Emerging market stocks, iShares MSCI Emerging Market Index ETF (EEM), made their last high almost three years ago, in January 2018. It was only at the start of this month that EEM bested that prior peak, explains Marvin Appel of Signalert Asset Management.

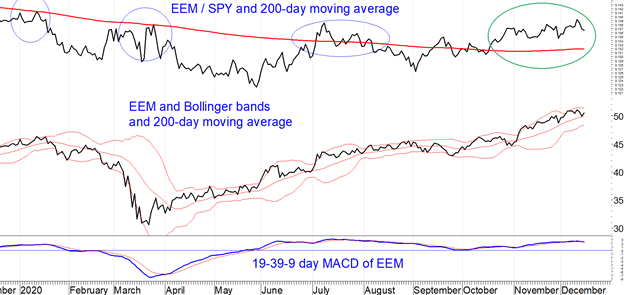

I like to look at the EEM/SPY ratio and the 200-day (or 10-month) moving average of this ratio to gauge whether relative strength trends favor emerging markets or not. The current period of emerging markets outperformance (circled in green in the EEM/SPY ratio in the chart below) is the longest since early 2018. Switching between EEM and SPY based on comparing the ratio of these two with to the 10-month moving average of the ratio would have kept you on the right side of major relative strength trends.

The last signal to favor EEM over SPY began on 10/31/2020. As a result, if allocation to foreign equities is part of your strategy, now is a good time to shift capital from the S&P 500 (SPX) to emerging markets (EEM). Note that we prefer trading SPY on our timing models to allocating to emerging markets for our clients because the risk management trading SPY only has been more effective.

To learn more about Marvin Appel, please visit Signalert Asset Management.