Earnings growth has been terrific over the past several quarters, proving a strong tailwind for stock prices, states Jesse Felder of The Felder Report.

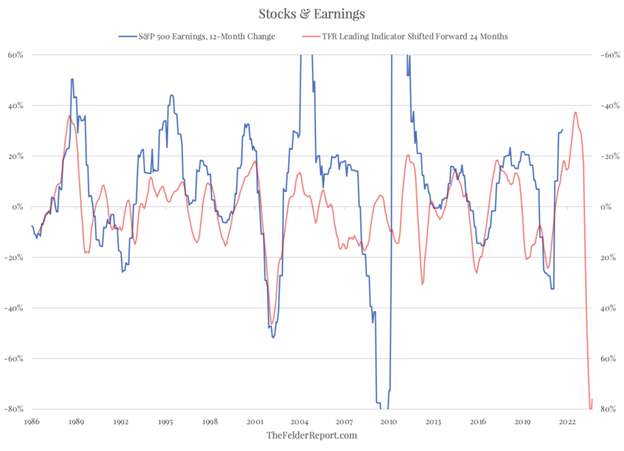

For astute market watchers, however, this should not come as any surprise. The decline in interest rates, oil prices, and the dollar over the past couple of years, in fact, predicted it. As a group, these markets have proven for decades now to be a far better forecaster of S&P 500 (SPX) earnings growth than any analyst on Wall Street. The chart below plots a composite of these indicators, shifted forward 24 months, against the 12-month change in S&P 500 earnings. The relationship is not perfect but generally gets the trend right.

With inflation pressures continuing to rise even as record amounts of fiscal stimulus begin to wear off and the economy clearly slows, however, an earnings recession over the next several quarters should also come as no surprise. In fact, that is exactly what the recent action in interest rates, oil prices, and the dollar now point to. Considering valuations are more extreme than ever before, traders and investors are also more highly leveraged than any other time in the past. A shifting in this fundamental driver of stock prices from tailwind to headwind should be something to pay close attention to.

Learn more about Jesse Felder at TheFelderReport.com.