US equity markets have reached a decisive fork in the road and this week’s price action will likely dictate the market direction for the coming months, states Ian Murphy of MurphyTrading.com.

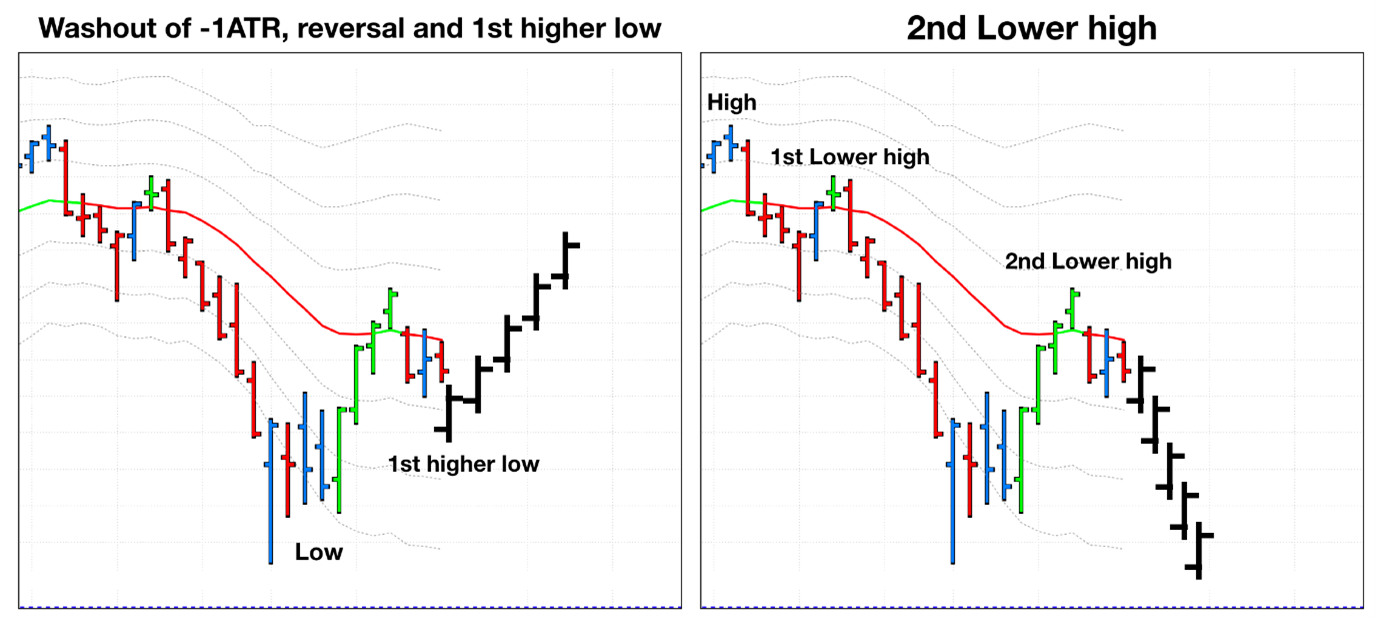

Against a backdrop of heightened volatility, the S&P 500 (SPX) has formed a classic consolidation pattern above the -1ATR channel on a daily chart, and this pattern typically unfolds in one of two ways, so I envisage two possible outcomes from here:

(a) The S&P 500 washes out the -1ATR line, reverses and forms a higher low, and starts to climb steadily higher.

(b) The -1ATR fails to hold as support and lower prices follow, confirming last week was another lower high.

Obviously, the price bars won’t look exactly like the examples shown above and the compression could last another day or so, but this type of pattern nearly always resolves in one or other of these scenarios. After that, the market will default to the established trend structure of lower highs in a bear market or higher lows in a bull market.

Learn More about Ian Murphy at MurphyTrading.com.