock market is sitting near all-time highs, the real damage has come in the form of our currency. Sad to say it likely has a lot more to fall. In the near term, we should be close to another bounce phase.

Finally, the Dow had no real gain since last week and we are now days away from the light volume vacation end-of-year trading season. It’s highly likely the tourist and travel industry are going to take it extremely hard on the chin this Christmas season. Trading might be incredibly good this time around. For those of you who are not fans of super-fast markets where risk is higher than usual, Christmas might be just what the doctor ordered. Lighter volume this year might mean some excellent intraday moves without markets being lightning quick.

The holidays are always a time where traders take a break to take inventory of their performance over the past year and examine what they could do to improve in the new year. If you are having a staycation this year, you may consider the holiday trade, which will likely provide just enough risk to keep things interesting.

For more information about Jeff Greenblatt, visit Lucaswaveinternational.com.